|

|

Recent Articles

-

SVB Financial, Silvergate Capital, Credit Suisse Reveal Cracks in Global Financial System

SVB Financial, Silvergate Capital, Credit Suisse Reveal Cracks in Global Financial System

Mar 9, 2023

-

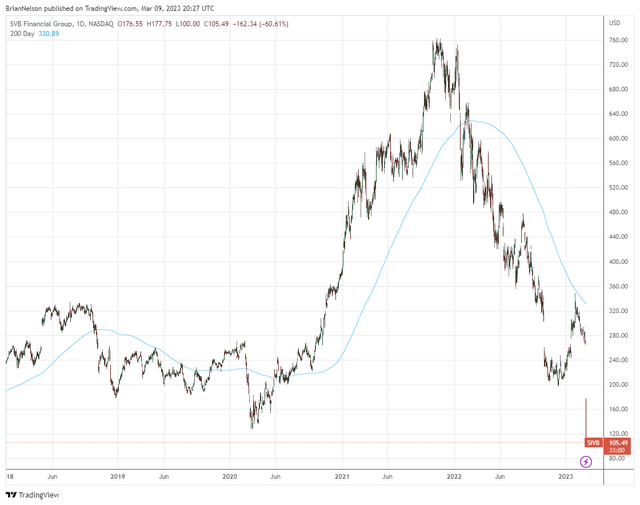

Image: SVB Financial looks to be collateral damage of the Fed’s rate-hiking cycle, and we can’t rule out that other regional banks could have also managed interest-rate risk wrong. Shares of SVB Financial have collapsed, and other banks could be facing similar issues that have yet to come to light. Image Source: TradingView.

SVB Financial announced March 8 what looks to be an emergency equity offering to the tune of $2.25 billion in common stock and convertible preferred shares. The company also announced that it had sold almost all of its available-for-sale (AFS) $21 billion securities portfolio, which resulted in an after-tax loss of ~$1.8 billion during the current quarter. This looks to be an effort to shore up liquidity while it can, and we would not be surprised to see some bad bets at the bank come to light. SVB Financial’s client cash burn has accelerated, and the executive team noted that the “challenging market and rate environment has pressured Q1 performance, with implications to (its) 2023 outlook.” It’s difficult to know just how bad things are at SVB Financial, but the bank seems to have mismanaged interest rate risks and its asset sensitivity. SVB is reconstructing its AFS portfolio with short-duration fixed rate U.S. Treasuries. Though this may be the right move, the stark scenario for the bank is that if market participants lack confidence in the institution, there is more downside to come.

-

We Woke Up on the Wrong Side of the Bed

We Woke Up on the Wrong Side of the Bed

Mar 9, 2023

-

Image: Valuentum's President of Investment Research Brian Nelson, CFA.

Let's cover five controversial topics today: 1) Large cap growth still dominating small cap value. 2) Who cares about whether fund managers beat their benchmarks. Pick the best group of stocks, right? 3) Dividends are capital appreciation that otherwise would have been achieved had the dividend not been paid. 4) Go figure -- bonds are down again so far in 2023. 5) REITs are underperformers and haven't been reliable dividend payers.

-

Dividend Growth Newsletter Portfolio Holding Dick’s Sporting Goods Doubles Dividend, Shares Soar!

Dividend Growth Newsletter Portfolio Holding Dick’s Sporting Goods Doubles Dividend, Shares Soar!

Mar 7, 2023

-

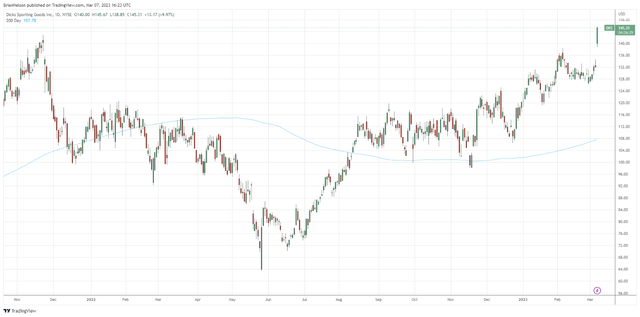

Image Source: Dick’s Sporting Goods’ shares are breaking out of a very nice technical cup-and-handle pattern, and we continue to like shares as an idea in the Dividend Growth Newsletter portfolio. Image: TradingView.

We include Dick’s Sporting Goods as an idea in the Dividend Growth Newsletter portfolio. On March 7, the company reported its fourth-quarter results for the three months ended January 28, 2023. Comparable store sales growth in the quarter came in at 5.3%, which was more than double that which consensus was looking for. The executive team also more than doubled its dividend (105%+), to $4.00 per share on an annualized basis, resulting in a ~2.8% forward estimated dividend yield on the basis of where shares are trading of late. We’re reiterating our $163 per-share fair value estimate of shares, and we continue to like them in the Dividend Growth Newsletter portfolio. We expect to update our dividend report shortly.

-

Markets Bounce Off Technical Support But Not Out of the Woods

Markets Bounce Off Technical Support But Not Out of the Woods

Mar 6, 2023

-

Image: The market-cap weighted S&P 500 (SPY) bounced off technical support last week, both the 200-day moving average as well as the breakout of the downtrend line, but while this may push off any leg down in the near term, we won’t hesitate to “raise cash” on a few newsletter portfolio names if a breakthrough of support to the downside happens. Image Source: TradingView.

The 200-day moving average remains a key technical level for the market-cap weighted S&P 500. The risks that the market may break through both the 200-day moving average and the breakout of the technical downtrend line remain elevated, but the past week showed a successful test of technical support levels, in our view, and that means to us markets may avoid any substantial leg down for the time being. We continue to be cautious on the equity markets in the near term, and we won’t hesitate to “raise cash” across the newsletter portfolios if the S&P 500 breaks through its 200-day moving average and the breakout of the technical downtrend line.

|