Shares of Newsletter Portfolio Idea Exxon Mobil Are Booming Higher!

Image Source: Newsletter portfolio idea Exxon Mobil Corporation has seen its share price boom higher over the past year. We see room for additional capital appreciation upside potential going forward.

By Callum Turcan

Shares of Exxon Mobil Corporation (XOM) have boomed higher over the past year, and we see room for additional capital appreciation upside potential. Our fair value estimate for Exxon Mobil sits at ~$90 per share, though in the current raw energy resources pricing environment, the top end of our fair value estimate range may prove to be a more pertinent gauge of Exxon Mobil’s intrinsic value.

We are huge fans of the energy major and include Exxon Mobil in the Best Ideas Newsletter, Dividend Growth Newsletter, and High Yield Dividend Newsletter portfolios. Shares of XOM yield a nice ~3.9% as of this writing, and its dividend growth outlook is quite bright in the current environment.

Earnings Update

On April 29, Exxon Mobil posted its first quarter 2022 earnings that beat consensus top-line estimates but missed consensus bottom-line estimates. That did not stop shares of XOM moving higher in the following weeks as investors looked towards the future. Exxon Mobil increased its share buyback program up to $30.0 billion through 2023 during its latest earnings update, triple the size of its previous program which commenced this year after management noted the goal was to resume share buybacks back in October 2021. During the first quarter, Exxon Mobil repurchased $2.1 billion of its shares. We view its share repurchases, in moderation, as a good use of capital.

Exxon Mobil’s GAAP ‘total revenues and other income’ boomed higher by 53% year-over-year last quarter as it benefited from stronger raw energy resources pricing, rising demand for petroleum fuels as the world put the worst of the coronavirus (‘COVID-19’) pandemic behind it, and due to its limited direct exposure to Russia.

The company announced it was exiting the Russian market in March 2022 in the wake of the Russian invasion of Ukraine, a move that prompted a pre-tax $4.6 billion impairment charge last quarter. We covered the exposure that Exxon Mobil and Chevron Corporation (CVX), another idea in our newsletter portfolios, have to Russia in a March 2022 article (link here) that we encourage our members to check out. In short, Exxon Mobil has modest direct exposure to Russia and Chevron has virtually none.

Pivoting here, upstream operations focus on extracting oil & gas from the ground. Exxon Mobil’s upstream production base slipped 3% year-over-year last quarter due to weather effects and declines from mature fields. Looking ahead, we are optimistic that Exxon Mobil will be able to revive its upstream production growth trajectory by developing its top-notch positions in the Permian Basin, Guyana, and Brazil.

Even in the face of the impairment charge, Exxon Mobil’s GAAP net income more than doubled year-over-year last quarter. Revenue growth and ongoing cost structure improvement initiatives went a long way in making that possible.

Image Shown: We appreciate that Exxon Mobil aims to aggressively improve its cost structure going forward, and the firm has already made substantial headway on this front. Image Source: Exxon Mobil – First Quarter of 2022 IR Earnings Presentation

The firm aims to generate around $9.0 billion in annual structural cost improvements by 2023 using 2019 levels as a baseline with workforce reductions, digital investments, portfolio optimization efforts, and implementing best practices representing how it intends to reach that goal. According to management during Exxon Mobil’s latest earnings call, the firm has achieved roughly $5.4 billion of those structural cost savings so far. Here is what management had to say on the issue in response to an analyst’s question during the call:

“At the end of the fourth quarter, we had said we've gotten to about $5 billion in structural cost savings relative to 2019. We're now at $5.4 billion. So I'd say, overall, we feel really good about that progress. Obviously, we have now put in place the new organizational structure, which should drive incremental efficiencies on top of just driving better operations, faster speed to market, better deployment, faster deployment of resources to the highest opportunities across the company.” --- Kathy Mikells, Senior VP and CFO of Exxon Mobil

However, Exxon Mobil’s CFO did go on to note that “we're not immune to inflation” and that “we would see a fair amount of both energy and feedstock inflation coming through the business in certain areas that put a little bit of pressure on margins.” With that in mind, the company’s past actions to secure favorable longer-term contracts are expected to help it keep inflationary pressures under control, to a degree, going forward.

Stellar Financial Position and Capital Allocation Priorities

Exxon Mobil generated $10.9 billion in free cash flow during the first quarter of this year, up 58% year-over-year. Keeping its capital expenditure expectations contained in recent years and to this day along with the favorable backdrop for energy producers has been essential in supporting Exxon Mobil’s free cash flow generating abilities. The firm spent $3.8 billion covering its total dividend obligations last quarter (inclusive of ‘cash dividends to non-controlling interests’) which along with its share repurchases were fully covered by Exxon Mobil’s free cash flows and then some.

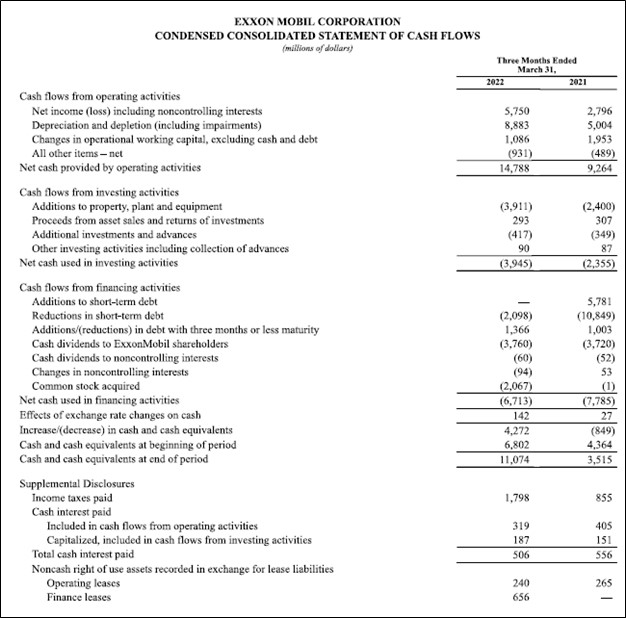

Image Shown: Exxon Mobil is a free cash flow cow in the current raw energy resources pricing environment, aided by its contained capital expenditure expectations. Image Source: Exxon Mobil – 10-Q SEC Filing covering the First Quarter of 2022

