|

|

Recent Articles

-

Enterprise Product Partners’ DCF Covered Its Distributions 1.7x in Third Quarter

Enterprise Product Partners’ DCF Covered Its Distributions 1.7x in Third Quarter

Oct 29, 2024

-

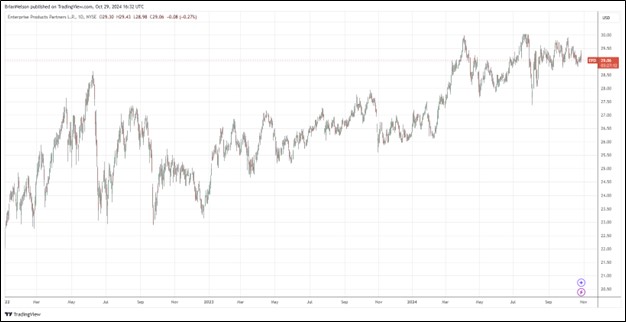

Image: Enterprise Products Partners’ units have done well the past couple years.

Enterprise’s distributable cash flow [DCF] was $1.96 billion for the third quarter, up 5% from the $1.87 billion it registered in the same period a year ago. Distributions during the third quarter increased 5% to $0.525 per common unit, with DCF providing 1.7x coverage of the distribution declared for the third quarter. The midstream energy company expects organic growth capital investment for 2025 in the range of $3.5-$4 billion to reflect opportunities in the Permian Basin and with its acquisition of Piñon Midstream. Our fair value estimate of Enterprise Products Partners stands at $30 per share. Units yield 7.2% at the time of this writing.

-

Phillips 66’s Dividend Well Covered with Free Cash Flow

Phillips 66’s Dividend Well Covered with Free Cash Flow

Oct 29, 2024

-

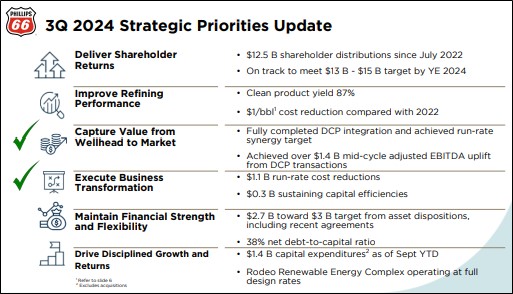

Image Source: Phillips 66.

In the quarter, Phillips 66 achieved its target of $1.4 billion in business transformation savings, including a $1 per barrel refining cost reduction. The firm is also optimizing its portfolio, with asset dispositions totaling $2.7 billion, approaching its $3 billion target. We like Phillips 66 free cash flow generation of $774 million in the third quarter, which easily outpaced its dividends paid in the quarter. The company has distributed $12.5 billion through share buybacks and dividends since July 2022, and it remains on pace to achieve its target of $13-$15 billion by year end. Our fair value estimate of Phillips 66 stands at $155 per share. Shares yield 3.6% at the time of this writing.

-

In the News: Newmont, McDonald’s, the Election

In the News: Newmont, McDonald’s, the Election

Oct 28, 2024

-

Newmont is facing cost pressures, while its gold production is expected to be flattish in 2025. McDonald's has worked fast to put the recent E. coli outbreak behind it. We don't expect the situation to damage McDonald's brand or impact the trajectory of its business in the long run. The U.S. Presidential election is on November 5, and while there are differences between the agendas of former President Donald Trump and Vice President Kamala Harris, we're not making changes to the newsletter portfolios on account of political risk and uncertainty.

-

UPS Returns to Revenue and Profit Growth

UPS Returns to Revenue and Profit Growth

Oct 25, 2024

-

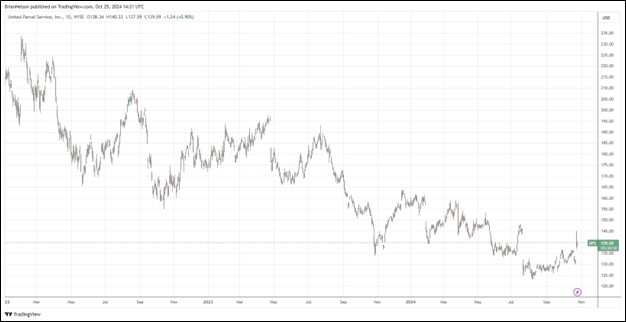

Image: UPS’ shares have been under pressure the past couple years.

For the first nine months of the year, UPS hauled in $6.8 billion in operating cash flow and generated free cash flow of $4 billion. For full year 2024, UPS is targeting consolidated revenue of approximately $91.1 billion (was $93 billion), while it now expects its consolidated non-GAAP adjusted operating margin to be roughly 9.6% (was 9.4%). For the year, capital expenditures are targeted at $4 billion, while dividend payments are expected to be around $5.4 billion. Shares yield 4.7% at the time of this writing.

|