Oracle’s Long-Term Outlook Remains Bright

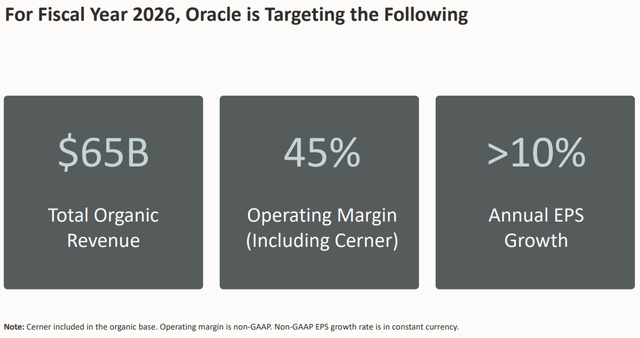

Image: Oracle has some lofty targets for fiscal 2026, and we were encouraged by recent commentary from the firm. Image Source: Oracle

By Brian Nelson, CFA

Oracle Corp (ORCL) has been a strong relative performer during 2022, with shares sliding ~12% versus a market return that has been much worse during the year. Oracle recently offered an encouraging mid-cycle fiscal 2026 outlook, calling for $65 billion in total organic revenue, a 45% operating margin (including its recent acquisition of Cerner), and greater than 10% annual earnings per share growth in the coming years.

At this writing, consensus expectations are for Oracle to achieve ~$49.2 billion in revenue for fiscal 2023, so this is no doubt good news, implying a strong growth runway. With our fair value estimate standing at $87 per share and the company’s equity trading shy of that mark, we see upside potential in shares. Though we remain cautious on Oracle’s balance sheet considering its Cerner acquisition, its dividend remains solid for now and shares yield ~1.7%.

Oracle operates across three businesses. It has a cloud and license business that includes its Oracle Cloud Services operations, and this part of its revenue model accounts for more than 80% of sales. ‘Cloud,’ in particular, is expected to reach 30%+ of revenue in fiscal 2023 from 20% of revenue just a few years ago as organic growth continues to accelerate. Its various hardware products and hardware support services generate about 10% of sales, while its general services business accounts for the balance. Oracle’s cloud business is a fully integrated offering and includes applications, computing, storage and networking functionality for customers’ IT systems.

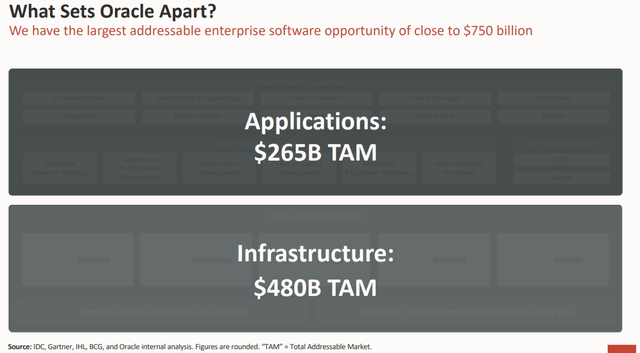

Rivals such as Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, Google Cloud Platform, IBM (IBM), salesforce.com (CRM), Workday (WDAY) and others make for a competitive industry. However, Oracle continues to find success. Among other reasons, customers love Oracle’s cloud offering because it is secure, easily maintained, cost effective (particularly with respect to lower upfront expenses), and can be rapidly deployed. Oracle likes to present its offering as having “one hand to shake,” meaning that it is a single source for enterprise technology needs to help customers modernize, expand their businesses, and remove inefficiencies from their operations. According to estimates, Oracle’s addressable market is close to $750 billion, a huge number.

Image: Oracle’s total addressable market is huge, meaning revenue growth opportunities are abundant. Image Source: Oracle

As Oracle continues to scale its business, margin opportunities will inevitably present themselves, too. The company’s operating margin is already higher than that of the average of its peers, but we expect further efficiencies to be gained as Oracle optimizes its operations following the Cerner deal. Management has also noted that it has visibility into 5%+ improvement in its Apps cloud gross margins and 20%+ improvement in infrastructure gross margins, and this should offer a nice tailwind to profit improvements.

Concluding Thoughts

There are always risks to achieving mid-cycle expectations, but even if Oracle comes up a bit short of fiscal 2026 targets, we like the company’s encouraging outlook. A strengthening U.S. dollar could hurt performance a bit and while we’ve expressed concerns about the company’s ~$91.6 billion debt position in the past, the company has sufficient liquidity as it optimizes its business following the Cerner transaction. In the event that dividend growth slows in the coming years due to debt service obligations, we won’t hesitate to reevaluate our views on shares, however.

Tickerized for ORCL, WDAY, SNOW, CRWD, COUP, FRSH, BOX, DBX, CRM, IBM

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.