Things Are Bad Out There

“I don’t like this market one bit, but we have to endure. Markets will rise again, but there will be a lot more pain to come in the near term. We think the base case is that we get a very bad recession in 2023. We’ve yet to pull the trigger on put option ideas in the simulated newsletter portfolios, but we expect things to get worse before they get better. For readers seeking ongoing option ideas each month, please consider subscribing to our options commentary here.” – Brian Nelson, CFA

By Brian Nelson, CFA

Things are bad out there, and there’s probably no better way to say it.

On September 28, Bloomberg reported that Apple Inc. (AAPL) is now “backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize.” According to the report, Apple has informed suppliers to reduce “from efforts to increase assembly of the iPhone product family by as many as 6 million units in the second half of this year.” That means iPhone production for 2022 will be roughly flat with the prior year, yet another blow to broad-based market sentiment.

Apple is roughly a ~7.5% weighting in the SPDR S&P 500 ETF Trust (SPY), and while the biggest weakness in the U.S. equity markets has come from ARK Innovation ETF (ARKK) related names, which collectively have fallen almost 60% so far this year, we’re now starting to see major cracks at the top of the technology chain, after only some modest weakness. Apple is now off nearly 20% year-to-date, a fraction of more speculative tech names that have dominated headlines in year’s past, but its leadership will now be challenged.

One of the Worst Years in Stock Market History

U.S. consumers continue to contend with rising food cost inflation, “Fed Raises 75 Basis Points; Food Price Inflation Continues to Wreak Havoc on Consumer Budgets,” which is taking a bite out of their budgets for discretionary items such as the new iPhone. European consumers and businesses continue to face pressure from soaring energy costs, and China is suffering from weakness in the mortgage market, among other areas. The U.S. housing market may be ready for a big correction, too, as mortgage rates have spiked considerably. U.S. mortgage interest rates are now north of 6.5%, the highest since mid-2008, and we can’t rule out housing price declines in the U.S. of 20%, 30% or more in the most heated areas in coming years.

As consumers continue to experience pressures both in the U.S. and abroad, investors are feeling even more pain. Through the first 184 trading days of 2022, this has been one of the worst years-to-date for the S&P 500 in history, with only the Great Depression (1931), recession of 1974, and the dot-com crash (2002) worse. Now, more than ever, investors need to be paying attention to their investments – not panicking, of course, but making sure they are comfortable with their risk allocations, as weakness has been broad based. Treasuries (TLT) and investment-grade corporate bonds (LQD) are down ~28% and 21%, respectively, so far in 2022.

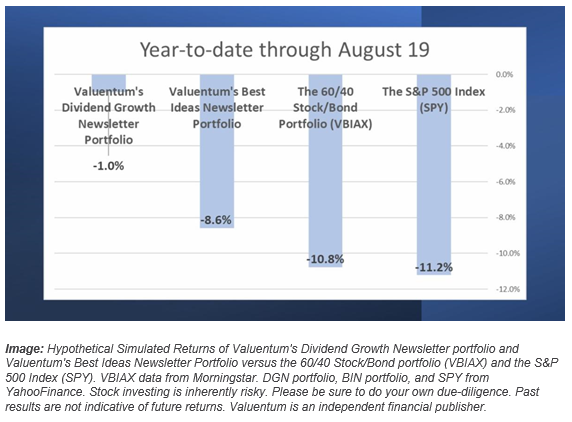

This year has been tough with Meta Platforms (META) and PayPal (PYPL) not panning out, “Post-Mortem on Facebook…,” and while the simulated Best Ideas Newsletter portfolio has carved out some nice relative outperformance through the latest “performance” update on August 19, it’s important for readers to note that things are bad almost everywhere, and we’re happy to have pivoted to an increased energy “weighting” in mid-2021 as it has helped to cushion the blow of these terrible equity markets. We moved to bearish, “Now Bearish…” with the simulated Best Ideas Newsletter portfolio down just 8.6% on the year, and if we’re correct, we think this was still early, meaning more tough sledding may be ahead.

