Member LoginDividend CushionValue Trap |

We Like NextEra Energy’s ESG Focus But Capital Market Conditions Now Showing Cracks

publication date: Oct 3, 2023

|

author/source: Brian Nelson, CFA

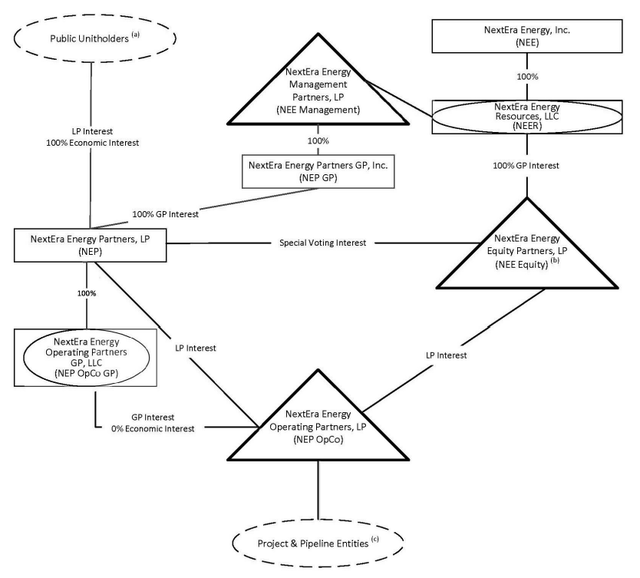

Image Source: NextEra Energy By Brian Nelson, CFA We’ve written in the past about NextEra Energy (NEE), and our latest note can be found here. The company remains one of our favorite utilities, but mostly because of its renewables energy exposure as it relates to ESG considerations. When it comes to utilities, more generally, however, we tend to take a pass on almost all of them given the capital intensity involved in their operations and their interest-rate sensitivity, especially now in an environment where interest rates are returning to “normal” levels in the mid-single-digits. The forward estimated dividend yield on the Utilities Select Sector SPDR ETF (XLU) stands at ~3.8% at the time of this writing, and if investors are plowing capital into the utilities sector solely for yield, locking in a 10-year Treasury rate, which now stands at ~4.75%, may be a much better consideration, in our view. For risk-seeking investors targeting aggressive capital appreciation potential, we continue to prefer ideas in the Best Ideas Newsletter portfolio. NextEra Energy operates a complex business structure, as shown in the image above, and the firm’s equity is facing pressure on news that its subsidiary NextEra Energy Partners (NEP) is cutting its distribution per unit growth rate to the range of 5%-8% annually through 2026, which is materially below its prior expectations of growth in the 12%-15%. Since most partnerships are owned primarily for their distribution yields, the revision has sent units of NextEra Energy Partners tumbling, hurting its partner along the way. The news, while not tragic, wasn't very welcoming, and reading between the lines, it appears that we’re starting to see some cracks in the capital markets, as most partnerships are debt-heavy, relying on continuous, affordable access to the capital markets to fund and grow their operations (distributions), which isn’t guaranteed. Here is what NextEra Energy Partners had to say in its press release, for example: Tighter monetary policy and higher interest rates obviously affect the financing needed to grow distributions at 12%, and the burden of financing this growth has had an impact on NextEra Energy Partners' unit price and yield. In the current market environment, the partnership believes revising its growth expectations for now is the appropriate decision for unitholders and better positions it to continue to deliver long-term value. By reducing its growth rate and executing on its previously announced transition plans as outlined in May, which includes the sale of the natural gas pipelines and the buyouts of the convertible equity portfolio financing payments due through 2025, NextEra Energy Partners does not expect to require growth equity to meet its revised growth expectations until 2027. If favorable market conditions exist, the partnership may elect to opportunistically issue equity, which would likely be executed through its at-the-market equity issuance program. We’re going to stick with NextEra Energy in the ESG Newsletter portfolio for now, but the read-through based on its commentary in the press release is that capital-market dependent entities from equity REITs (VNQ) to master limited partnerships (AMLP) have been put on notice that capital market conditions are tightening. These high-yielding areas are already reeling from higher interest rates and investors migrating to fixed income, but tightening capital market conditions will only further increase the pain as most will have to hunker down on spending until the environment eases a bit. We’re sticking with our $78 per-share fair value estimate of NextEra Energy for now, and we continue to take a long view with respect to its shares. We like NextEra Energy's renewables portfolio, a view offset in part by the complexity of its business structure and the capital-market dependence of its myriad subsidiaries. NOW READ: ICYMI -- Shocking?!?! Utility Dividends Aren't Always Safe ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment