|

|

Recent Articles

-

Domino’s Suspends Long-term Global Net Store Growth Guidance

Domino’s Suspends Long-term Global Net Store Growth Guidance

Jul 18, 2024

-

Image: Domino’s shares have done well since the beginning of 2023, but visibility into its long-term global net store growth has become murky given problems at one of its master franchisees.

Domino’s quarterly results and free cash flow performance weren’t poor by any stretch, but the firm disappointed investors with respect to its updated global net store growth forecast. The company noted that it will come up 175-275 stores short of its international store growth target in 2024, and it temporarily suspended its guidance that previously called for 1,100+ global net stores annually over the period 2024-2028. It now expects 825-925 net new stores in 2024. We didn’t like the news, but we remain fans of Domino’s long-term story and are keeping the idea as a holding in the Best Ideas Newsletter portfolio.

-

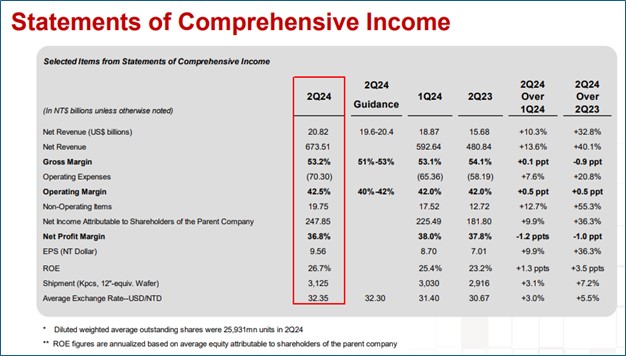

Taiwan Semiconductor Impresses in Second Quarter, Gives Strong Outlook

Taiwan Semiconductor Impresses in Second Quarter, Gives Strong Outlook

Jul 18, 2024

-

Image: Taiwan Semiconductor reported better-than-expected second quarter results.

Though Taiwan Semiconductor is exposed to geopolitical uncertainty, perhaps exacerbated by former President Donald Trump’s latest comments about how Taiwan should pay the U.S. for national defense, the company’s outlook remains robust, in our view. Taiwan Semiconductor remains one of our favorite ideas in the ESG Newsletter portfolio.

-

Johnson & Johnson Finetunes 2024 Bottom Line Guidance

Johnson & Johnson Finetunes 2024 Bottom Line Guidance

Jul 17, 2024

-

Image: J&J’s shares have faced pressure since the beginning of 2023.

Looking to all of 2024, J&J continues to expect adjusted operations sales growth in the range of 5.5%-6%, but it finetuned adjusted operational earnings per share to the range of $10.00-$10.10 from $10.60-$10.75 previously. The company’s improved performance was offset by the collective impact of its recent acquisitions of Shockwave Medical, Proteologix, and NM26 Bispecific Antibody. We’re not reading too much into the downward bottom-line guidance revision as J&J remains a free-cash-flow cow with a pristine AAA credit rating. Though J&J is not included in any newsletter portfolio, it’s hard not to like the company. Shares yield ~3.3% at the time of this writing.

-

ASML Holding Reports Strong Bookings in Second Quarter

ASML Holding Reports Strong Bookings in Second Quarter

Jul 17, 2024

-

Image: ASML Holding has been a strong stock performer since the beginning of 2023.

Though performance in the second quarter could have been better, ASML reiterated its outlook for 2024, which it describes as a “transition year.” Total net sales in 2024 are expected to be similar to 2023. The company ended the quarter with €4.6 billion in long-term debt and €5.0 billion in cash and short-term investments. Second quarter results were disappointing, but we continue to like ASML as one of the most prolific innovators in the semiconductor industry.

|