AT&T’s Video Streaming Growth Story Is Starting to Take Flight

Image Source: AT&T Inc – 2021 Investor & Analyst Day Presentation

By Callum Turcan

On March 12, AT&T Inc (T) hosted its 2021 Analyst & Investor Day event. In conjunction with the event, AT&T issued long-term financial and operational guidance which included a substantial upward revision in its expected HBO/HBO Max subscriber growth over the coming years. We continue to be big fans of AT&T as a high yielding opportunity and include AT&T as an idea in the High Yield Dividend Newsletter portfolio (more here). As of this writing, shares of AT&T yield ~7.0%.

Background Information

In June 2018, AT&T completed its acquisition of Time Warner which gave AT&T the keys to Home Box Office (‘HBO’). A pillar of AT&T’s long-term growth strategy involves building out a vast video streaming business around the HBO brand (specifically its new HBO Max offering). However, AT&T struggled initially with getting its streaming ambitions off the ground due in part to an unnecessarily complex branding strategy. We covered this situation in a December 2020 article (link here):

Back in May 2020, AT&T launched HBO Max at the same price (more or less) as its traditional HBO offering, largely to encourage existing subscribers (including traditional cable subscribers) to transition to the new video streaming service (which has a significantly larger content library). Many existing HBO subscribers, at the time, received access to the new service at no additional cost.

However, AT&T’s initial branding strategy for HBO Max was confusing as there were several HBO offerings on the market which had similar names including HBO Now, HBO Go, and HBO. Since then, HBO Go has been retired and HBO Now has been rebranded to HBO to simplify the branding strategy, which we appreciate. Additionally, AT&T is bundling certain wireless packages with HBO Max to help get the nascent video streaming service off the ground.

When AT&T launched HBO Max, it faced another problem as well. The company had launched the video streaming service before securing distribution deals with several major TV platforms. Since then, AT&T has secured deals with Amazon Inc (AMZN), Roku Inc (ROKU), Comcast Corporation (CMCSA), and privately-held Cox Communications to enable HBO Max to be distributed easily through their TV platforms and related hardware. In our view, these agreements will go a long way in supporting future subscriber growth at HBO Max and we appreciate AT&T getting these deals done.

To keep the momentum going, AT&T committed to adding every movie release this year from its Time Warner segment to its HBO Max service (for a limited time) free of charge. Subscribers that already have the video streaming service do not need to pay extra to view those new movie releases (which are available on HBO Max for about a month before getting removed so movie theaters can have a period of exclusivity with those titles). In December 2020, AT&T first attempted this strategy by adding the movie Wonder Woman 1984 to its HBO Max service for free for a month.

Major Positive Revision

Putting this all together, AT&T now views its video streaming growth trajectory much more favorably than it did back in 2019. According to guidance put out during the March 12 investor event, AT&T expects to have 120-150 million HBO/HBO Max subscribers worldwide by the end of 2025. Back in October 2019, AT&T forecasted it would have 75-90 million HBO/HBO Max subscribers by the end of 2025, indicating recent operational changes have positively impacted the subscriber growth trajectory of the company’s video streaming business in a big way. This strategy reportedly involved a major corporate restructuring at WarnerMedia and HBO along with the aforementioned changes.

By 2025, AT&T forecasts that HBO will generate approximately $15.0 billion in annual revenue, up from roughly $6.8 billion in 2020. The company plans to make enormous investments in original content for HBO Max over the coming years to capitalize on the vast growth opportunity. Please note these investments are expected to weigh on HBO’s medium-term profitability as AT&T expects its HBO segment will not reach breakeven status by 2025 as one can see in the upcoming graphic down below. In our view, AT&T made the right move by committing to these investments given that its HBO/HBO Max streaming business could eventually become an enormous cash flow cow as greater economies of scale are achieved.

