Member LoginDividend CushionValue Trap |

Pet Insurer Trupanion’s Business Facing Numerous Challenges; Short Interest at 35%+

publication date: Jul 12, 2023

|

author/source: Brian Nelson, CFA

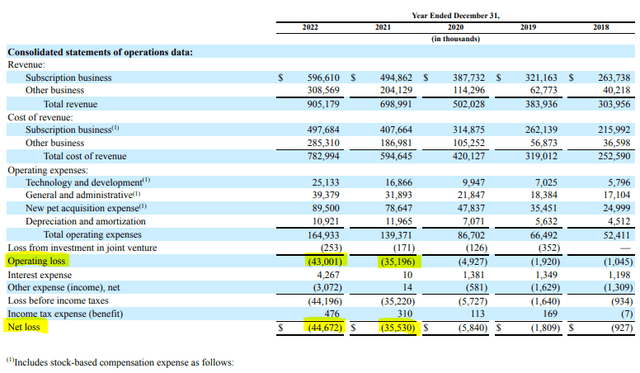

Image: Trupanion may be growing its top line like a weed, but its operating losses have been growing, too. Image Source: Trupanion 10-K. By Brian Nelson, CFA Trupanion, Inc. (TRUP) offers medical insurance for cats and dogs across the U.S, Canada, Europe, Puerto Rico, and Australia. The company generates revenue primarily from subscription-based insurance fees, and the firm prices its offerings to achieve a target margin that seeks to balance the costs of pets with less-expensive veterinary expenses with the costs of pets that have more-expensive veterinary expenses. As with any insurer, Trupanion’s actuarial team is a big value driver to its operations, and the firm has been collecting pet health data for over 20 years to finetune its pricing model to handle cost volatility. Trupanion is the biggest provider of pet medical insurance in North America.

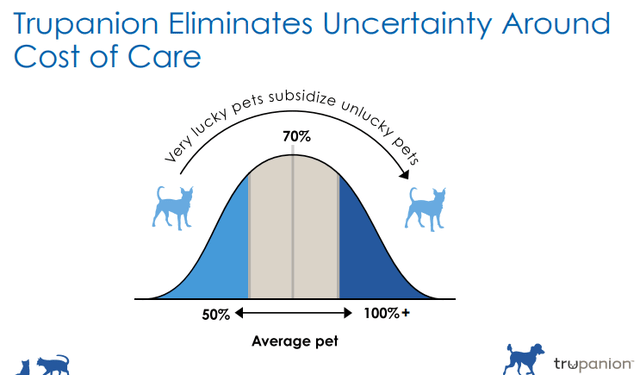

Image: Trupanion’s insurance model. Source: Trupanion May Investor Presentation. There are a few reasons to like Trupanion. For starters, the “humanization” of pets is a trend that continues to accelerate. People view their pets as members of the family, and they want to treat them like humans, even getting medical insurance for them. As an insurance provider, Trupanion has built an incredible network of consumers that have insured pets as well as veterinarians that serve these pets, resulting in moaty and competitive-advantaged characteristics. Though Trupanion has been growing at a nice clip for a couple decades now, there are still large underpenetrated markets across the globe that have yet to be tapped. Every year, there are millions of puppies and kittens born, too.

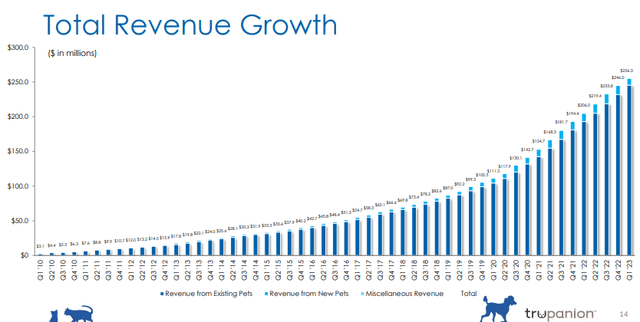

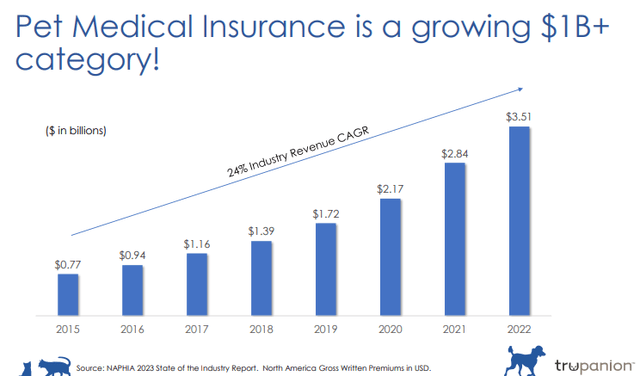

Image: Trupanion has experienced impressive revenue growth in recent years. Source: Trupanion May Investor Presentation. That said, we have a number of concerns with Trupanion’s ability to generate long-term value for shareholders. Let’s cover the obvious first. Trupanion continues to struggle to generate positive operating income, let alone positive net income--and operating cash flow generation remains choppy and largely immaterial during its best years. Meager profitability and cash-flow generation has been the case for a very long time at Trupanion. Lack of profits coupled with weak cash-flow generation is a huge red flag at this point in Trupanion’s life cycle. In the best light, the company is still trying to figure out how to deliver value for shareholders. In the worst light, its business model is starting to look more and more like it will have to depend heavily on new subscription revenue from newly-insured pets to sustain the medical costs of existing pets. Veterinary inflation, for example, was running at 15% on a year-over-year basis during the first quarter of 2023. With the heightened inflationary environment of the past few years, Trupanion may have mispriced its insurance services, or it may be equally likely that economic rents of the medical pet insurance business flow more to the veterinarians, themselves, not necessarily to the insurance companies. Said another way, shareholders of Trupanion may be the ones largely funding the earnings growth of the vet business, not their own insurance operations: …“Trupanion” product was designed by veterinarians to enable them to practice the best medicine – thus recommending the optimal treatment for the pet. As a result, we believe our Trupanion product enables veterinarians to establish stronger ties and better alignment with their clients. Trupanion members tend to visit their veterinarian more frequently and spend more money on the best course of treatment for their pet (Source: Form 10-K). There could be an adverse-selection dynamic going on in the medical pet insurance business, too. Those that seek medical insurance for their pets may be more likely to have pets that need it given asymmetric information between owner and insurer. Without mandating insurance for all pets, the number of healthy pets whose owners are paying into the overall pool may be insufficient to achieve the levels of long-term profitability one might want from Trupanion. There are also inevitable conflicts of interest that may exist. As outlined in the company’s 10-K in the quote immediately above, Trupanion members spend more money on veterinarian visits, and that undoubtedly eats into Trupanion profits. Adverse selection and conflicts of interest are not new to the insurance business, but these are just two more considerations negatively impacting financial performance: (Trupanion has) incurred significant cumulative net losses since (its) inception. (Trupanion) incurred net losses of $44.7 million and $35.5 million in the years ended December 31, 2022 and 2021, respectively, and as of December 31, 2022, (it) had an accumulated deficit of $171.6 million. (It has) funded (its) operations through equity financings, and borrowings under revolving lines of credit and term loans (Source: Form 10-K). There are a lot of things to consider, but the main problem for Trupanion may be as simple as industry economic rents not flowing into its pockets, but rather into the pockets of veterinarians. As evidenced by the firm's significant cumulative net losses since its founding, one can posit that Trupanion's efforts to grow the pet medical insurance industry have mostly benefited veterinarians (which have gained new customers that they otherwise wouldn't)--and not the shareholders of Trupanion. Pet medical insurance was a $770 million business in 2015, and it has now grown into a ~$3.5 billion operation. With weak earnings year after year, hardly any of these industry economic rents have flowed to Trupanion.

Image: The pet medical insurance industry has grown considerably in recent years. Source: Trupanion May Investor Presentation. The company’s first-quarter 2023 results, released May 4, weren’t great. Though total revenue and total enrolled pets grew 24% and 28% on a year-over-year basis, respectively, the company’s net loss exploded to $24.8 million from $8.9 million in the year-ago period, as veterinary inflation costs advanced more than expected--all the while the company has experienced push back on proposed rate increases, the latest objection in California. During the quarter, Trupanion burned through $12 million in free cash flow, which compares to a $7.1 million cash burn in the first quarter of 2022. At the end of the first quarter of 2023, the company held cash and cash equivalents of $126.7 million and short-term investments of $117.9 million versus long-term debt of $102.9 million, so it has a nice liquidity position to handle continued adversity from industry pressures and rising veterinary costs. Let’s now talk valuation. We’ve never been fond of valuing businesses on their unit economics, as these types of valuations can sometimes miss the big picture. This is the case when it comes to Trupanion. For example, Trupanion estimates that it generates $6.67 of cash per month for each subscription pet, but that hardly explains how or why the firm has generated a meager $21 million in total cumulative operating cash flow for the past 3 years, in aggregate. With ~1.62 million enrolled pets at $6.67 cash per month, that’s $32+ million in cash per quarter that is just not showing up in the GAAP financials. Because Trupanion’s new pet acquisition expenses are a part of the company’s incremental revenue growth, we can’t ignore that line item either in our analysis. Without the add-back of stock-based comp (~$34 million in fiscal 2022), operating cash flow would look even worse, too. Capital spending had been modest in the past, but it, too, has increased to $17 million in 2022 from $7.45 million in 2020. That $17 million in capex in 2022 alone pretty much wipes clean all its operating cash flow the past 3 years. Trupanion talks about “compounding” cash flow and “strong returns on invested capital,” but we’re just not seeing it in the financials. Recent executive turnover in its finance, pricing, and legal departments hasn’t been very encouraging either. On the basis of an optimistic discounted cash flow methodology, using peak 2020 operating cash flow of ~$21.5 million and a modest annual capital spending assumption of ~$5-$7.5 million, which is about what it spent in the first quarter of 2023 alone, we’re looking at annual run-rate (mid-cycle) free cash flow $14-$16.5 million on an optimistic basis. If we apply a growing 3% perpetuity to that range at an 8% discount rate, we’re looking at $280-$330 million in equity value. Adding the firm’s net cash position arrives at a DCF-derived intrinsic value shy of $500 million at the high end of the range. Trupanion’s market capitalization stands north of $1 billion at the time of this writing. Concluding Thoughts The insurance business is a tough one, and medical pet insurance may be even more difficult. A number of dynamics from adverse selection to conflicts of interest to lack of bargaining power within the industry’s structure have plagued Trupanion’s financial performance for years, with the company accumulating significant net losses since inception. We’re huge fans of Trupanion’s moaty network of clients and veterinarians as well as its tremendous top-line growth potential, but veterinarians continue to capture the industry’s economic rents, in our view, to the detriment of Trupanion’s shareholders. Unit economics have not been adding up at Trupanion either, and free cash flow has been meager at best for a very long time. As veterinarian costs continue to rise and the firm receives push back on proposed rate increases, Trupanion’s net losses may continue to mount, and even under optimistic assumptions, Trupanion’s shares could be considered rich. NOW READ -- ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio NOW READ -- Expect Huge Equity Returns This Decade, Much More Volatility However NOW READ -- There Are No Free 'Income' Lunches ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for TRUP, AFL, CHWY, LMND, MET, ALL, PGR, PAWZ, PDCO, SPB, ELAN, ZOM, SJM, PETS, CENT, PETQ, ROVR, ABC, MUSTI, GIS, PET, CL, VIRP, CVSG, PETS, MRK, NESN, WOOF, FRPT, ZTS, DPH, IDXX Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |