|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of September 13

Dividend Increases/Decreases for the Week of September 13

Sep 13, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Kroger Raises Identical Sales Growth Outlook

Kroger Raises Identical Sales Growth Outlook

Sep 12, 2024

-

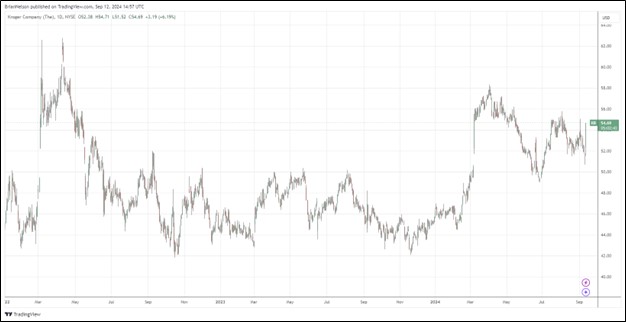

Image: Kroger’s shares have been choppy during the past couple years.

Looking to fiscal 2024, Kroger reaffirmed its guidance for adjusted FIFO operating profit in the range of $4.6-$4.8 billion, adjusted net earnings per diluted share in the range of $4.30-$4.50, and adjusted free cash flow of $2.5-$2.7 billion. It updated its identical sales growth without fuel forecast to 0.75%-1.75% for the year, which is up from the prior range of 0.25%-1.75%. Kroger continues to work toward closing its merger with Albertsons, the completion of which remains uncertain given criticism from the FTC. Our fair value estimate for Kroger stands at $55 per share.

-

Medtronic Raises Fiscal 2025 Guidance

Medtronic Raises Fiscal 2025 Guidance

Sep 11, 2024

-

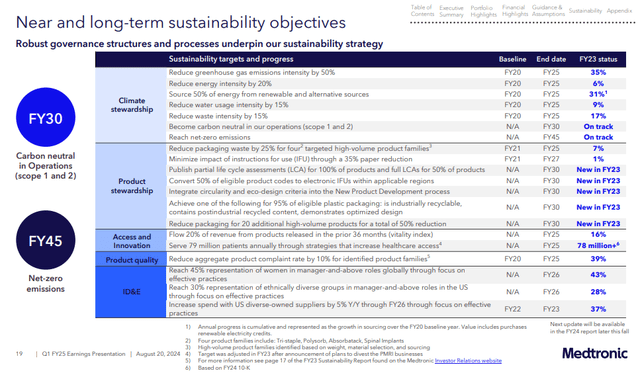

Image Source: Medtronic.

Medtronic raised its fiscal 2025 organic growth guidance to the range of 4.5%-5% versus the prior range of 4%-5%, and it also raised its fiscal 2025 diluted non-GAAP earnings per share guidance in the range of $5.42-$5.50 versus the prior range of $5.40-$5.50, implying growth of 4%-6%. Medtronic is taking advantage of healthy underlying markets and “new product innovation is fueling diversified growth across many health tech growth markets.” The company continues to invest in its “future innovation pipeline to drive growth” in the longer run. The high end of our fair value estimate range stands north of $100 per share.

-

Oracle Expects Increased Revenue Growth Throughout Fiscal 2025

Oracle Expects Increased Revenue Growth Throughout Fiscal 2025

Sep 10, 2024

-

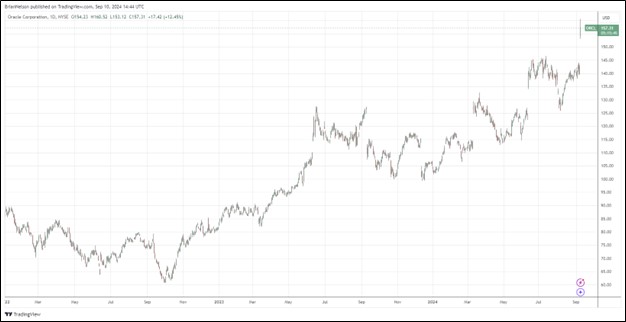

Image: Oracle’s shares have performed quite well during the past couple years.

Oracle remains a key idea in both the Dividend Growth Newsletter portfolio as well as the ESG Newsletter portfolio, and its fiscal first quarter results support our bullish take on the name. Though Oracle has a rather large net debt position, free cash flow remains robust, while the company capitalizes on its total remaining performance obligations, which advanced 53% in the quarter on a year-over-year basis. We liked the commentary about revenue growth to accelerate throughout fiscal year 2025, and we point to the high end of our fair value estimate range ($178 per share) for shares.

|