Image Shown: Exxon Mobil Corporation is a big player in the global LNG industry. Image Source: Exxon Mobil Corporation – March 2022 Investor Day Presentation

By Callum Turcan

Europe’s dependence on Russian natural gas supplies has taken centerstage in the wake of the Russian invasion of Ukraine. Members of the European Union (‘EU’) receive roughly 40% of their natural gas needs from Russia. In March 2022, the US and the EU announced an agreement covering energy security that among other things encouraged greater liquified natural gas (‘LNG’) exports from the US to the EU. Such an accord would require Europe to boost its LNG regassification capacity.

Recent LNG News

In February 2022, Germany announced plans to build two LNG import terminals, one in Brunsbüttel and another in Wilhelmshaven, to reduce its reliance of Russian natural gas supplies. Currently, Germany has no operational LNG import terminals though it does have access to LNG supplies via import terminals in other EU countries. In the Netherlands, the Dutch natural gas infrastructure company Gasunie and Dutch energy firm Royal Vopak N.V. (VOPKY) operate the Gate LNG terminal which is a source of LNG supplies for the broader region. For reference, Dutch TTF natural gas prices represent a key pricing benchmark for gas supplies into Western Europe.

Gasunie, the German utility firm RWE AG (RWEOY), and the German state-owned investment and development bank KfW are working together to develop the LNG terminal in Brunsbüttel. At Wilhelmshaven, the Germany energy firm Uniper SE (UNPRF) has considered developing a floating LNG import terminal in the past. The project was mothballed in 2020 though recent events have seen Uniper resume some work on the potential endeavor. Italy, which already has substantial LNG import capacity through the Adriatic LNG terminal and the Livorno LNG terminal, is working on reducing its reliance on Russian gas supplies as well. The Italian energy firm Sorgenia and the Italian utility company Iren are considering developing an LNG import terminal in Southern Italy.

Pivoting to the U.S., LNG exports have surged higher in recent years as additional export capacity came online according to the US Energy Information Administration (‘EIA’). That trend is expected to continue going forward in the view of the EIA. Facilities that are currently operational are running at full tilt to capitalize on lofty natural gas prices in global markets, with natural gas prices recently reaching all-time highs in Europe.

Exxon Mobil LNG Presence

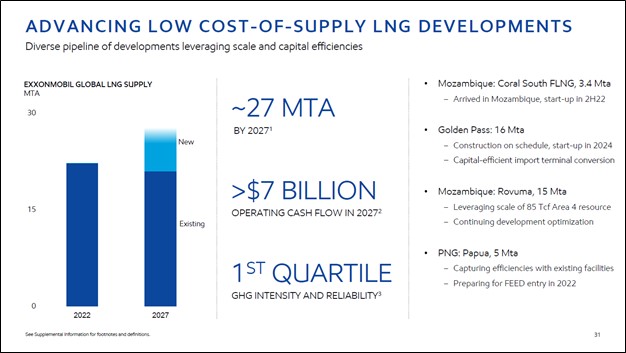

As it concerns our newsletter portfolios, Exxon Mobil Corporation (XOM) is doing its best to assist European energy consumers. Back in February 2019, Exxon Mobil announced it was moving forward with the Golden Pass LNG export project in Texas with state-run Qatar Petroleum. Construction at the ~$10 billion development started in 2019 and the facility is expected to be operational by 2024. This development aims to turn a facility that was originally set up to receive LNG imports (before the fracking boom really took off in the US) into an LNG export terminal, with existing infrastructure at the site expected to keep a lid on development costs.

Located near Port Arthur along the US Gulf Coast, the Golden Pass LNG terminal is close to Cheniere Energy Inc’s (LNG) enormous Sabine Pass LNG export facility which commenced LNG exports in 2016. Cheniere Energy has aggressively ramped up the LNG export facility of its Sabine Pass facility since 2016 by bringing additional “LNG trains” online and is currently working on developing a third berth at the site by 2023 to improve the terminal’s logistical operations.

Exxon Mobil owns 30% of the Golden Pass LNG project and Qatar Petroleum owns the remaining 70% stake. The facility will be able to source natural gas supplies from the Haynesville shale play in Louisiana, various plays in Oklahoma, from the Gulf of Mexico, the Eagle Ford shale play in South Texas, and the Permian Basin in West Texas and Southeastern New Mexico, and other prolific natural gas producing regions in the US. Having ample access to existing natural gas supplies and the related energy infrastructure (pipelines, storage facilities) along with crucial logistical infrastructure (namely deepwater port facilities) supports the economic outlook for this project. Exxon Mobil recently noted that the development remains on schedule.

There are many other US LNG export projects in the works including both brownfield and greenfield developments that will help Europe wean itself off Russian natural gas supplies over time. Exxon Mobil and Qatar Petroleum may pursue brownfield expansion efforts at the Golden Pass LNG terminal once the current development is complete, just as Cheniere Energy did at its Sabine Pass LNG terminal.

Its Golden Pass LNG project represents just one of several LNG developments Exxon Mobil is actively working on. Exxon Mobil is also participating in LNG projects in Mozambique and Papua New Guinea. Boosting its LNG production capabilities represents a key strategic priority for Exxon Mobil as it concerns growing its operating cash flows over the long haul.

Exxon Mobil’s current LNG export operations include economic interests in the Gorgon LNG facility in Australia, the PNG LNG facility in Papua New Guinea, and various LNG export facilities in Qatar. The energy company also owns economic interests in LNG import terminals including the aforementioned Adriatic LNG import terminal in Italy and the South Hook LNG import terminal in the UK.

Financial Considerations

At the beginning of March 2022, Exxon Mobil announced it was exiting its Russian investments which had a book value of $4.1 billion at the end of December 2021. Its position in Russia is relatively modest in size and the impact of this decision on Exxon Mobil’s future earnings and cash flows should be negligible. We appreciate Exxon Mobil taking a stand on the Ukraine-Russia crisis.

During its annual investor day event held in March 2022, Exxon Mobil announced it was targeting ~$9 billion in annual cost structure improvements by 2023 versus 2019 levels. Exxon Mobil also noted it had already achieved ~$5 billion of those cost savings.

Image Shown: Exxon Mobil has significantly improved its cost structure in recent years and intends to continue doing so going forward. Image Source: Exxon Mobil – March 2022 Investor Day Presentation

Exxon Mobil reiterated its longer term capital expenditure guidance during its recent annual investor day event that calls for keeping its annual spending levels broadly flat through 2027 versus 2022 levels. Elevated raw energy resources pricing combined with targeted cost structure improvements and a commitment to keep its annual capital expenditures tame underpin why we expect Exxon Mobil’s free cash flows to swell higher over the coming years, keeping geopolitical volatility in mind.

The company took advantage of its strong financial position in 2021 to pay down a significant amount of its (net) debt, which we appreciate. Exxon Mobil intends to continue pursuing deleveraging activities in 2022. The favorable macroeconomic backdrop combined with its fiscal discipline allowed Exxon Mobil to resume share buybacks (starting this year) while maintaining its Dividend Aristocrat status. Exxon Mobil has increased its annual dividend over the past ~40 consecutive years (adjusted for stock splits).

Concluding Thoughts

We appreciate that energy firms, including Exxon Mobil, are stepping up to the plate during these turbulent times. Europe needs new sources of natural gas supplies and Exxon Mobil is participating in projects around the globe to make that possible. Furthermore, European governments and private companies are working hard to ensure that the continent can absorb additional LNG supplies by expanding their import capabilities.

Shares of Exxon Mobil have surged higher in recent months and are converging towards our fair value estimate of $87 per share as of this writing. The top end of Exxon Mobil’s fair value estimate range sits at $115 per share, indicating the energy giant still has ample capital appreciation upside. Exxon Mobil has significant dividend growth potential as well as its free cash flows are set the swell higher in the current raw energy resources pricing environment. Shares of XOM yield a nice ~4.2% as of this writing. We continue to be huge fans of Exxon Mobil.

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS (now SHEL), TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Tickerized for XOM, VOPKY, RWEOY, UNPRF, LNG, ESG, EWI, QAT

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, and XLE and is long call options on DIS and FB. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and simulated High Yield Dividend Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.