Two High-Quality Self-Storage REITs Beat Estimates and Raise Guidance

Image Shown: Shares of CubeSmart (depicted by the blue line) and Public Storage (depicted by the orange line), two self-storage REITs that are included as ideas in the High Yield Dividend Newsletter portfolio, have surged higher year-to-date.

By Callum Turcan

We are big fans of the self-storage real estate investment trust (‘REIT’) industry, particularly in the US. These REITs offer their customers an economical way to maximize their living space at a time when domestic housing prices are surging from a baseline that is already quite high. Additionally, self-storage REITs are well-positioned to push through continuous rent increases given that the monthly rental expense for a self-storage unit for an ordinary US household likely represents just a sliver of their monthly budget, as compared to a monthly rental expense for a primary home or the monthly food budget, etc.

This dynamic (generally speaking) enables self-storage REITs to post strong and consistent organic growth, outside of extenuating circumstances. Even during the worst of the coronavirus (‘COVID-19’) pandemic in the US last year, it did not take long for the self-storage REIT industry to resume rental rate increases and other normal business practices, such as evicting long overdue tenants (meaning their stuff) from self-storage units.

Unlike primary housing units, the US government, at least at the federal and most state levels (if at all), did not intervene on a mass scale to prevent self-storage operators from kicking out the “stuff” of overdue tenants. Please note many firms in the industry did offer a couple to a few months reprieve during the worst of the COVID-19 pandemic to those that couldn’t or wouldn’t pay.

Overview of CubeSmart and Public Storage

Our favorite two names in the space are CubeSmart (CUBE) and Public Storage (PSA). Both companies are included as ideas in the High Yield Dividend Newsletter portfolio (more on that here), and we continue to be huge fans of CUBE and PSA.

CubeSmart’s asset base is located entirely in the US as of the end of 2020, which included ~540 self-storage facilities along with a sizable third-party self-storage management platform. What makes CubeSmart stand out is the size of its third-party management platform, especially compared to that of its peers. At the end of 2020, CubeSmart managed over 720 self-storage facilities for third parties, which included just under 110 facilities managed via five separate unconsolidated ventures. These management platforms are an important way to source future growth opportunities and in the meantime, these operations can generate meaningful cash flows and insights into the industry at-large.

Public Storage has a sizable international presence, though its core asset base and most of its operations are in the US. At the end of 2020, Public Storage’s asset base consisted of ~2,550 self-storage facilities (a small portion of which Public Storage had only a noncontrolling interest in) along with a third-party self-storage management platform. Public Storage managed over 90 self-storage facilities at the end of 2020, and more recently, growing this operation has become a core focus for the REIT.

Furthermore, Public Storage owned a ~42% equity interest in PS Business Parks Inc (PSB), a REIT that focuses on multi-tenant industrial, flex and office space, at the end of 2020, along with a ~35% equity interest in Shurgard Self Storage SA, which owns and operates self-storage facilities in seven countries across Western Europe and trades on the Euronext Brussels stock exchange.

In 2020, CubeSmart generated ~$0.25 billion in positive free cash flow (defined here as net operating cash flow less ‘additions and improvements to storage properties’ and ‘development costs’), while spending a similar amount covering its total payout obligations. Public Storage generated ~$1.7 billion in positive free cash flow last year (defined as net operating cash flow less ‘capital expenditures to maintain real estate facilities’ and ‘development and expansion of real estate facilities’) while spending ~$1.6 billion covering its total payout obligations.

Most REITs tend to generate sizable negative free cash flows after dividend payments, though given the less capital-intensive nature of the self-storage industry versus most other types of REITs, there is room for top-quality entities here to generate substantial positive free cash flows after dividend payments. This is another reason why we are huge fans of the space.

Now, let us take a look at each REIT’s latest earnings update and guidance boost.

CubeSmart

On July 29, CubeSmart reported second-quarter 2021 earnings that beat both consensus top- and bottom-line estimates. Its same-storage net operating income (‘NOI’) surged higher 18% year-over-year last quarter as 14% revenue growth outpaced 7% operating expense growth. CubeSmart’s same-store occupancy levels stood at a nice 95.6% during the second quarter and exited June 2021 at 96.1%, highlighting the REIT’s ongoing strength in this arena. In our June 2021 article CubeSmart Outperforms and Boosts Its Full-Year Guidance (link here), we highlighted how the REIT’s same-store occupancy rates were steadily trending upwards (from 93.4% at the end of December 2020) which in turn helped CubeSmart boost its full-year guidance in April 2021.

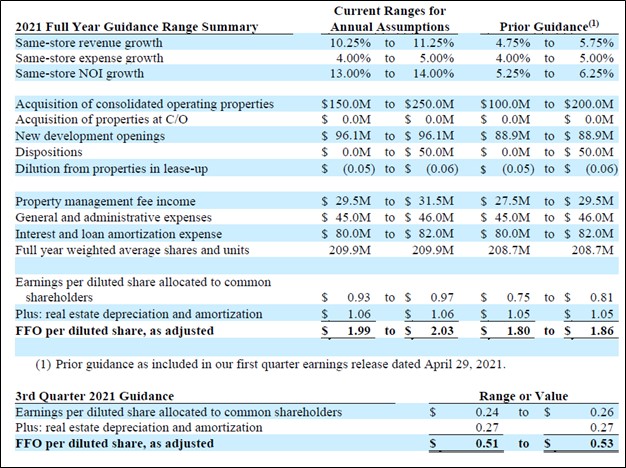

CubeSmart’s non-GAAP adjusted funds from operations (‘FFO’) per share stood at $0.50 in the second quarter of 2021, up 22% versus year-ago levels. Furthermore, CubeSmart once again boosted its full-year guidance for 2021 as one can see in the upcoming graphic down below. Among other things, CubeSmart significantly raised its same-store revenue and NOI growth forecasts along with its expected adjusted FFO per share in 2021. We are incredibly pleased with CubeSmart’s latest earnings update.

Image Shown: CubeSmart raised its full-year guidance for 2021 once again during its latest earnings report. Image Source: CubeSmart – Second Quarter of 2021 Earnings Press Release

CubeSmart’s third-party management platform continued to perform well during the first half of 2021, though please note that as the REIT will often acquire properties affiliated with this offering, its total managed store count has stayed largely flat this year (even though the REIT added a significant amount of new self-storage facilities to the operation on a gross basis in both the first and second quarters of 2021).

Here is what CubeSmart’s management team had to say on the firm’s recent performance during the REIT’s second quarter earnings call (emphasis added):

“Broad-based consumer demand for our space, when combined with positive trends in customer behavior, has contributed to our record levels of physical occupancy and an extremely strong pricing power across our portfolio. These positive trends when combined with our award-winning customer service and innovative technology resulted in 14% same-store revenue growth in the second quarter, the highest such growth in our history.

Rates to new customers were up 47% over 2019 levels during the quarter, and we were more aggressive in rate increases to existing customers. This pricing power has continued into the third quarter and is contributing to our significantly raised expectations for the back half of the year.” --- Christopher Marr, CEO of CubeSmart

During the first half of 2021, CubeSmart generated $166 million in free cash flow and spent $139 million covering its total payout obligations during this period. While CubeSmart exited June 2021 with a sizable net debt load, the REIT retains ample access to capital markets at attractive rates, in our view, supported by its stellar free cash flow generating abilities.

In the second quarter, CubeSmart “sold 1.0 million common shares of beneficial interest through its at-the-market (“ATM”) equity program at an average sales price of $41.02 per share, resulting in net proceeds of $42.4 million, after deducting offering costs” and its stock price has only climbed higher since. Going forward, CubeSmart possess the financial capacity to keep making good on its payout obligations while managing its refinancing needs and continuing to invest in the business.

Public Storage

On August 3, Public Storage reported second quarter 2021 earnings that beat both consensus top- and bottom-line estimates. Public Storage’s same-store NOI surged higher by 21% year-over-year last quarter due to a combination of an 11% increase in same-store revenues and a 16% decrease in same-store direct cost of operations. Public Storage’s non-GAAP core FFO per share climbed higher by 28% year-over-year in the second quarter, hitting $3.15. The self-storage REIT’s occupancy rate by square footage stood at 96.5% at the end of last quarter, up sharply from 94.2% at the end of December 2020.

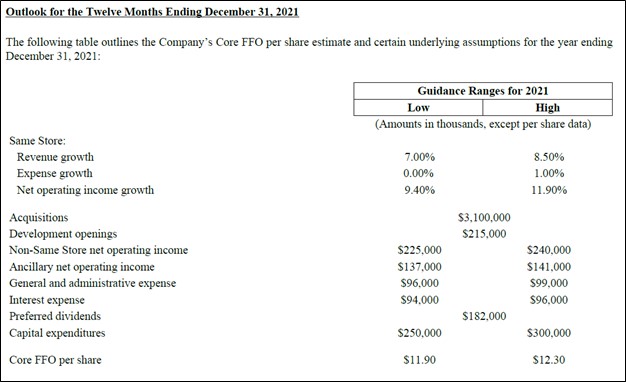

Public Storage boosted its full-year guidance in conjunction with its latest earnings update. Among other things, Public Storage raised its same-store revenue and NOI growth to 7.0%-8.0% (from 4.0%-5.0% previously) and 9.4%-11.9% (from 4.8%-7.3% previously), respectively. We appreciate the large guidance boost. Furthermore, Public Storage now expects to generate $11.90-$12.30 in core FFO per share this year, up from previous guidance that called for $11.35-$11.75 in core FFO per share in 2021.

Image Shown: Public Storage significantly boosted its full-year guidance for 2021 during its latest earnings report. Image Source: Public Storage – Second Quarter of 2021 Earnings Press Release

In April 2021, Public Storage closed its $1.8 billion acquisition of ezStorage which further bolstered its self-storage portfolio in the US. We covered that deal in an article published on June 2021 (link here) and also provided our thoughts on Public Storage’s long-term growth ambitions and financial targets in that note.

Last quarter, Public Storage grew its third-party management platform to ~130 self-storage properties and aims to grow that figure to 500 by 2025, according to management commentary provided during the REIT’s second quarter earnings call. Additionally, Public Storage’s management team had this to say regarding the REIT’s pricing strength during the earnings call (emphasis added, moderately edited):

“Our financial performance accelerated into the second quarter driven by both strong demand from customers and execution from the team. Our same store revenue increased 10.8% compared to the second quarter of 2020. That performance represented the sequential improvement and growth of 7.4% from the first quarter driven by [rental] rate [increases]. Two factors led to the acceleration in realize[d] rate per foot.

First, about half came from strong demand and limited inventory which allowed us to achieve moving rates that were up 48% versus 2020. And as [Joseph Russell, President and CEO of Public Storage] mentioned 27% versus pre-pandemic 2019. Secondly, existing tenant rate increases also made up about half of the improvement, comparing against the period when we did not send increases at the onset of the pandemic in 2020.” --- Thomas Boyle, CFO of Public Storage

During the first half of 2021, Public Storage generated $0.9 billion in free cash flow and spent $0.8 billion covering its total payout obligations. Like CubeSmart and virtually every other REIT, Public Storage exited June 2021 with a hefty net debt load. In our view, Public Storage retains quality access to capital markets at attractive rates and should be able to continue meeting its dividend obligations and refinancing requirements while investing in the business going forward. During the second quarter, Public Storage “refinanced $525.0 million of 5.02% weighted average preferred equity with $604 million of 4.00% preferred equity, continuing to lower our in place cost of capital” which we appreciate.

Concluding Thoughts

We are big fans of the self-storage industry. CubeSmart and Public Storage are two of the best names in the business. Both REITs recently beat consensus estimates and raised their full-year guidance, highlighting the ongoing momentum in their respective operational and financial performance. Shares of CUBE yield ~2.7% and shares of PSA yield ~2.6% as of this writing after a stellar run up in their respective stock prices year-to-date.

-----

Real Estate Investment Trust Industry - CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Related: PSB, VNQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. CubeSmart (CUBE), CyrusOne Inc (CONE), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust Inc and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment