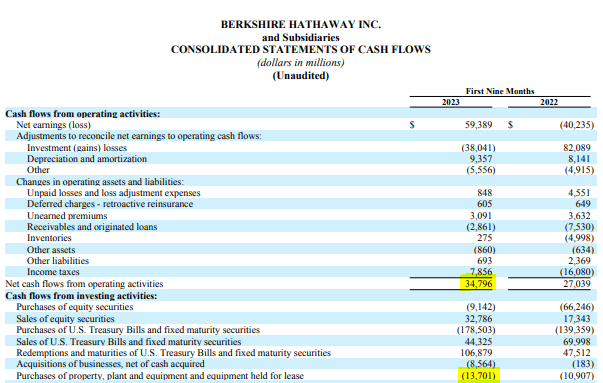

Image: Berkshire Hathaway continues to be a strong free cash flow generator.

By Brian Nelson, CFA

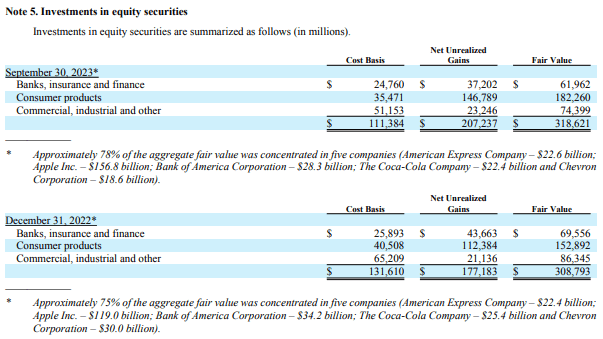

Berkshire Hathaway (BRK.A) (BRK.B) reported third-quarter results on November 4 that were about in-line with what we were expecting. A huge cash balance and strong free cash flow are par for the course at Berkshire, and the company’s stake in Apple (AAPL) continues to power its equity securities portfolio. Year-to-date, shares of Berkshire are up more than 13%, but we do admit that some of the luster has come off shares in light of the performance of asset-heavy names across the utilities and energy sectors. Given Berkshire’s strong run the past few years, we’re not as enamored with shares as we once were, but we still think they are worthy of inclusion to the Best Ideas Newsletter portfolio.

Image: Apple continues to be the star performer of Berkshire’s equity securities portfolio.

NOW READ: Berkshire’s Stake in Apple Has Been a Boon for Shareholders

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.