|

|

Recent Articles

-

Moderna’s Personalized Cancer Vaccine (PCV) Could Be a Game-Changer When Combined with Merck’s KEYTRUDA

Moderna’s Personalized Cancer Vaccine (PCV) Could Be a Game-Changer When Combined with Merck’s KEYTRUDA

Dec 13, 2022

-

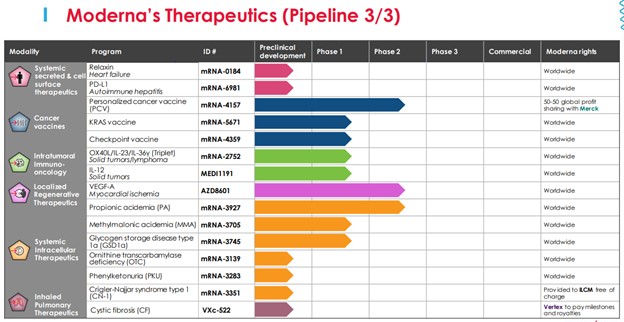

Image: Moderna’s therapeutics pipeline continues to advance, and the company recently received positive news regarding its personalized cancer vaccine (PCV), ID # mRNA-4157, when combined with Merck’s KEYTRUDA. Image Source: Moderna.

Moderna and Merck have revealed what could be a big breakthrough with respect to investigational cancer treatment, but we remind investors that the news is a Phase 2b study, and there is still a meaningful probability that the Phase 3 trial for the immunotherapy may be unsuccessful. Still, the Phase 2b results for the PCV-KEYTRUDA combination showed an impressive 44% reduction in the risk of recurrence or death in patients with late-stage melanoma, and the adverse effects from the combined PCV-KEYTRUDA therapy occurred in just 14.4% of patients, which was not terribly different than those receiving KEYTRUDA alone. There are a plethora of players dabbling in mRNA vaccine technology these days, and we remain excited about its future potential to improve patient outcomes, as much as we are about CRISPR gene-editing technology.

-

Oracle Puts Up Huge Revenue Growth Number in Second Quarter Fiscal 2023 Results

Oracle Puts Up Huge Revenue Growth Number in Second Quarter Fiscal 2023 Results

Dec 13, 2022

-

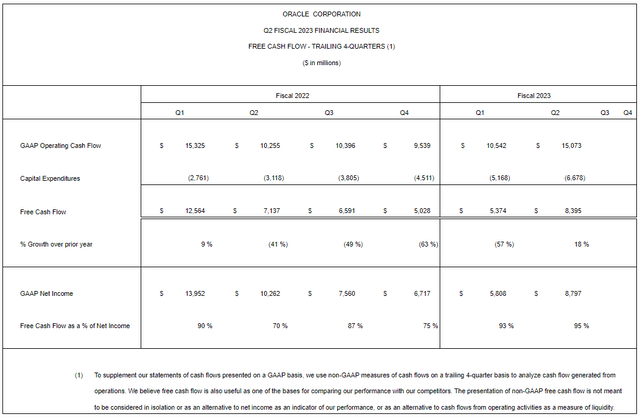

Image: Trailing four-quarter free cash flow trends at Oracle are strong but lumpy. Image Source: Oracle.

On December 12, Oracle Corporation reported better than expected second quarter fiscal 2023 results for the three months ended November 30. Total revenue advanced 18% in the quarter on a year-over-year basis, leaping 25% in constant currency, thanks in part to strong performance at its infrastructure and application cloud businesses. Non-GAAP operating income increased 5%--and 12% in constant currency--and its non-GAAP operating margin was 41% in the period. Fiscal second-quarter non-GAAP earnings per share of $1.21 beat the consensus estimate, despite foreign currency headwinds. We liked that we saw in the quarterly results, and we’ll be sticking with the company as one of our best ideas.

-

American Tower Ups Dividend Payout 6%+ But Shares Not Immune to REIT Sector Weakness

American Tower Ups Dividend Payout 6%+ But Shares Not Immune to REIT Sector Weakness

Dec 12, 2022

-

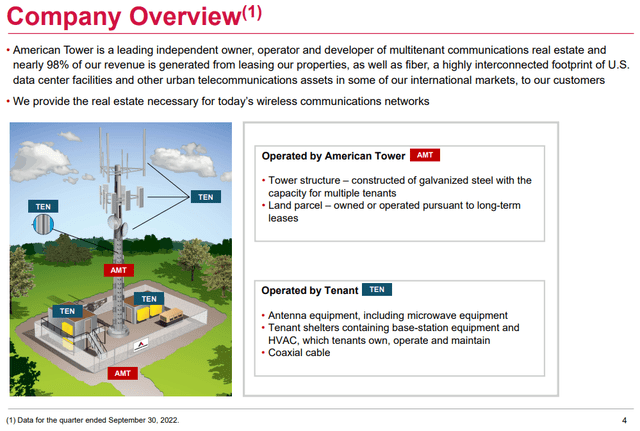

Image Source: American Tower.

Cell tower operator American Tower raised its dividend more than 6% from its last payout in October, and while we like the payout growth momentum, we’re taking note of weakening AFFO and free cash flow trends. The REIT’s net debt position takes on greater prominence in the current rising interest rate environment, too, and its forward estimated dividend yield stands at just ~2.9%, about in line with traditional near-term rates on certificates of deposits. We’re watching deteriorating REIT economics closely.

-

CubeSmart Raises Dividend 14% But We’re Monitoring High Net Debt Load and Deteriorating Occupancy Rates

CubeSmart Raises Dividend 14% But We’re Monitoring High Net Debt Load and Deteriorating Occupancy Rates

Dec 12, 2022

-

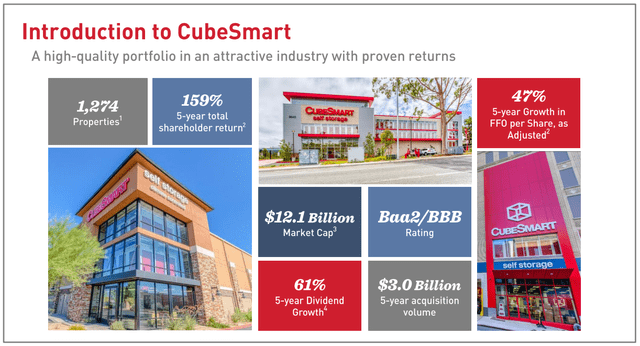

Image Source: CubeSmart.

CubeSmart announced a 14% increase in its dividend payout December 7. The REIT upped its guidance for earnings per share and adjusted FFO when it reported its third-quarter results last October but deteriorating occupancy rates and the impact of rising interest rates on the firm’s massive net debt position have us on alert. We continue to monitor these dynamics closely in light of the REIT’s weak share-price performance during 2022.

|