Image Shown: AT&T expects its HBO business will more than double its annual revenues by 2025 versus 2020 levels. Image Source: AT&T – 2021 Investor & Analyst Day Presentation

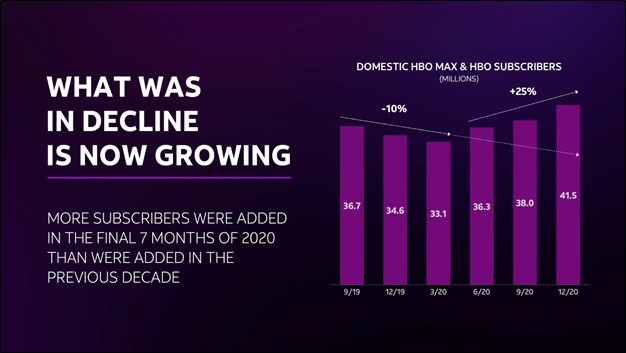

According to management commentary given during AT&T’s second quarter of 2020 earnings call, the company had 34.6 million domestic HBO subscribers at the end of 2019. Previously, the goal was to grow that figure to 50 million by the end of 2025 according to management commentary given back in December 2020. In our view, that target was quite modest.

With this in mind, please note HBO/HBO Max had only 38 million domestic subscribers by the end of the third quarter of 2020 and 57 million subscribers worldwide. From the end of 2019 to the end of September 2020, the launch of HBO Max had added less than 4 million net paying customers to its HBO/HBO Max subscriber base (AT&T’s reported HBO/HBO Max domestic subscriber figures do not include subscribers on free trials).

Put another way, by the Fall of 2020, AT&T’s video streaming growth strategy was still off to a slow start. In the fourth quarter of 2020, AT&T had over 41 million domestic paying HBO/HBO Max subscribers and almost 61 million international HBO/HBO Max subscribers, indicating its subscriber growth trajectory was starting to pick up pace by the end of 2020.

Image Shown: AT&T’s domestic HBO/HBO Max subscriber base has been moving in the right direction of late after subscriber growth at HBO Max got off to a slow start. Image Source: AT&T – 2021 Investor & Analyst Day Presentation

Growth Strategy

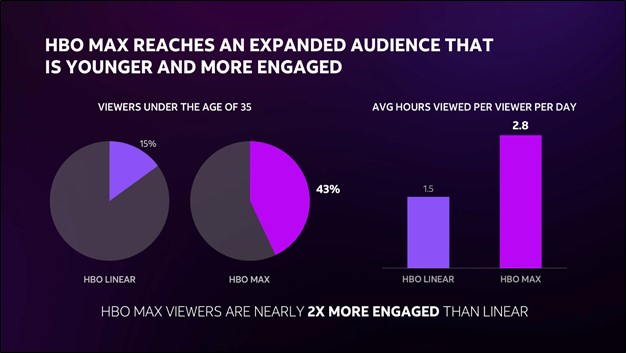

Management has a strategy in place to build on AT&T’s recent momentum in the video streaming world. During the presentation, AT&T noted that about one quarter of HBO Max’s subscribers came from AT&T, indicating the company is starting to realize serious operational synergies between its wireless business and its media and entertainment business. The ongoing adoption of 5G technology and related wireless plans by consumers in the US should provide a nice tailwind on this front going forward.

Looking ahead, AT&T plans to launch HBO Max in 60 international markets this year. That includes plans to roll out the service in 39 Latin American “territories” and 21 “territories” in Europe in 2021 (starting in late June, though additional expansions are expected during the second half of this year). Additionally, AT&T intends to launch an advertising-supported video on demand (‘AVOD’) version of HBO Max in the US this upcoming June. These moves, combined with the recent acceleration in its subscriber growth, underpin management’s confidence in AT&T’s video streaming strategy.

One of the reasons why it took AT&T some time to secure distribution deals covering HBO Max with companies such as Amazon and Roku was due to AT&T’s desire to keep operational control of the HBO Max app (instead of having HBO Max included as an additional service on a platform that is managed by a different company). Management wanted to keep operational control of the HBO Max app so AT&T could launch an effective AVOD version of the video streaming service. This in turn is expected to enable AT&T to offer HBO Max at a lower monthly price point, which in theory expands the base of potential HBO Max subscribers without sacrificing a significant amount or any revenue due to the incremental sales generated by digital advertising activities, positively impacting AT&T’s long-term growth runway.

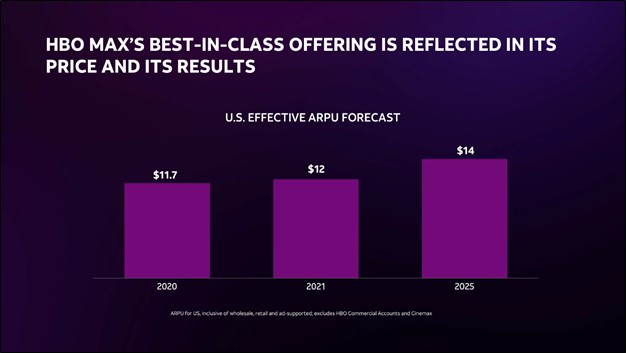

Going forward, AT&T plans to steadily grow its average revenue per user (‘ARPU’) at its domestic HBO Max service as one can see in the upcoming graphic down below. That could be achieved via pricing increases and by building out a successful digital advertising business. Internationally, AT&T will eventually focus on ARPU growth, though the company’s first goal will likely be to build out as large of a paying subscriber base as possible at a reasonable price point (before considering substantial pricing increases).

Image Shown: AT&T plans to steadily grow its ARPU at its domestic HBO Max service over the coming years. Price increases and establishing a successful digital advertising business represent two ways AT&T could accomplish this goal. Image Source: AT&T – 2021 Investor & Analyst Day Presentation

Other Considerations

Now that AT&T’s video streaming growth story is starting to gain some real momentum, the company’s decision to invest sizable sums towards developing original content for the business in the coming years is starting to look like a smart decision. When the firm decided to launch movies from its Time Warner segment simultaneously at physical movie theaters (where available) and on its HBO Max streaming service, that effectively removed a major source of revenue generation (box office sales) in return for an opportunity to build up sizable recurring revenues (i.e., a larger paying subscriber base at HBO Max). Box office ticket sales remain subdued, as evidenced by the domestic and international performance of Time Warner’s new Tom & Jerry movie, leaving movie producers with few options.

Companies in the movie making business that also have substantial video streaming services were better positioned to navigate headwinds arising from the COVID-19 pandemic due to the ability to make a bet on their future recurring revenue streams. Another one of our favorite companies which we include as an idea in the Best Ideas Newsletter portfolio, The Walt Disney Company (DIS), has had tremendous success growing its numerous video streaming services businesses of late (which we covered here and here). In certain instances, Disney has added new movie launches to its Disney+ service that traditionally would have been released exclusively at physical movie theaters for a few months before potentially ending up on those video streaming services. Some of those movies were available at no extra charge on Disney+ and others required an additional payment on top of the subscription as video streaming companies are still attempting to figure out the right economic balance.

As an aside, as with AT&T, Disney also recently restructured the corporate umbrella that overseas its video streaming businesses. These restructurings appear to have yielded positive results as both companies have sharply increased their long-term video streaming subscriber growth targets since making these changes (Disney sharply increased its long-term video streaming subscriber growth guidance back in December 2020 during its Investor Day update). While Netflix Inc (NFLX) continues to be a leader in the video streaming business, Disney is hot on Netflix’s heels and now even AT&T is starting to become a contender. Please note we forecast Netflix will become a free cash flow generating machine as ever-greater economies of scale are achieved, something we covered here.

Concluding Thoughts

We continue to like exposure to AT&T in the High Yield Dividend Newsletter portfolio and view the company’s cash flow growth outlook quite favorably. During the March 12 event, AT&T noted it expected to generate around $26.0 billion in free cash flow this year and that its dividend payout ratio would be in the high 50s percent range this year (dividend obligations divided by free cash flows). AT&T intends to continue paring down its hefty net debt load going forward, which we appreciate.

On a final note, AT&T finally found a partner willing to take a stake in DirecTV at an acceptable price. Private investment firm TPG intends to take a 30% equity stake in a new entity which will include the DirecTV, AT&T TV, and U-verse video services through a deal announced in February 2021. The new entity (dubbed “New DIRECTV”) will have an enterprise value of ~$16.25 billion, and AT&T will retain the remaining 70% equity stake. This deal is expected to close in the second half of 2021, and AT&T expects to receive $7.8 billion in net cash from the deal ($7.6 billion in cash from New DIRECTV plus the assumption of $0.2 billion in existing DirecTV debt). We like the move as it will better enable AT&T to pivot towards its 5G wireless, fiber optic, and video streaming service operations which have promising growth outlooks. AT&T expects to use the proceeds from this deal to further pare down its net debt load.

AT&T's 16-page Stock Report (pdf) >>

AT&T's Dividend Report (pdf) >>

-----

Telecom Services Industry - CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC

Related: AMZN, NFLX, DIS, DISCA, ROKU, FOX, FOXA, FUBO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) and Crown Castle International Corp (CCI) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment