|

|

Recent Articles

-

Best Ideas Booking Holdings, Chipotle Hit All-Time Highs!

Best Ideas Booking Holdings, Chipotle Hit All-Time Highs!

Dec 12, 2023

-

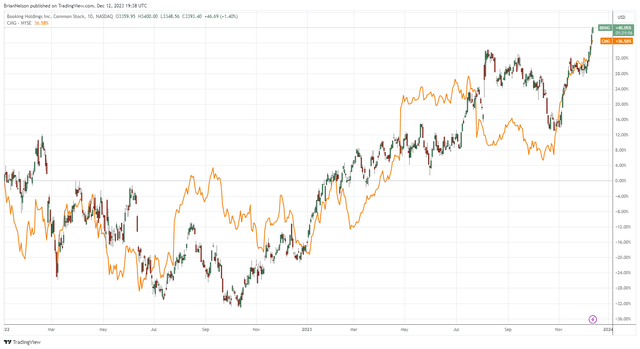

Image: Booking Holdings and Chipotle hit brand new all-time highs!

Two of our favorite investment idea considerations held within the simulated Best Ideas Newsletter portfolio, Booking Holdings and Chipotle, have just hit all-time highs. Our fair value estimate of Booking Holdings stands north of $3,600, and we still expect more upside potential in shares. As it relates to Chipotle, we're huge fans of its long-term restaurant growth potential, and we see upside potential on the basis of the high end of our fair value estimate range. We continue to reiterate our positive stance on both ideas.

-

Oracle’s “Business Is Good and Getting Better”

Oracle’s “Business Is Good and Getting Better”

Dec 11, 2023

-

Image Source: Peter Kaminski.

On December 11, Oracle reported mixed second-quarter results for its fiscal 2024 that showed total revenue advancing 5% on a year-over-year basis (4% in constant currency), slightly lower than expectations, and non-GAAP earnings per share of $1.34 that came in slightly ahead of what the market was looking for. The company’s non-GAAP operating margin of 43% in the quarter helped to drive non-GAAP net income 14% higher than the same period a year ago (11% in constant currency). We’re not letting the slight miss on the top line sway us from our constructive stance on shares. Our fair value estimate stands at $108 per share, about in-line with where shares are currently trading.

-

First Gene-Editing Therapy Coming to Market; Reiterating Our Positive Stance on Vertex Pharma

First Gene-Editing Therapy Coming to Market; Reiterating Our Positive Stance on Vertex Pharma

Dec 10, 2023

-

Credit: Darryl Leja, NHGRI.

On December 8, 2023, the U.S. Food and Drug Administration announced that it had approved Vertex Pharma’s and CRISPR Therapeutics’ novel gene-editing therapy (“Casgevy” – exa-cel) for sickle cell disease [SCD] in patients that are 12 years of age or older. This is the first such approval of its kind in U.S. history and will likely open the door for more gene-editing therapies for other rare diseases in the future. Estimates indicate that roughly 16,000 people will be eligible for the treatment at an estimated cost of around $2.2 million each, according to Reuters. The one-time market size of roughly $35.2 billion is a needle-mover, but the pace and timing of adoption of the therapy among the eligible population is difficult to estimate at this time. Note also that the therapy is of one-time application, meaning the therapy is a functional cure and will not be a source of recurring revenue from each patient. Nevertheless, it is an exciting development for medical science.

-

ESG Matters: Applied Materials Faces Criminal Investigation

ESG Matters: Applied Materials Faces Criminal Investigation

Dec 10, 2023

-

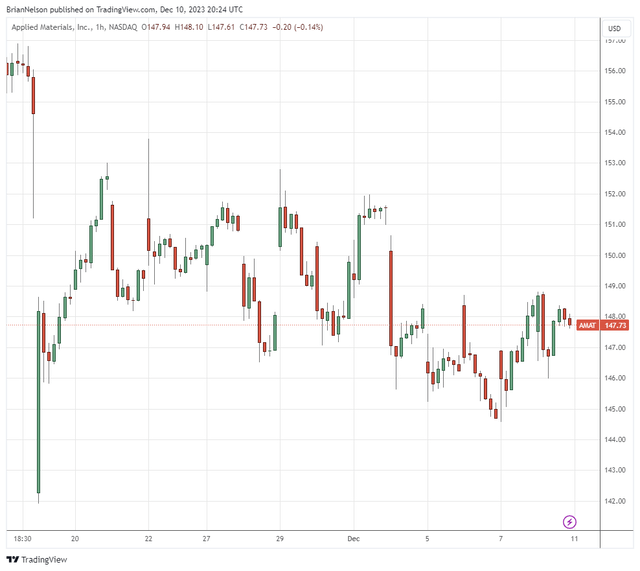

Image: Applied Materials’ shares faced considerable pressure November 17 as news that it had violated export restrictions to China came to light.

On November 16, Reuters reported that Applied Materials allegedly evaded export restrictions by shipping hundreds of millions of dollars of equipment to a subsidiary in South Korea before sending it to China’s biggest chipmaker SMIC. This alleged miscue falls under the Governance (G) category of ESG investing, and shares of Applied Materials have yet to recover from the aggressive sell-off it experienced during the trading session November 17. Though the results of the Department of Justice investigation are still pending, this is quite the black eye for Applied Materials, and we view this as a serious infraction given the U.S.’s stated efforts to keep advanced chips and chipmaking equipment out of China for national security reasons. We’re keeping a close eye on this story, as further news regarding the matter comes to light.

|