A Massively Negative Wealth Effect Has Yet to Be Factored Into Earnings Numbers

In addition to the pressures of inflation on consumers, a negative wealth effect is having a huge impact across discretionary spending and sentiment. Many investors have been reeling from the steep declines in the cryptocurrency (BITO), non-fungible token (NFT), and collectibles markets from the huge gains preceding and during the COVID-19 shutdowns, but the modest, conservative 60/40 stock/bond portfolio hasn’t been a good place to hide either. The Vanguard Balance Index (VBIAX), for example, is off more than 20% so far this year.

Dividend growth stocks (SDY) had been one place to hide in 2022, but more recently, these names have come under pressure, too. We continue to like the dividend growth strategy in this market environment, but investors that are focused solely on a company’s yield may seek to broaden their perspective a bit as lower prices and even higher yields might be in the future, even for some of the strongest names. We’re watching Realty Income (O) to get cheaper, in particular, as the Monthly Dividend Company now sports a dividend yield of ~5%, “Realty Income’s Dividend Growth Track Record Is Stellar.”

Based on estimates from Bloomberg and BofAML data, the drawdown in total market capitalization of U.S. equity and fixed income since the recent peak is $57.8 trillion, a number that includes corporate, government and mortgage fixed income performance. For context, the drawdown during the Great Financial Crisis was less than $10 trillion, so we’re looking at a marketplace so far this year and a potential negative wealth effect that may be nearly six times worse than the Great Financial Crisis, according to Gavekal.

We think the base case is that we get a very bad recession in 2023.

Global Banking Contagion Risk Has Increased Substantially

Things are so bad out there that the Bank of England (BoE) has started to buy long-dated debt to support a U.K credit market that has become disorderly of late. Some have been saying that the action by the BoE to buy bonds was necessary to prevent a “run dynamic” on pension funds, which continue to languish in light of the weakness of asset allocation strategies – the 60/40 stock/bond portfolio, in particular – and as the pound (FXB) remains under pressure, trading at a record low against the U.S. dollar (UUP). According to Bloomberg, the BoE “was concerned that margin calls would cause” a bond (gilt) crash.

Should U.K. banks start to need support, global financial contagion risks would be on the table.

All of this coupled with the ongoing war in Ukraine and questions over sustainable energy supplies in Europe this winter have created a market environment with as much uncertainty as the first sighting of hazmat suits in Wuhan in January/February 2020. Things are simply not good, and while markets may be hoping the Fed may pivot like the BoE has done to stem off a crisis, we think the Fed remains committed to fighting inflation at home. But even as the Fed raises and raises, it may not truly be able to tackle food cost inflation when elasticities are working in businesses’ favor. A look at General Mills’ (GIS) recently-reported quarter showed considerable improvement in earnings growth, despite lower volumes. The Fed may be stuck between a rock and a hard place.

Concluding Thoughts

The Bank of England’s intervention to stem what might have turned into a “run on the bank” dynamic for pension funds in the country amid a collapsing pound has given rise to the view that the Fed may start to slow its rate of increases amid global uncertainty. We think it’s too early to tell.

From our perspective, the Fed remains committed to stomping out inflation, something that it may not truly be able to do, given that interest rate hikes may be too blunt of an instrument to stymie food cost inflation, which remains one of the the biggest inflationary headwinds that is hurting consumer budgets.

What is happening on the global stage is quite concerning, and we remain bearish on the equity markets. The bull case may very well be a deep recession in the U.S., where dollar cost averaging in the U.S. markets could be had, followed by sharp interest rate cuts by the Fed, and a return to all-time highs.

This is not a time to lose interest, but a time to pay even closer attention to your investments. What you do over the next couple years will have implications on your portfolio 5, 10, and 20 years forward. Let’s keep focused on preserving and building long-term wealth!

----------

Video: Valuentum's President of Investment Research, Brian Nelson, CFA, explains the importance of diversification, how to think about firm-specific and systematic risk, how many stocks one should own to achieve 90% of the diversification benefits, how to think about active asset allocation versus active equity management, and why diversification is a means to achieve goals, not the goal itself. A content-packed 14-minute video. Don't miss it!

----------

Related: GBTC, BTF, XBTF, USDU, FXY, SPY, VOO, IVV, QQQ, TQQ, DIA, FXE, EUO, ULE, RSX, MCHI, FXI, BCS, LYG, HSBC, DB, CS, ING

Also tickerized for holdings in the ITB, our banking coverage universe, various Apple suppliers, as well as BKI, FMCC.

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment