|

|

Recent Articles

-

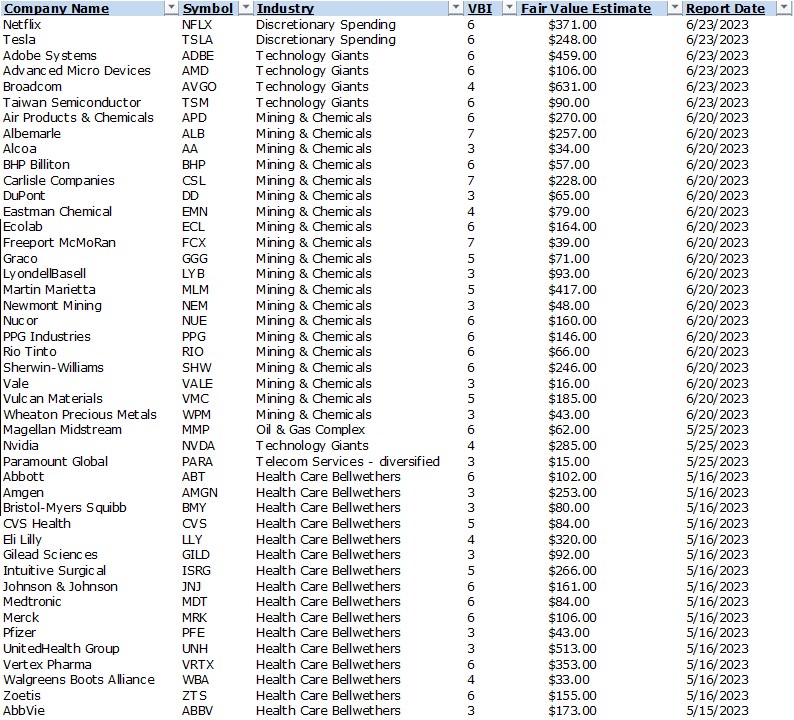

Latest Report Updates Concentrated in Mining & Chemicals and Healthcare Industries

Latest Report Updates Concentrated in Mining & Chemicals and Healthcare Industries

Jun 26, 2023

-

In our 16-page equity research reports, we offer a fair value estimate for each company based on a rigorous and transparent discounted cash flow process, assess the attractiveness of a stock based on a firm-specific margin of safety, and provide a relative valuation comparison in the context of the company’s industry and peers. Each report includes detailed pro forma financial statements, explicit fundamental forecasts, and scenario analysis. A cross section of the ValueCreation and ValueRisk ratings provides a financial assessment of a company’s business quality (competitive position), while the ValueTrend and Economic Castle ratings offer insight into the trajectory of a firm’s economic profit creation (ROIC versus WACC). Included in each 16-page report is a company's rating on the Valuentum Buying Index (VBI), a methodology that combines rigorous financial and valuation analysis with an evaluation of a firm's technicals and momentum indicators to derive a score between 1 and 10 for each company (10=best). We believe the VBI methodology helps identify the most attractive stocks at the best time to consider buying, helping to avoid value traps and lagging performance due to the opportunity cost of holding a stock with great potential but at an inopportune time. The Best Ideas Newsletter portfolio puts the VBI into practice. Read more about the Valuentum Buying Index rating system, "Value and Momentum Within Stocks, Too." Members can access our 16-page company research reports by using our 'Symbol' search box in our website header.

-

CFA Institute Blog: "Hide-'Til-Maturity" Accounting

CFA Institute Blog: "Hide-'Til-Maturity" Accounting

Jun 26, 2023

-

CFA Institute Blog: "The Silicon Valley Bank (SVB) collapse recalls the tussle over the accounting for financial instruments after the global financial crisis (GFC) in 2009, particularly the debate about whether some financial instruments should be carried at amortized cost (held-to-maturity, HTM) rather than at fair value (available-for-sale, AFS), or what is referred to as the “mixed measurement model.”" -- Sandy Peters, CPA, CFA

-

Dividend Increases/Decreases for the Week of June 23

Dividend Increases/Decreases for the Week of June 23

Jun 23, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Expect Huge Equity Returns This Decade, Much More Volatility However

Expect Huge Equity Returns This Decade, Much More Volatility However

Jun 21, 2023

-

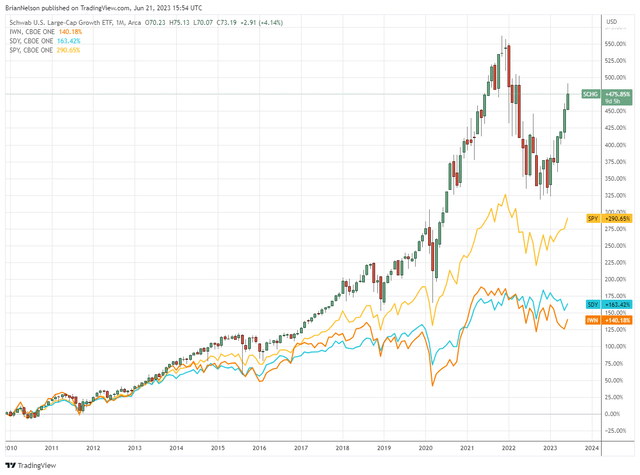

Image: Without question, the stylistic area of large cap growth has been the place to be for almost 15 years now. We think it remains the place to be.

We expect huge equity returns this decade, but much more volatility – the kind of volatility that will make holding stocks painful at times (and shake out some investors at the worst possible time), but it is what it is, as it has always been. We’re as bullish today as we’ve ever been. Cheers!

|