|

|

Recent Articles

-

Constellation Brands’ Beer Business Continues to Propel Results

Constellation Brands’ Beer Business Continues to Propel Results

Jul 6, 2024

-

Image Source: Constellation Brands.

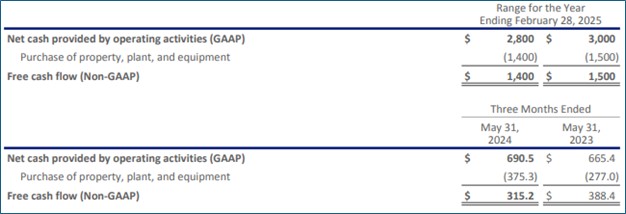

On July 3, alcoholic beverages giant Constellation Brands reported mixed first quarter fiscal 2025 results, where revenue came in a bit light relative to expectations, but non-GAAP earnings per share was better than the consensus forecast. Comparable net sales increased 6%, while comparable operating income jumped 12%. Comparable earnings per share advanced 17%, to $3.57. Shares yield ~1.6% at the time of this writing.

-

Tesla’s Deliveries Bounce Back in Second Quarter

Tesla’s Deliveries Bounce Back in Second Quarter

Jul 6, 2024

-

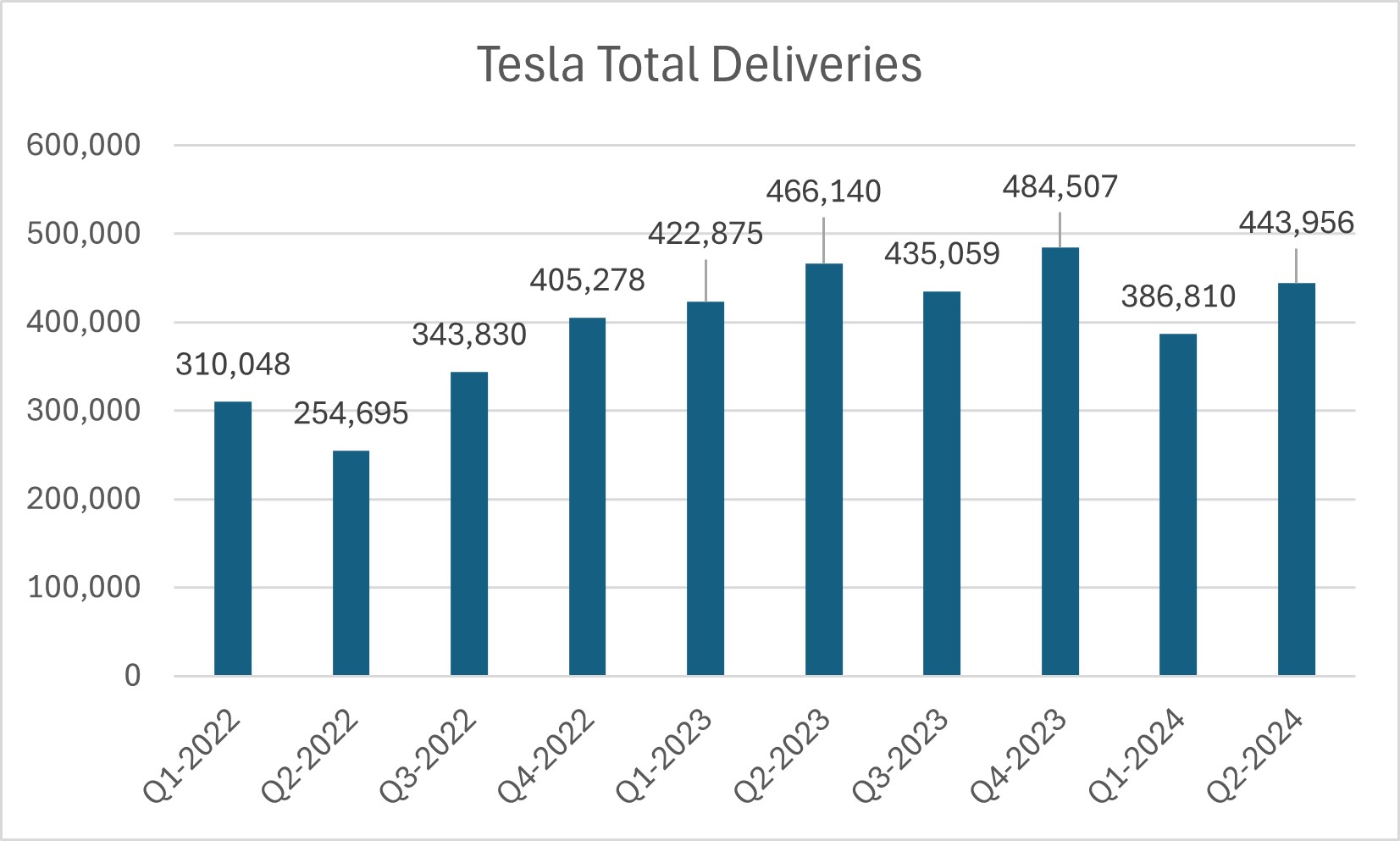

Source: Tesla.

On July 2, Tesla released its production and delivery numbers for the second quarter of 2024. Production of Model 3/Y and other models totaled 410,831, while total deliveries came in at 443,956 units, consisting of 422,405 Model 3/Y and the balance coming from other models. The results were better than expected and helped to propel shares of the electric-vehicle maker higher. Tesla’s equity has shot up past the high end of our fair value estimate range, and while we liked the better-than-feared news regarding its deliveries, we continue to be on the sidelines with respect to Tesla’s shares. The next big catalysts for Tesla’s shares are its earnings release on July 23 and its robotaxi event on August 8. The high end of our fair value estimate range stands at $224, shy of where the company’s equity is trading ($250+).

-

Dividend Increases/Decreases for the Week of July 5

Dividend Increases/Decreases for the Week of July 5

Jul 5, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

High Yield Dividend Income Investing Is Not as Easy as Chasing the Highest Yield

High Yield Dividend Income Investing Is Not as Easy as Chasing the Highest Yield

Jul 3, 2024

-

Image: EpicTop10.com.

The skills to successfully invest for long-term capital gains or long-term dividend growth are much different than those required for generating high yield dividend income. Income investing is a much different proposition. However, the skills do center on a similar equity evaluation process, but one that requires an acknowledgement and heightened awareness of considerably greater downside risks. Income investing, or high yield dividend income investing, should at times be considered among the riskiest forms of investing, as many high dividend-yielding securities tend to trade closer to the characteristics of junk-rated bonds than they do most net cash rich and free cash flow generating powerhouses that we like so much in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

|