Member LoginDividend CushionValue Trap |

Details Regarding Visa’s Exchange Offer

publication date: Sep 21, 2023

|

author/source: Brian Nelson, CFA

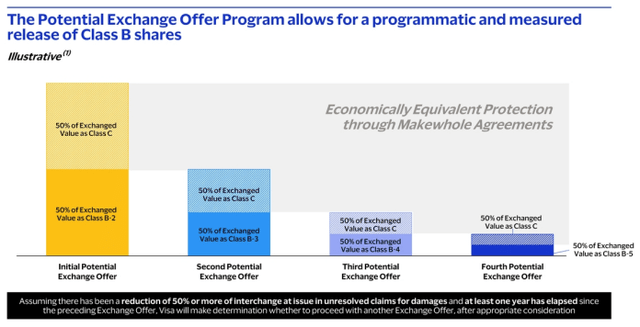

By Brian Nelson, CFA Best Ideas Newsletter portfolio holding Visa Inc. (V) has a number of different common stock and preferred share classes. Investors in Visa generally hold its class A common stock that is traded on the NYSE, but the credit card giant also has class B and class C common stock as well as series A, series B, and series C preferred stock that are tied to the value of its class A common shares. Due to prior litigation corresponding to its initial public offering and 2007 capital restructuring, Visa has both a U.S. retrospective responsibility plan and a European retrospective responsibility plan, and pursuant to the terms of these plans, the company’s class B and class C common stock as well as its series A, series B, and series C preferred stock will eventually be converted into class A common stock, with the end result eventually being an increase in the number of shares of class A common stock outstanding. On September 13, Visa announced that it is conducting an exchange offer program that would allow class B holders to convert and potentially sell up to 50% of their class B common stock that would eventually result in new economically-equivalent class A shares.

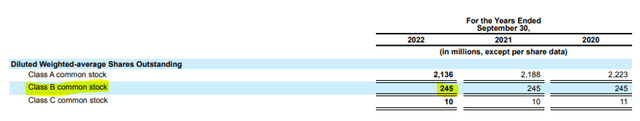

Image Source: Visa’s 10-K At the current conversation rate, the 245 million class B shares could eventually be converted into 390 million new class A shares, roughly 145 million higher than the count we use when accounting for class B dilution in total diluted shares outstanding within our valuation infrastructure. Because the number of to-be-converted class B shares (390 million) is higher than the 245 million already embedded in our valution construct, we would expect an immaterial and modest downward revision to our fair value estimate of Visa, to the tune of ~3% upon the next report update, all else equal, as class B common shareholders would be eligible to convert and sell up to half of their class B shares. Investors should expect news corresponding to future potential exchange offers related to Visa’s capital structure to have a similar modest negative effect, with any impact to the fair value estimate a function of the difference between the existing number of diluted shares outstanding we use in our valuation based on Visa’s 10-K versus the delta in the number of diluted shares outstanding based on current conversion rates at the time of any future potential exchange offer.

Image Source: Visa’s 8-K All told, Visa remains a free-cash-flow generating powerhouse, and the firm’s operating and free cash flow margins are about as good as it gets. Future potential exchange offers from Visa corresponding to its various share classes should be viewed as a minor intermediate-term inconvenience that will only provide but a modest potential headwind to the advancement of the company’s intrinsic value over time, and only in the scenario where diluted shares outstanding increase relative to expectations based on then-conversion rates for non-A class shares when converted. We continue to like Visa as a holding in the simulated Best Ideas Newsletter portfolio, and we like it and Mastercard (MA) more than their rivals such as American Express (AXP) and Discover Financial (DFS) that take on credit risk. NOW READ: ESG Issues Plague Discover

NOW READ: We Prefer Visa ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment