|

|

Recent Articles

-

Dick’s Sporting Goods Raises Guidance as It Closes its Deal for Foot Locker

Dick’s Sporting Goods Raises Guidance as It Closes its Deal for Foot Locker

Sep 18, 2025

-

Image Source: TradingView.

Year-to-date, Dick’s Sporting Goods has opened three new House of Sport locations, and eight new Dick’s Field House locations. Dick’s Sporting Goods bought back $299 million in stock, while it paid $196 million in the quarter. The firm raised its full year 2025 guidance for comparable sales growth to a range of 2%-3%, up from 1%-3% previously. Dick’s Sporting Goods raised its full year 2025 guidance for earnings per diluted share to the range of $13.90-$14.50, up from $13.80-$14.40 previously. We liked the fundamental momentum in the second quarter and remain positive on the company’s decision to buy Foot Locker. Dick’s Sporting Goods remains an idea in the Dividend Growth Newsletter portfolio.

-

Dividend Increases/Decreases for the Week of September 12

Dividend Increases/Decreases for the Week of September 12

Sep 12, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Booking Holdings Expects Mid-Teens Adjusted EBITDA Growth in 2025

Booking Holdings Expects Mid-Teens Adjusted EBITDA Growth in 2025

Sep 11, 2025

-

Image Source: TradingView.

Looking to the third quarter, Booking Holdings expects room nights growth in the range of 3.5%-5.5%, constant currency gross bookings growth of 4%-6%, constant currency revenue growth of 3%-5%, and adjusted EBITDA growth of 6%-9%. Looking to 2025, Booking Holdings expects constant currency gross bookings growth in the high-single-digits and constant currency revenue growth in the high-single-digits. Adjusted EBITDA growth for the year is targeted to expand at a mid-teens percentage pace. We continue to like Booking Holdings’ free cash flow profile, and the company remains an idea in the newsletter portfolios.

-

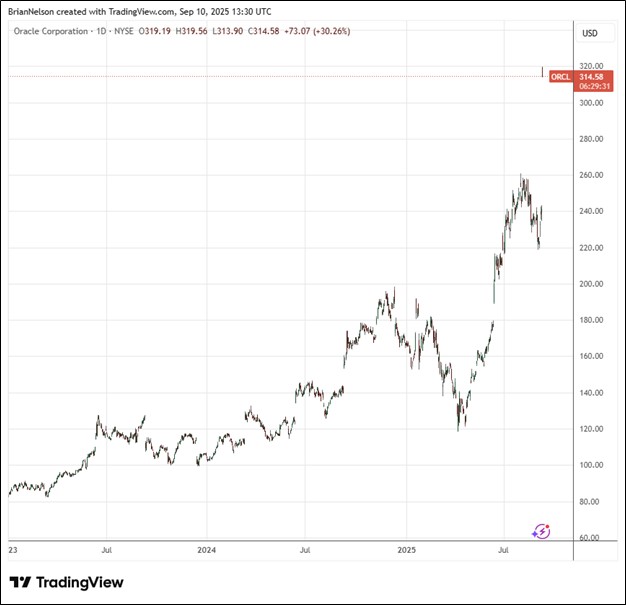

Shares of Dividend Growth Idea Oracle Surge!

Shares of Dividend Growth Idea Oracle Surge!

Sep 10, 2025

-

Image Source: TradingView.

Oracle’s non-GAAP operating income in the fiscal first quarter of 2026 was $6.2 billion, up 9% in USD and up 7% in constant currency. Non-GAAP net income was $4.3 billion in the quarter, up 8% in USD and up 6% in constant currency. We were impressed by the company’s remaining performance obligations growth in the quarter and management’s guidance calling for Oracle’s Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Management noted that most of the revenue in this 5-year forecast is already booked in its reported remaining performance obligations. Shares of Oracle surged on the news, and we continue to like Oracle in the newsletter portfolios.

|