|

|

Recent Articles

-

Dick’s Sporting Goods Beats Second Quarter Numbers, Raises 2024 Outlook

Dick’s Sporting Goods Beats Second Quarter Numbers, Raises 2024 Outlook

Sep 4, 2024

-

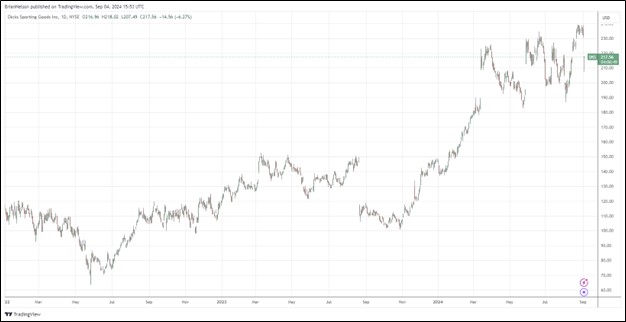

Image: Dick’s Sporting Goods has performed nicely since the beginning of 2022.

Looking to all of 2024, Dick’s Sporting Goods’ earnings per share is targeted in the range of $13.55-$13.90, up from $13.35-$13.75 per share previously, while net sales are expected in the range of $13.1-$13.2 billion (unchanged from last quarter), on comparable sales growth of 2.5%-3.5%, up from 2%-3% previously. We like Dick’s Sporting Goods’ quarter, and we’re fans of its raised outlook. The firm remains a holding in the portfolio of the Dividend Growth Newsletter.

-

NextEra Energy’s Outlook Looks Great

NextEra Energy’s Outlook Looks Great

Sep 3, 2024

-

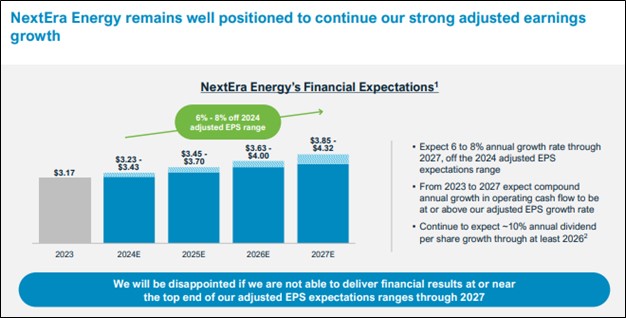

Image Source: NextEra Energy.

NextEra Energy reiterated its long-term financial expectations. “For 2024, NextEra Energy continues to expect adjusted earnings per share to be in the range of $3.23 to $3.43. For 2025, 2026 and 2027, NextEra Energy expects adjusted earnings per share to be in the ranges of $3.45 to $3.70, $3.63 to $4.00 and $3.85 to $4.32, respectively. NextEra Energy also continues to expect to grow its dividends per share at a roughly 10% rate per year through at least 2026, off a 2024 base.” As far as utilities are concerned, we like NextEra Energy, and the company continues to be a key position in the ESG Newsletter portfolio.

-

Campbell Soup’s Sovos Acquisition Helps Power Fiscal Fourth Quarter Results

Campbell Soup’s Sovos Acquisition Helps Power Fiscal Fourth Quarter Results

Sep 3, 2024

-

Image Source: Campbell Soup.

Looking to fiscal 2025, Campbell’s net sales are expected to expand 9%-11% thanks to a twelve-month contribution of Sovos Brands, offset in part by the divestiture of Pop Secret. Organic net sales are expected to be flat to up 2%, which reflects positive volume/mix compared to last year. Adjusted EBIT growth is targeted at 9%-11%, including Sovos and the impact of the divestiture of Pop Secret. Adjusted earnings per share growth is expected in the range of 1%-4%, inclusive of Sovos acquisition and Pop Secret divestiture, to $3.12-$3.22 (versus $3.23 consensus).

-

Lululemon Lowers 2024 Outlook

Lululemon Lowers 2024 Outlook

Aug 30, 2024

-

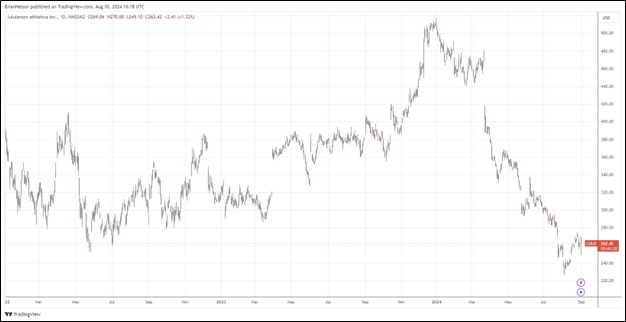

Image: Lululemon’s shares have come under pressure recently.

Looking to 2024, Lululemon now expects net revenue in the range of $10.375-$10.475 billion, representing growth of 8%-9%, below consensus numbers and lower than its initial guidance of $10.7-$10.8 billion. Diluted earnings per share is now expected to be in the range of $13.95-$14.15 for the year, down from previous guidance of $14.27-$14.47. We have no plans to add Lululemon to any newsletter portfolio.

|