publication date: Sep 28, 2016

|

author/source: Brian Nelson, CFA

This article was originally published July 17, 2013.

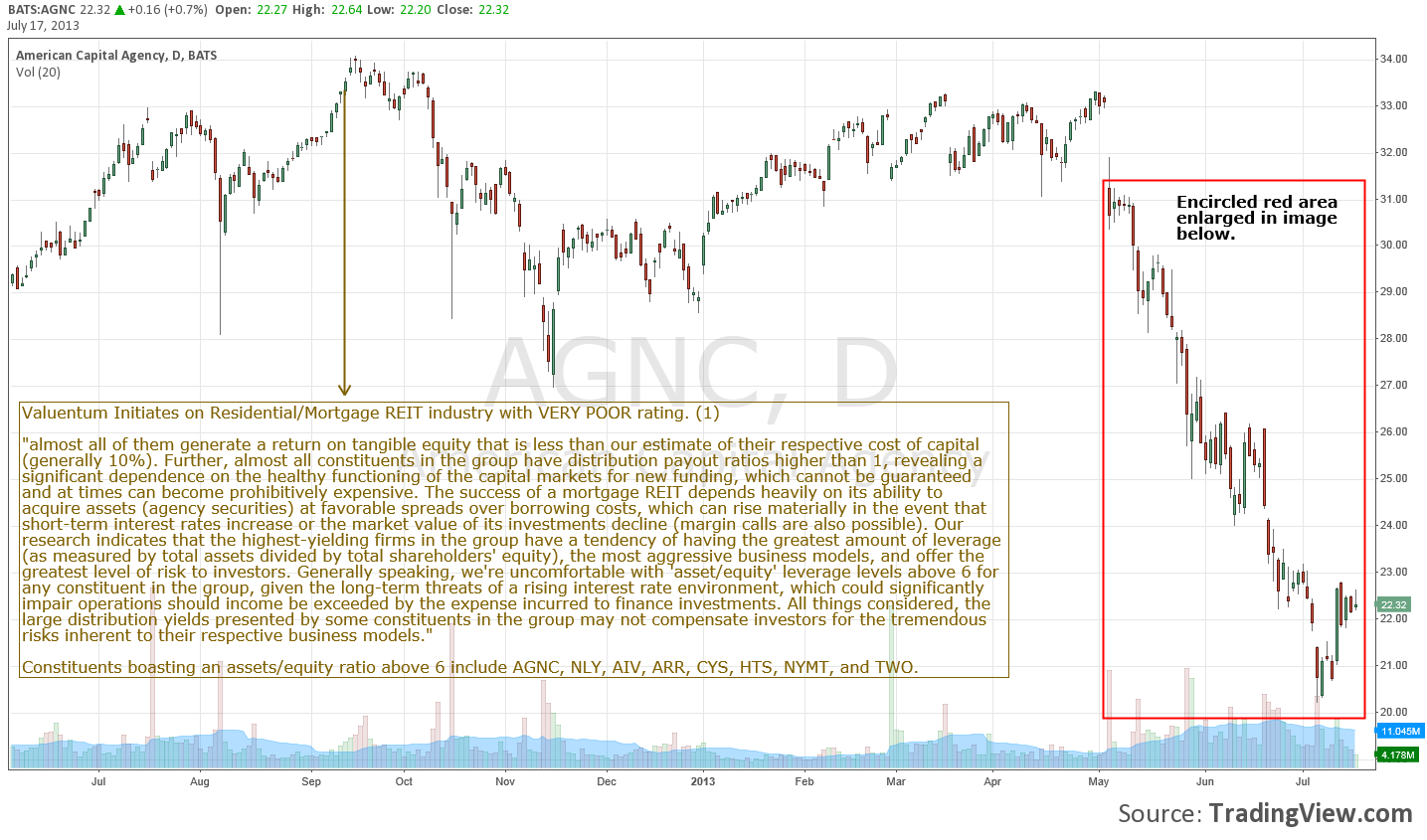

Valuentum's Best Ideas portfolio and Dividend Growth portfolio continue to exceed their respective goals, but the firm's research on the mortgage REIT industry has put it in a class by itself. In this article, please find a graphic portrayal of its call on the mREIT industry. Maxim, KBW, RBC, Edward Jones, Seeking Alpha, Wunderlich, Citi, Evercore, and JP Morgan were all behind the curve. Will still more research shops come around?

1) September 13, 2012. http://www.valuentum.com/downloads/20130717/download

2) May 6, 2013. http://www.valuentum.com/downloads/20130717_1/download

3) May 6, 2013. http://blogs.barrons.com/focusonfunds/2013/05/06/mortgage-reit-funds-in-focus-jefferies-says-investors-underestimate-mreit-risks/

4) May 26, 2013. http://www.valuentum.com/articles/20130526_1

5) May 30, 2013. http://www.thestreet.com/story/11937184/1/mortgage-reit-sell-off-overdone-on-rate-fears-kbw-rbc.html?puc=yahoo&cm_ven=YAHOO

6) June 7, 2013. http://seekingalpha.com/symbol/agnc/currents/2

7) June 24, 2013. http://seekingalpha.com/article/1515952-american-capital-agency-corp-book-value-resilience-in-the-face-of-rates-back-up

8) July 8, 2013. http://www.analystratings.net/ratings/Downgrades/7-8-2013/

9) July 9, 2013. http://blogs.barrons.com/incomeinvesting/2013/07/09/citi-calls-mortgage-reits-oversold-still-cuts-nly-agnc-target-prices/?mod=yahoobarrons

10) July 11, 2013. http://seekingalpha.com/symbol/agnc/currents

11) July 17, 2013. http://blogs.barrons.com/incomeinvesting/2013/07/17/jpm-cuts-all-residential-mortgage-reit-price-targets/?mod=BOL_hpp_blog_ii