|

|

Recent Articles

-

UnitedHealth Is A Free Cash Flow Powerhouse; Shares Yield ~1.3%

UnitedHealth Is A Free Cash Flow Powerhouse; Shares Yield ~1.3%

Jan 13, 2023

-

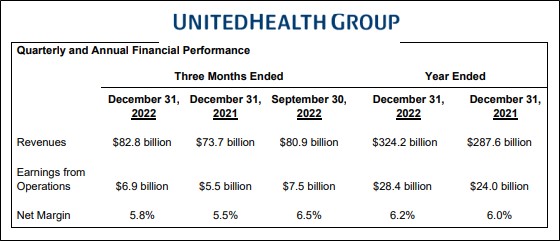

Image Source: UnitedHealth Group.

Very few firms have the type of free cash flow conversion as that of UnitedHealth Group, and the company’s free cash flow coverage of its cash dividends remains phenomenal, all the while its balance sheet remains as strong as ever. We expect the firm to continue to raise its 2023 guidance throughout the year as momentum behind its UnitedHealthcare and Optum divisions accelerate. The executive team remains confident that it will achieve its long-term goal of growing earnings per share in the range of 13%-16% per annum, and while that may seem aggressive, it is achievable, in our view. Healthcare spending remains a large part of U.S. GDP, and we expect overall spending on healthcare to continue to expand at a rapid clip in coming years. We continue to like UnitedHealth Group as a dividend growth idea, and its financials speak to tremendous payout support.

-

Dividend Increases/Decreases for the Week of January 13

Dividend Increases/Decreases for the Week of January 13

Jan 13, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Taiwan Semiconductor’s Shares May Have Bottomed

Taiwan Semiconductor’s Shares May Have Bottomed

Jan 12, 2023

-

Image: We’re liking the technical bottom forming in Taiwan Semiconductor’s shares. Image Source: TradingView.

Everyone has their eyes on Taiwan Semiconductor these days. The firm is the center of attention with respect to Sino-American relations, and the risk that China may invade Taiwan has added a degree of uncertainty to shares that is almost impossible to quantify within general valuation frameworks. Headquartered in Hsinchu, Taiwan, the world’s largest pure-play semiconductor foundry is a key bellwether for an area within technology that has faced considerable pressure during the past year. However, from our perspective, shares of Taiwan Semiconductor look to have carved out what we believe to be a technical bottom, and the high end of our fair value estimate range of $90 speaks to more upside potential.

-

Don't Let "Them" Spin the Narrative

Don't Let "Them" Spin the Narrative

Jan 11, 2023

-

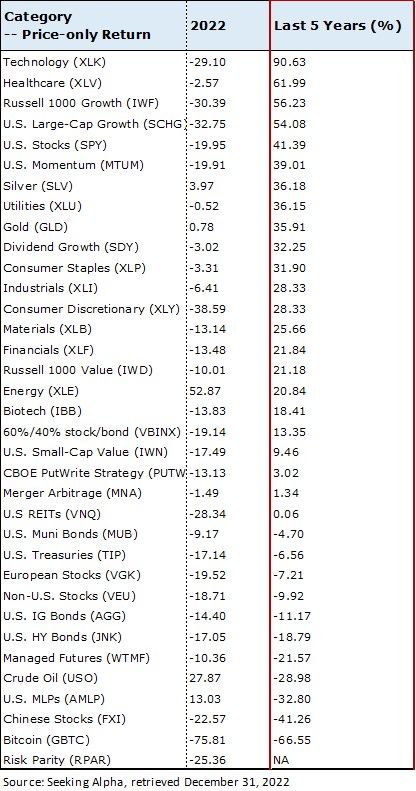

Here’s the bottom line: The 60/40 stock/bond portfolio has failed both during the COVID-19 crisis as well as during 2022, when diversification was needed most. The strongest performers during 2022 were among the weakest performers in the years prior, and their 5-year returns still pale in comparison to those of big cap tech and large cap growth during the past five years. Small cap value, of which factor investing has been built on top of, continues to trail most other stylistic areas during the past five years. We’re staying the course. Though we expect continued tough sledding during the first quarter of 2023, we think the year will offer an incredible opportunity for investors to dollar cost average into what could be yet another strong decade of returns for stocks!

|