|

|

Recent Articles

-

IBM Raises Full-Year Revenue Growth and Free Cash Flow Outlook

IBM Raises Full-Year Revenue Growth and Free Cash Flow Outlook

Oct 23, 2025

-

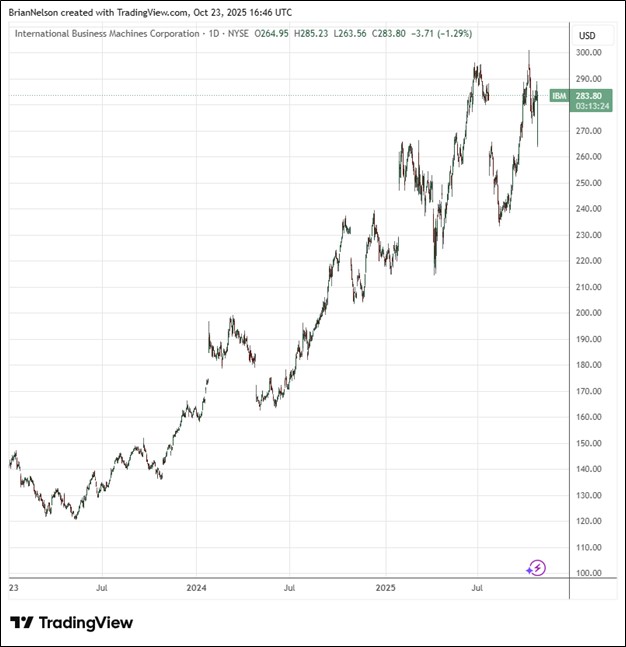

Image Source: TradingView.

Looking to full-year 2025 expectations, IBM now expects constant currency revenue growth of more than 5%, with free cash flow now expected to be about $14 billion. IBM ended the third quarter with $14.9 billion of cash and marketable securities, up $0.1 billion from year-end 2024. Debt, including IBM Financing debt of $11.3 billion, totaled $63.1 billion, up $8.1 billion year-to-date. IBM continues to pay a regularly quarterly dividend of $1.68 per common share and has paid consecutive quarterly dividends every year since 1916. IBM is one that we’re watching closely for the Dividend Growth Newsletter portfolio, but we remain on the sidelines at this time. Shares yield 2.3% at the time of this writing.

-

Tesla Faces Earnings and Margin Pressure But Free Cash Flow Soars

Tesla Faces Earnings and Margin Pressure But Free Cash Flow Soars

Oct 23, 2025

-

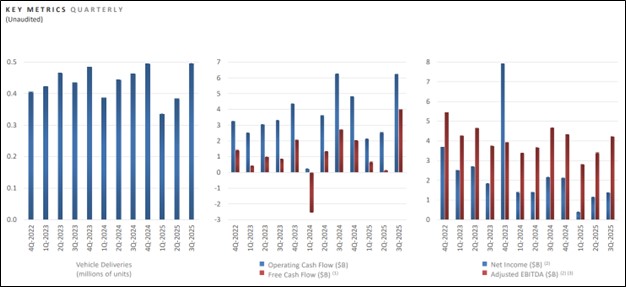

Image Source: Tesla.

Tesla’s cash flow from operations was roughly flat year-over-year at $6.24 billion and the company slowed capital spending to $2.25 billion, resulting in free cash flow of nearly $4 billion in the quarter. Cash and cash equivalents totaled $41.65 billion at the end of the quarter versus $7.7 billion in debt and finance leases, resulting in a net cash position of nearly $34 billion. Tesla delivered 497,099 vehicles in the quarter, up 7%, buoyed by a pull-forward in demand from the expiration of the $7,500 government tax credit. Though fourth quarter results may be pressured, the company remains a net cash rich, free cash flow generating powerhouse. The high end of our fair value estimate range stands at $345 per share, however, well below where shares are currently trading.

-

AT&T Expects Strong Free Cash Flow in Coming Years

AT&T Expects Strong Free Cash Flow in Coming Years

Oct 22, 2025

-

Image Source: TradingView.

AT&T reiterated its full year 2025 financial guidance. Consolidated service revenue is targeted to grow in the low-single-digit range, while adjusted EBITDA is expected to grow 3% or better. Free cash flow is expected in the low-to-mid $16 billion range, while adjusted earnings per share is targeted in the higher end of the $1.97-$2.07 range. The company also reiterated its 2026-2027 financial outlook. Consolidated service revenue growth is expected in the low-single-digit range annually from 2026-2027, with adjusted EBITDA growth of 3% or better annually from 2026-2027. Adjusted earnings per share is expected to accelerate to double-digit percentage growth in 2027. Free cash flow is targeted at $18+ billion and $19+ billion for 2026 and 2027, respectively. We like the free cash flow growth expectations at AT&T, but its huge net debt position keeps us on the sidelines. Shares yield 4.3% at the time of this writing.

-

Netflix Reports Mixed Third Quarter Results

Netflix Reports Mixed Third Quarter Results

Oct 22, 2025

-

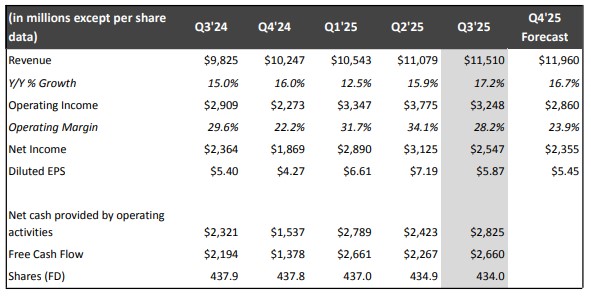

Image Source: Netflix.

Looking to the fourth quarter, Netflix expects revenue growth of 17% (16% on a currency-neutral basis) thanks in part to growth in members, pricing, and ad revenue. The company projects an operating margin of 23.9%, representing a two percentage-point improvement year-over-year. For 2025, it expects to record $45.1 billion in revenue (16% growth, 17% on a currency-neutral basis), a level that is in line with the company’s prior expectations calling for 15%-16% revenue growth (16%-17% on a currency neutral basis). Though revenue growth remains robust, Netflix now forecasts a 2025 operating margin of 29%, which is below prior expectations calling for a 30% reported operating margin due to the impact of the Brazilian tax matter. Management expects 2025 free cash flow of roughly $9 billion (+/- a few hundred million dollars), up from its prior forecast of $8-$8.5 billion. It ended the quarter with gross debt of $14.5 billion and cash of $9.3 billion.

|