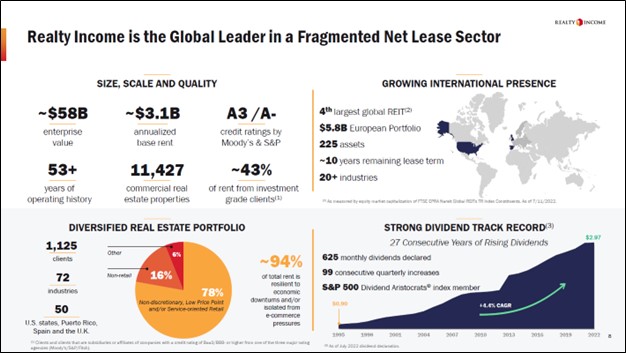

Image Shown: We like exposure to shares of Realty Income Corporation in our Dividend Growth Newsletter portfolio. Image Source: Realty Income Corporation – Second Quarter of 2022 IR Earnings Presentation

By Callum Turcan

We include Realty Income Corporation (O), a real estate investment trust (‘REIT’), as an idea in the Dividend Growth Newsletter portfolio because we like the exposure the REIT provides to the commercial property market. Back in November 2021, Realty Income closed its merger with VEREIT and subsequently spun off Orion Office REIT Inc (ONL), a move that effectively saw Realty Income exit the corporate office property space. Realty Income’s portfolio consists of 11,400+ commercial properties in the US, Puerto Rico, and the UK that provide the REIT with stable income streams, which enables Realty Income to pay out monthly dividends.

During its 50+ year operating history, Realty Income has paid out 625+ consecutive monthly dividends and has increased its payout 115+ times since going public in 1994. Its latest payout increase was in September 2022, when Realty Income boosted its monthly payout to $0.248 per share (up modestly on a sequential basis) or $2.976 per share on an annualized basis. As of this writing, shares of O yield a nice ~4.8% on a forward-looking basis. We are big fans of Realty Income’s dividend track record and its commitment to income seeking investors.

Earnings Update

On August 3, Realty Income reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. The REIT benefited from its portfolio occupancy rate standing at 98.9% at the end of June 2022, up from 98.6% at the end of March 2022 and 98.5% at the end of June 2021. Furthermore, Realty Income noted in its latest earnings press release that (emphasis added):

During the three months ended June 30, 2022, the annual new rent on re-leases was $35.51 million, as compared to the previous annual rent of $33.63 million on the same units, representing a rent recapture rate of 105.6% on the units re-leased. We re-leased four units to new clients without a period of vacancy, and seven units to new clients after a period of vacancy.

Strong re-leasing rates and rising occupancy rates, along with the uplift provided by the merger with VEREIT, enabled Realty Income to grow its GAAP revenues 75% year-over-year to $810 million in the second quarter. Its adjusted funds from operations (‘AFFO’), a non-GAAP metric, grew by 10% year-over-year to hit $0.97 per share in the second quarter of 2022. While AFFO is a non-GAAP, industry-specific metric with its flaws, the metric is still a useful tool to gauge the underlying performance of REITs. Cost synergies from its VEREIT merger should enhance Realty Income’s cash flow generating abilities over the long haul.

Favorable Capital Market Updates

Realty Income remains a capital market dependent entity given its sizable dividend obligations, meaning capital expenditure requirements, growth ambitions, and its large net debt load (which stood at $16.0 billion, inclusive of short-term debt, at the end of June 2022). In April 2022, Realty Income’s unsecured revolving credit line was upsized to $4.25 billion (from $3.0 billion previously), and the maturity date was extended to June 2026 (from March 2023 previously). Additionally, Realty Income has been able to tap equity markets at reasonably attractive rates of late and noted this in its latest earnings press release (emphasis added):

During the three months ended June 30, 2022, we raised approximately $1.1 billion from the sale of common stock at a weighted average price of $67.13 per share, primarily through our “at-the-market” (‘ATM’) program. In June 2022, we replaced our prior ATM program, which authorized us to offer and sell up to 69,088,433 shares of common stock, with a new ATM program, pursuant to which up to 120,000,000 additional shares of common stock may be offered and sold.

Furthermore, Realty Income recently upsized its unsecured commercial paper program and was able to raise debt in UK debt markets at attractive rates in recent months. In our view, the REIT should be able to retain access to capital markets at attractive rates going forward, thus enabling Realty Income to keep making good on its dividend obligations.

Concluding Thoughts

We appreciate Realty Income’s improving outlook and its commitment to income seeking investors. Realty Income has a stellar dividend growth track record, one that we expect management will rigorously defend going forward. We like shares of Realty Income as an idea in the simulated Dividend Growth Newsletter portfolio.

—–

Real Estate Investment Trust Industry – DLR, FRT, O, REG, SPG, PEAK, OHI, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: ONL

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. Digital Realty Trust Inc (DLR) shares are included in both Valuentum’s simulated Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios. Realty Income Corporation (O) shares are included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.