One of the reasons why we are big fans of Exxon Mobil is that the company has made deleveraging activities a priority, particularly since the start of 2021 when the outlook for the global energy complex started to improve. At the end of March 2022, Exxon Mobil had a net debt load of $36.5 billion (inclusive of short-term debt) with its $11.1 billion in cash and cash equivalents on hand offering the firm ample liquidity.

For reference, Exxon Mobil’s net debt load (inclusive of short-term debt) stood at $40.9 billion at the end of December 2021 and $63.3 billion at the end of December 2020. In a relatively short period of time, Exxon Mobil has been able to reduce its leverage substantially, which in turn supports its ability to reward shareholders going forward. Additionally, these moves make its dividend obligations more sustainable and create room for powerful payout increases going forward.

During the firm’s latest earnings call, management reiterated Exxon Mobil’s ~$21-$24 billion capital expenditure budget for 2022. That is higher than its subdued spending levels in the recent past, particularly in 2020 and 2021, but remains relatively tame, considering where raw energy resources prices are currently trading at and given the need for Exxon Mobil to maintain the operational capabilities of its existing businesses. Put another way, Exxon Mobil is not chasing oil and gas prices higher. Subdued capital expenditure budgets in the past are partially why Exxon Mobil’s upstream production base shifted lower last quarter on a year-over-year basis.

Upstream Upside

Looking ahead, Exxon Mobil has three core upstream growth drivers. The first is its enormous position in the Permian Basin that stretches from Southeastern New Mexico to West Texas. As Exxon Mobil either owns the mineral rights or has secured the mineral rights at a relatively low rate across a large portion of its position in the Permian Basin, due primarily to its longstanding presence in the region, its economics are quite favorable in most operating environments. Exxon Mobil gets to keep the lion’s share of the wellhead revenues from new and existing wells in the region. In the current raw energy resources pricing environment, Exxon Mobil’s upstream Permian Basin operations are incredibly lucrative.

Drilling horizontal wells that are hydraulically fractured (“fracking”) represent short cycle upstream projects, meaning endeavors that churn out cash flows rather quickly (within months not years). Increased investment in this area can swiftly generate upstream production growth, with a heavy focus on liquids production (oil and natural gas liquids) though the region also produces sizable amounts of natural gas as well.

Exxon Mobil’s management team recently noted that the firm produced ~560,000 barrels of oil equivalents per day (BOE/d) in March 2022 in the Permian Basin, up 25% year-over-year. Its management team also noted there were bottlenecks in this region as it concerns labor shortages, and that inflationary pressures were a factor as well, though overall Exxon Mobil remains incredibly bullish on the Permian Basin.

In Guyana, a country along the northern coast of South America, Exxon Mobil’s upstream production trajectory is quite bright after an Exxon Mobil-led construction struck liquid gold (crude oil) in 2015 and achieved first-oil (production commenced) in 2019. We’ve covered Exxon Mobil’s Guyanese upside often in the past, and here we will note that the firm aims to boost gross output in the region to ~800,000 BOE/d by 2025 (by bringing new producing developments online) and potentially significantly more than that by the end of this decade. The firm sanctioned its fourth production development in Guyana in April 2022.

Exxon Mobil started up its second producing operation in Guyana in February 2022 which supports its near term outlook. Additionally, the company announced in April 2022 that recent discoveries had pushed its recoverable resource estimate in the offshore Stabroek Block in Guyana to ~11 billion BOE. Exxon Mobil owns 45% of this venture alongside its partners Hess Corporation (HES) and China’s state-run CNOOC. We are huge fans of Exxon Mobil’s exposure to Guyana’s booming energy sector.

Looking at its operations in Brazil, Exxon Mobil and its partner Equinor ASA (EQNR) are reportedly moving forward with an ~$8 billion expansion of the offshore Bacalhau oil field according to Reuters. As Exxon Mobil owns a 40% stake in the venture, this is a meaningful development for the firm that will support its production outlook along the margins. Exxon Mobil has ample exploration and expansion opportunities in Brazil’s offshore upstream space.

Divestment News

On May 19, Exxon Mobil announced it was selling its assets in the Barnett shale play in Texas to Thailand-based BKV Corporation for ~$0.75 billion (along with the potential for additional payments contingent on future natural gas prices) through a deal expected to close in the second quarter of this year. This is a mature natural gas-rich asset with limited development opportunities that did not fit in with Exxon Mobil’s broader corporate strategy. We like the deal and appreciate that Exxon Mobil was able to take advantage of strong domestic (and overseas) natural gas pricing of late to reach an agreement.

Concluding Thoughts

Exxon Mobil is a tremendous enterprise, and we continue to view the firm’s capital appreciation and dividend growth upside potential quite favorably. The company’s capital allocation priorities are spot on, particularly as it concerns keeping a lid on its spending and paying down debt while returning “gobs” of cash to shareholders. Energy prices are elevated and will likely remain so for some time, supporting Exxon Mobil’s cash flow outlook.

To read more about Exxon Mobil, check out how the energy giant is working towards boosting US liquefied natural gas (‘LNG’) export capacity by reading this article (link here).

Article updated 10:56am, May 25, 2022.

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, RDS (now SHEL), TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: EQNR, HES

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and simulated High Yield Dividend Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment