Bullets: Recapping the Crash, Where Are We Now?

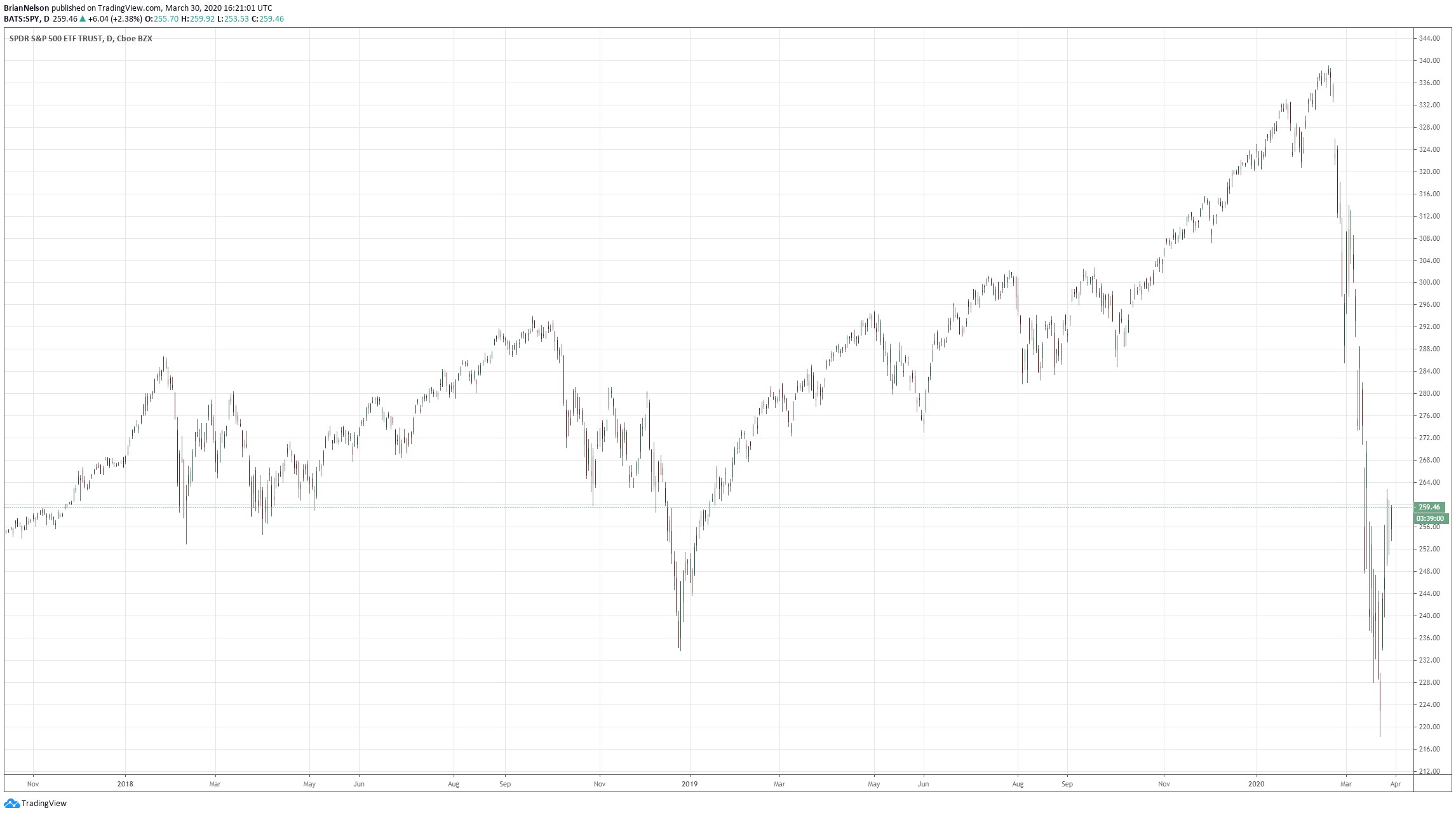

Image: The S&P 500 has only retraced a small part of its decline since the top in February 2020.

By Brian Nelson, CFA

- In August 2019, Valuentum took a cautious bent on the markets, removing the Financial Select Sector SPDR (XLF) and the Energy Select Sector SPDR (XLE), raising cash at the time. Financials and energy have been material underperformers during the swoon, with the Fed/Treasury launching more stimulus than the Great Financial Crisis and Saudi Arabia/Russia continuing their oil-price war. Here’s what we said in August 2019:

August 2019: There are myriad risks as we near the end of this now-decade long bull market: a US-China trade/currency war, slowing global economic growth (Germany's economic growth turned negative during the second quarter), the U.S. 2-year/10-year spread inverted for the first time since 2005 (behavioral-driven selling could spread like wildfire), the Fed unusually cutting rates amid a market that is near all-time highs, political uncertainty regarding a roll-back of corporate tax cuts if there is a Democratic 2020 victory, and market structure (price-agnostic trading)…Just like we said the market would melt-up in December 2018…when we took the newsletter portfolios to "fully invested," we think the base case may be a re-test of the December 2018 lows, and we might get there very quickly. We think members should expect the markets to come in aggressively in the coming months, but that doesn't mean panic. Please don't overreact. Right now, we're prudently raising some cash on a couple out-of-favor ETFs that were added to the newsletter portfolio for diversification benefits. For investors that may want to bet more aggressively, the Exclusive short ideas could be a great consideration.

- On January 13, we made some big defensive changes to the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, removing Apple (AAPL) and General Motors (GM). At the time, Apple registered a warning of a 2 on the Valuentum Buying Index (1=worst, 10=best), indicating that this market was extremely vulnerable to a sharp correction, given Apple’s large weighting across many broad market indices. We diversified into gold miner Newmont Mining (NEM) and garbage hauler Republic Services (RSG) in the Dividend Growth Newsletter portfolio, two highly-defensive positions.

- We established an S&P 500 target of ~2,550 in late February and more formally established a target range of 2,350-2,750 in the March edition of the Dividend Growth Newsletter (pdf), prior to the crash. As predicted, the S&P 500 crashed to the mid-point of our S&P 500 target range of 2,350-2,750, now trading at ~2,590 at this moment. We continue to emphasize that panic selling during this crisis may continue to 2,000 on the S&P, while we emphasize that the range of fair value outcomes for equities has increased, both to the upside and to the downside.

- On February 22, Valuentum warned about the coming crash of the equity markets, and on February 24 and on March 6, added SPY puts to the newsletter portfolios, with the first of the “crash protection” alerts coming with the S&P 500 well north of 3,000. Note, these have been subsequently closed, and we have not added further “crash protection” with expectations of a strong retracement, which has also happened. We continue to be measured and prudent with our idea generation. Derivatives trading can result in complete loss of premium (capital).

- Investors that had been on the sidelines may have dollar-cost-averaged to as much as 50%-75% of an equity portion of widely diversified, multi-asset class portfolios during this swoon. Both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolios have had about 10%-20% cash positions through most of the sell-off. Unless requiring necessary income, it's generally good practice to always seek to retain dry powder in the event we have not put in the lows for this crisis.

- No energy-related dividends, especially those with MLP business models, are safe, and many REIT dividends, particularly mall-based retail, may not be safe. WTI is now fighting to stay above $20 per barrel as demand destruction from COVID-19 combined with an abrupt end to the OPEC+ crude oil supply curtailment agreement in early-March (which we covered here) has pushed global storage levels to the brim. Some midstream companies in the U.S. are now asking their upstream clients to prove they have an end buyer for their raw energy resource volumes in order to prevent a massive build-up in pipeline storage levels (effectively utilizing long-haul pipelines as a storage of last resort, which would be detrimental to the performance of those pipelines on an operational basis). Major raw energy resource exporters, like Russia and Saudi Arabia, show no signs of backing down now, which we covered in detail here.

- Capital-market dependent business models, ones where traditional free cash flow (as measured by cash flow from operations less capital spending) does not completely cover cash dividends paid may be in jeopardy. Read about this in Value Trap. Dividend cuts have been running rampant as companies free up much needed cash flow to outlast the impact of COVID-19 on the economic environment. One of the reasons why Cisco Systems (CSCO), a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, is very appealing comes down to the firm exiting its latest fiscal quarter (period ended January 25, 2020) with a ~$11.1 billion net cash position. Demand for networking hardware and software offerings should bounce back materially once the pandemic is contained considering the level of stress placed on existing networks in light of surging data demand worldwide during the pandemic (due to increased use of telecommunication and video streaming services as households “cocoon” in their homes).

- Even if the United States enters the next Great Depression, a growing probability, stocks may continue to be in demand. Once the dust settles from the COVID-19 crisis, the market could enter a period of significant inflation as a result of runaway government spending and unlimited quantitative easing. As the probability of the next Great Depression increases, so does the probability of a blow-off top in coming years due to inflationary pressures on equities even as many businesses go under and unemployment spikes. Pick your spots wisely: companies with strong net cash positions, solid free cash flows, resilient business models (see “Top Ten Ideas for Consideration Amid COVID-19”).

- Our best ideas for equity portfolio construction remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. We have also established supplemental lists for members looking for additional ideas in this tumultuous environment here for dividend growth and here for capital appreciation. Be wary of those trying to call a bottom or saying that this is “the buying opportunity of a lifetime” as it’s very likely they missed preserving client capital at the top.

- In Value Trap, we said that quant value factors lacked analytical substance, and all of them generated negative returns in 2019 as the market soared. The traditional value factor also got off to the worst start in decades in 2020. In Value Trap, we said price-agnostic trading would create market volatility like never before witnessed, even greater than that witnessed during the Great Crash of 1929 and the Great Depression. This has happened.

- In Value Trap, we said that the airlines would continue to be terrible investments, disagreeing with Warren Buffett. The airlines have crashed. We did not predict, however, that the US government would bailout airlines (and Warren Buffett, who owns many of them). We pleaded with Congress not to once-again punish small business in giving grants to airlines and bailing out publicly-traded entities that can issue new stock via secondaries, draw down their revolvers, float new debt, and otherwise lean on a Federal Reserve backstop. We failed in getting our views out, and now many small- and medium-size businesses will fail.

- In Value Trap, we emphasized the importance of forward-looking expected data in assessing contingent adaptive environments, and the COVID-19 outbreak has all but reinforced the superiority of this process over backward-looking empirical processes--note, everything that has happened is empirical and even reading the Zodiac is evidence based analysis (read Value Trap). The terms “empirical” and “evidence based” are catch phrases and not informative; they should be flagged as marketing.

- What matters in investing, as well as in epidemiology and other fields, is expert analysis and expert forecasts. Director of the National Institute of Allergy and Infections Diseases, Dr. Anthony Fauci expects that the COVID-19 pandemic could kill between 100,000-200,000 people in the United States. White House coronavirus response coordinator Dr. Deborah Birx agrees. Just like you should not trust quantitative research in epidemiology from those that do not have intricate knowledge of COVID-19, you should not trust quantitative research in finance from those that do not have intricate knowledge of the discounted cash-flow model and enterprise valuation.

- The next edition of the Dividend Growth Newsletter and High Yield Dividend Newsletter will be released April 1. Due to extreme market conditions, the quarterly Financial Advisor level publications will be released Saturday, April 18. We will begin a series of educational material for those that have signed up to the additional options commentary in the coming days, and we remain excited about new ideas to come in the Exclusive publication, which has put up simply unmatched success rates across capital appreciation ideas and short-idea candidates.

- As we said in August 2019, don’t panic. The economy is not the stock market. The stock market tends to lead the economy, and a bottoming in the stock market may precede economic recovery by about 6-9 months. To close on an optimistic note, Best Ideas Newsletter portfolio holding and Dividend Growth Newsletter portfolio holding Johnson & Johnson (JNJ) is working aggressively on a vaccine for COVID-19 that could be available as early as 2021 (about 12 months from now). This is the best news we’ve heard in a while.

As we await vaccination, we hope you and your loved ones stay safe.

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment