Member LoginDividend CushionValue Trap |

J.C. Penney: Equity Offering Shows Desperation; Shares Score a 1 on the VBI; Lights Out by Mid-2014?

publication date: Oct 1, 2013

|

author/source: RJ Towner

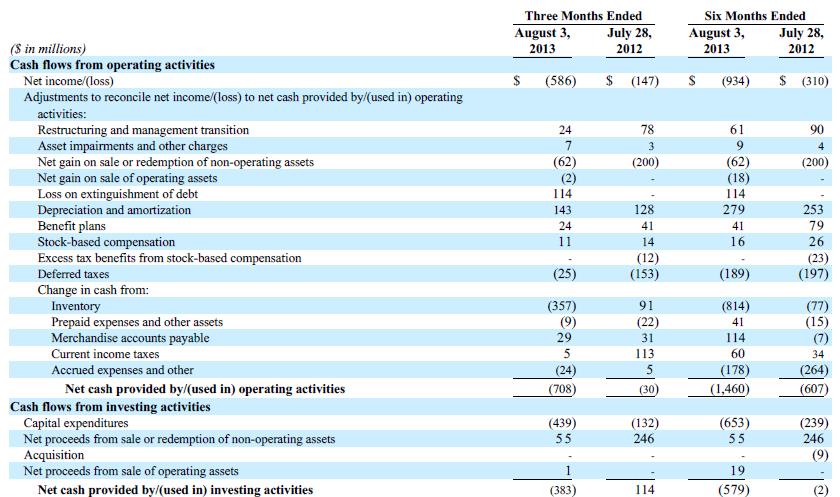

With sales declining precipitously and bankruptcy looking like a real possibility, we have materially lowered our equity fair value estimate on retailer J.C. Penney (click ticker for report: JCP) to $3 per share. The firm now scores a 1 on the Valuentum Buying Index, and we’re avoiding shares at all costs in the portfolio of our Best Ideas Newsletter. Why Now? We haven’t liked J.C. Penney since former CEO Ron Johnson’s plan showed signs it clearly wasn’t working, and we have consistently maintained that Penney’s business model was obsolete and doomed to fail over the long term, even before Johnson made changes. Still, earlier this year, the firm improved its liquidity position when it raised over $2 billion in cash via debt with an interest rate of 7.125%. It had appeared at the time that maybe...just maybe...this cash boost would be enough. However, the company's decision last week to raise capital via a dilutive equity offering shows the situation is now desperate. On September 27, J.C. Penney announced it would sell 84 million shares for $9.65 per share, generating net proceeds of approximately $810 million. The fact that the firm had to issue equity (at depressed prices)--even though it has an extensive asset profile--signals the company is still burning through cash at a brisk pace. During the six months ending August 3, J.C. Penney has burned through roughly $1.46 billion on the operating line (net cash provided by operations) and more than $2 billion after factoring in capital expenditures, as shown below.

Image Source: JCP 10-Q, 9/10/13 The big question for shareholders is: will J.C. Penney be able to turn around operations quickly enough to avoid bankruptcy? Though we don’t think bankruptcy is 100% certain at this time (we retain a positive fair value estimate), same-store sales trends have been nothing short of atrocious at the firm. The firm’s CDS spreads have also surged in the past few months, revealing the perception of a greater likelihood of technical default by market participants.

Image Source: FactSet Still, according to J.C. Penney, same-store sales “coming out of the third quarter” are on track to be positive, and the firm is experiencing greater customer conversions. However, it’s worth noting that this only means that a larger percentage of people in its stores are making purchases, but not that more people are visiting the store. Same-store sales declined a whopping 26.1% year-over-year during the third quarter of 2012, so it would take massive sales gains to get the firm on solid footing. We just can’t see a meaningful improvement in sales, given competitive pressures from peers, especially Kohl’s (click ticker for report: KSS). Valuentum’s Take J.C. Penney continues to suffer from a mismanaged and expensive turnaround that alienated core customers while failing to recruit enough new customers to avoid sales declines. The firm has raised capital twice this year alone--a sign, in our view, that a liquidity event is close. If J.C. Penney continues to burn cash at its current pace--$1 billion per quarter--the firm’s $810 million equity raise plus the $1.5 billion in cash on its balance sheet at the beginning of August suggests it probably has enough funds to operate through the middle of 2014 (barring a catastrophic holiday season). A turnaround is always possible, but the odds are stacked against the retailer. J.C. Penney looks like a value trap that Valuentum will be avoiding. We may look to open a put option in the portfolio of our Best Ideas Newsletter on any near-term optimism in shares. |