Image Source: Oracle Corporation – September 2019 IR Presentation

By Callum Turcan

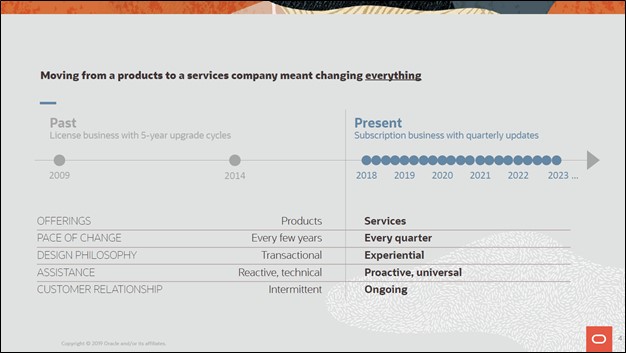

On March 10, Oracle Corporation (ORCL) reported third quarter earnings for fiscal 2022 (period ended February 28, 2022) that matched consensus top-line estimates but missed consensus bottom-line estimates. The company’s revenue growth came in at a decent clip last fiscal quarter, and that trajectory is expected to continue into the current fiscal quarter, according to guidance management announced during Oracle’s latest earnings call. We include Oracle as an idea in the Dividend Growth Newsletter portfolio, and shares of ORCL yield ~1.7% as of this writing.

Financial Update

In the fiscal third quarter, Oracle’s GAAP revenues grew 4% and its non-GAAP constant currency revenues grew 7% year-over-year. Strong growth at its Cloud Infrastructure (sales were up 47% year-over-year in constant currency terms) and its Cloud Application (sales of its Fusion ERP and NetSuite ERP offerings were up 35% and 29% year-over-year in constant currency terms, respectively) businesses supported its sales performance. As Oracle is aggressively investing in its cloud computing and related data center operations, meaningful growth in its operating expenses saw its GAAP operating income shift lower by 1% year-over-year in the fiscal third quarter, while being up 3% on a non-GAAP constant currency basis.

During the trailing twelve month period ended February 2022, Oracle generated $6.6 billion in free cash flow according to the company’s calculations. The firm exited February 2022 with a net debt load of $55.0 billion (inclusive of short-term debt), which is concerning, though Oracle’s $23.4 billion in cash, cash equivalents, and current marketable securities on hand provides it with ample liquidity to manage its near term funding needs.

Cerner Acquisition Update

The biggest thing weighing on Oracle’s outlook and stock price performance of late, in our view, is its pending ~$28.3 billion all-cash acquisition of Cerner Corporation (CERN) announced back in December 2021. In short, this deal will see Oracle obtain a sizable position in the health care IT space which it can use as a base to grow from. Cerner provides electronic health records (‘EHR’) services, back office services, and analytical services for health care companies.

According to the Centers for Medicare and Medicaid Services (‘CMS’), the health care sector represented almost 20% of US GDP in 2020. There is clearly a big opportunity here, though Oracle’s balance sheet was bloated before the deal was even announced. Investors are concerned Oracle is taking on too much leverage at a time when its capital expenditure expectations are ramping up to fuel its cloud growth runway by building additional data center hubs across the globe.

We covered our thoughts on the Cerner deal in detail in our January 2022 article Oracle Buys Cerner (link here) that we encourage our members to check out. Here is an excerpt from that note:

Within the press release announcing the deal, Oracle noted that the Cerner acquisition is “accretive to Oracle’s earnings on a non-GAAP basis in the first full fiscal year after closing and will contribute substantially more to earnings in the second fiscal year and thereafter.” Furthermore, “Cerner will be a huge additional revenue growth engine for Oracle for years to come as Oracle expands Cerner’s business into many more countries throughout the world.” In our view, this deal is primarily about giving Oracle’s cloud computing offerings a foothold in the healthcare space.

Oracle noted how integrating its operations with Cerner’s would help healthcare providers cut down on the time spent on paperwork and similar activities while improving patient outcomes. Additionally, Oracle highlighted how many of Cerner’s operations already run on Oracle Database, which will make integrating Oracle’s various cloud computing applications with Cerner’s operations an easier task. In particularly, Oracle’s digital voice assistant offering was highlighted several times in the press release as representing an effective way healthcare providers will be able to streamline their operations when accessing the EHRs of relevant patients. Security remains a key focus as well, and Oracle intends to make sure EHRs are only being accessed by the appropriate parties.

Management reiterated that Oracle expects the Cerner deal will be accretive to its earnings performance within the first year of the deal closing during the firm’s latest earnings call. We are keeping an eye on the acquisition.

Guidance Update

During Oracle’s latest earnings call, management also noted that the Cerner deal may close in the fiscal fourth quarter, though the firm’s guidance did not take that into account. The company expects its GAAP and constant currency revenues will grow by 6%-8% and 3%-5%, respectively, on a year-over-year basis during the final quarter of fiscal 2022.

Oracle’s bottom-line is facing tough comparisons in the current fiscal quarter due to large investment gains and a relatively low corporate income tax rate seen in the same quarter in fiscal 2021. Management noted that Oracle’s GAAP and non-GAAP EPS would shift lower on a year-over-year basis in the fiscal fourth quarter for those reasons, though the firm’s underlying profitability is expected to remain strong.

Concluding Thoughts

We continue to like Oracle as a dividend growth idea, though we are concerned that the Cerner deal is stretching its balance sheet. Oracle’s growth story has legs, and after years of stagnation during the past decade, its sales performance has been trending in the right direction in recent fiscal years–and the firm has done a solid job maintaining its revenue growth trajectory in the face of major exogenous shocks. Still, dividend growth investors should not let their guards down, as lofty net debt positions, as in the case of Oracle’s balance sheet, can often come back to bite even the most dividend-focused executive suites.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Related: CERN, XLV, MSFT, CRM

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of FB and XLE and is long call options on FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Microsoft Corporation (MSFT), and Health Care Select Sector SPDR Fund ETF (XLV) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.