|

|

Recent Articles

-

Earnings Roundup: TSLA, NEE, IBM, CMCSA, NOW

Earnings Roundup: TSLA, NEE, IBM, CMCSA, NOW

Jan 25, 2024

-

Image: The Model Y was the best-selling vehicle globally in 2023. Image Source: Tesla.

Tesla missed fourth-quarter results, and while the firm continues to generate robust free cash flow with a solid net cash position, uncertainty surrounding the name looms. NextEra makes the cut for ESG investors, and its earnings outlook for the next few years remains robust, even if its dividend growth may slow. IBM is back in growth mode, and the firm is looking to capitalize on watsonx and generative AI. Comcast has a lot of things going for it, and the firm's robust free cash flow generation suggests that future dividend growth will be robust, despite its lofty net debt position. ServiceNow continues to deliver for investors, and it continues to grow at a robust pace.

-

Earnings Roundup: NFLX, ASML, T, ABT

Earnings Roundup: NFLX, ASML, T, ABT

Jan 24, 2024

-

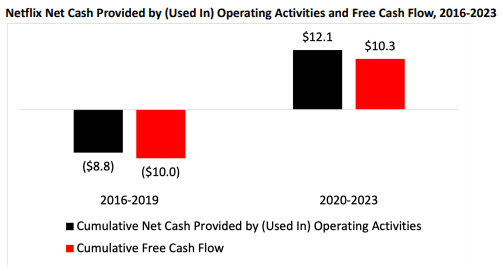

Image: Netflix’s substantially improved free cash flow has made it a clear winner in the streaming wars. Image Source: Netflix.

Netflix has won the streaming wars and continues to throw off material free cash flow as it lands incremental deals, the latest for WWE Raw. ASML is one of the most prolific innovators in the semiconductor industry, and its quarterly net bookings in the fourth quarter reveal an exciting future, even as revenue is forecast to be flat in 2024. AT&T's earnings outlook for 2024 disappointed, and rising capital spending will pressure free cash flow in 2024. Dividend King Abbott Labs continues to drive strong organic growth rates, exclusive of COVID-19 related weakness, and we expect years of future dividend growth at the company.

-

Earnings Roundup: LMT, PG, MMM, GE, JNJ, VZ

Earnings Roundup: LMT, PG, MMM, GE, JNJ, VZ

Jan 23, 2024

-

Lockheed Martin's backlog hits a new high. Procter & Gamble's gross margin surprises to the upside. 3M's bottom-line outlook for 2024 came in lower than expectations. We're excited about GE's split into two companies this year and are positive on GE Aerospace. Johnson & Johnson reaffirmed its outlook for 2024, while Verizon's free cash flow continues to improve.

-

Chinese Equities Still Uninvestable

Chinese Equities Still Uninvestable

Jan 22, 2024

-

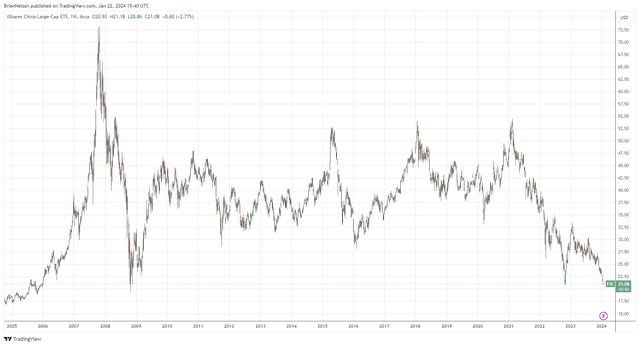

Image: Large cap Chinese equities are back to levels first reached in 2005, almost two decades ago.

Things have been so bad in Chinese equities that China’s largest broker has even taken steps to curb short sales. For the past 52 weeks, Alibaba’s shares have fallen more than 41%, Baidu’s shares have dropped more 22%, JD.com’s shares are off more than 63%, Bilibili’s shares are down more than 65%, while Tencent Holdings has fallen more than 30%. Though the steep declines in shares of Chinese equities may attract some bottom fishing, we’re not interested in any Chinese exposure at this time. We continue to like ideas in the newsletter portfolios.

|