By Brian Nelson, CFA

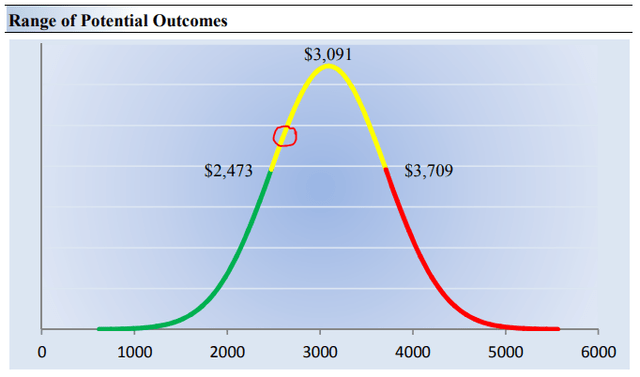

We’ve been receiving questions about the companies that we are looking to add to the Best Ideas Newsletter to replace the ones we recently removed, and I can say that we’re strongly considering adding Booking Holding (BKNG) and adding to the existing “position” in Chipotle (CMG) following their first-quarter 2023 results. We recently raised our fair value estimate for Booking Holding significantly (now $3,091; was $2,147 per share), and we expect a huge fair value increase at Chipotle in the coming weeks. Booking Holding will report its first-quarter 2023 earnings in early May, while Chipotle will report first-quarter 2023 results on April 25. We have several other ideas in mind to add to the Best Ideas Newsletter portfolio, too, including ASML Holding (ASML).

Image: We view valuation as a range of probable fair value outcomes. Our updated fair value estimate for Booking Holding stands north of $3,000, while shares are trading at less than $2,700.

First-quarter 2023 earnings season has been coming in better than feared, in our view, and bank earnings have not spooked the market as many may have thought they would. But again, any banking crisis takes far more than just a month or two to work through the system, and in the event another shoe drops – whether in Europe or in U.S. commercial real estate or U.S. housing – things could get ugly for the banking sector. We continue to prefer equities over bonds, and as was shown once again during SVB Financial (SIVB) meltdown, the Fed was there once again to bail out the “market” and prevent contagion at any cost. With roughly 10% of the S&P 500 reporting first-quarter 2023 earnings so far, many companies have been beating consensus estimates. Here are some of the key reports we’ve been monitoring.

Netflix, Inc. (NFLX) is not a company that we want to “own,” but it’s still a bellwether we’re paying very close attention to. We prefer other large cap growth entities such as Apple (AAPL) and Microsoft (MSFT), which are already included in the newsletter portfolios. More generally, we’re not big fans of the economics of the entertainment streaming business, as competition remains intense and content costs are steep. Disney (DIS), Paramount+ (PARA), Peacock, HBO Now, Amazon (AMZN) Prime are but a few rivals that can gain share against Netflix by leaps and bounds depending on the content. There may be some strings Netflix could pull to drive further growth, whether it be clamping down on password sharing and rolling out advertising on a broader scale, but we just don’t like the business model.

Netflix’s first-quarter 2023 report, released April 18, showed only modest year-over-year revenue growth (+3.7%), while GAAP earnings per share was largely in-line with the consensus forecast. The company’s free cash flow is now targeted to be at least $3.5 billion for fiscal 2023, but the strength is largely due to reduced cash content spending, which fell $1.3 billion on a year-over-year basis in the March quarter alone. Bolstering free cash flow by cutting content spending and reducing capital spending is low quality. Though Netflix recently received an upgrade to its credit rating to investment-grade by Moody’s, it still holds a large net debt position of ~$6.7 billion. Netflix is a pass for us. Quite simply, we like other stocks in the area of large cap growth.

ASML Holding (ASML) has shot up more than 13% to start 2023, and the firm posted better-than-expected first-quarter 2023 results April 19. The company is among several that we’re considering adding to the Best Ideas Newsletter portfolio. As we’ve written previously, ASML is one of the most prolific innovators in the semiconductor industry. The firm provides chipmakers with hardware, software and services to make patterns on silicon with lithography, a vital system in the chip-manufacturing process that increases chip value while lowering costs. The resolution of ASML’s lithography systems contributes to the ever-shrinking nature of transistors and microchips needed for ongoing industry innovation. Smaller and smaller chips save energy, cost and time, and the wavelength of the light used by ASML’s lithography systems can print smaller and smaller features to accommodate required shrink.

ASML expects substantial opportunities as lithography intensity increases on future nodes, and in the past, the firm has offered specific targets for 2025 and 2030. By 2025, ASML expects annual revenue between €30 billion and €40 billion with its gross margin coming in at 54%-56%. By 2030, management expects annual revenue between €44 billion and €60 billion with gross margin between 56%-60%. The company also expects to return a significant amount of capital to shareholders during this time in the form of dividends and repurchases via a new €12.0 billion buyback program that runs through the end of 2025. Its first-quarter 2023 results showcased an impressive 90%+ growth in revenue and a very strong GAAP earnings-per-share beat thanks in part to a better-than-expected gross margin of 50.6%. ASML expects net sales growth of 25% for fiscal 2023 and a “slight improvement in gross margin, relative to 2022.” It’s hard for us not to like its growth potential.

Lockheed Martin (LMT) reported better-than-expected first-quarter 2023 results April 18 that showed a modest beat on the top line and a bigger beat on the bottom line. The defense giant generated $1.3 billion in free cash flow in the quarter (up from $1.1 billion in the year-ago period), and it reaffirmed its 2023 outlook in the press release. As a hot war rages in Ukraine, stimulating defense spending across Europe, and tensions between the U.S. and China intensify over myriad issues, not the least of which is Taiwan, we like some exposure to the defense contracting business, and Lockheed Martin is one of the best. Free cash flow is targeted at north of $6.2+ billion for the fiscal year on operating cash flow of $8.15+ billion. We expect continued strong dividend growth at the defense contractor and think it is a great fit for the Dividend Growth Newsletter portfolio.

Concluding Thoughts

2023 has been a great year thus far. The area of large cap growth (SCHG) has surged nearly 19% so far, while the Vanguard Long-Term Bond Fund ETF (BLV) is up a modest ~2.5% year-to-date, showcasing that staying the course in equities over the long term continues to make a lot of sense. During 2022, both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio did better than the traditional 60%/40% stock/bond portfolio, which was supposedly designed to mitigate drawdowns more than all-equity portfolios. The 60%/40% stock/bond portfolio failed in this regard. We’ll be looking to “redeploy” capital across the newsletter portfolios in the coming weeks, and BKNG and CMG are two possible ideas; ASML is another one. We continue to monitor first-quarter 2023 reports as they continue to come in.

Happy investing!

———-

Tickerized for BKNG, CMG, NFLX, SIVB, FRC, WAL, SCHW, RF, NYCB, MTB, SBNY, ASML, LMT, IYR, LQD, HYG, JNK, SPY, QQQ, DIA, XLV, XLP, XLK, VGK, EWU, XLE, XLF, KBE, MCHI, FXI, KWEB, EWI, RSX, EWT, BLV, VBIAX, DIS, PARA, AMZN

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.