Image Source: Oracle

By Brian Nelson, CFA

On December 9, Oracle (ORCL) reported lower than expected second quarter fiscal 2025 results with revenue and non-GAAP earnings per share coming in lower than the consensus forecasts. Total revenue was up 9% year-over-year in both USD and constant currency, while GAAP earnings per share increased 24% and non-GAAP earnings per share advanced 10%, to $1.47. Cloud services and license support revenues increased 12% year-over-year in both USD and constant currency, while cloud license and on-premise license revenue nudged up 1% in USD and 3% in constant currency.

Management’s commentary was upbeat in the press release:

Record level AI demand drove Oracle Cloud Infrastructure revenue up 52% in Q2, a much higher growth rate than any of our hyperscale cloud infrastructure competitors. Growth in the AI segment of our Infrastructure business was extraordinary—GPU consumption was up 336% in the quarter—and we delivered the world’s largest and fastest AI SuperComputer scaling up to 65,000 NVIDIA H200 GPUs. With our remaining performance obligation (RPO) up 50% to $97 billion, we believe our already impressive growth rates will continue to climb even higher. This fiscal year, total Oracle Cloud revenue should top $25 billion.

Oracle Cloud Infrastructure trains several of the world’s most important generative AI models because we are faster and less expensive than other clouds. And we just signed an agreement with Meta—for them to use Oracle’s AI Cloud Infrastructure—and collaborate with Oracle on the development of AI Agents based on Meta’s Llama models. The Oracle Cloud trains dozens of specialized AI models and embeds hundreds of AI Agents in cloud applications. For example, Oracle’s AI Agents automate drug design, image and genomic analysis for cancer diagnostics, audio updates to electronic health records for patient care, satellite image analysis to predict and improve agricultural output, fraud and money laundering detection, dual-factor biometric computer logins, and real time video weapons detection in schools. Oracle trained AI models and AI Agents will improve the rate of scientific discovery, economic development and corporate growth throughout the world. The scale of the opportunity is unimaginable.

For the current fiscal third quarter, total revenue is expected to grow 9%-11% in constant currency (7%-9% in USD at today’s exchange rate), while total cloud revenue is expected to grow 25%-27% in constant currency (23%-25% in USD). Non-GAAP earnings per share is expected to grow 7%-9% and be between $1.50-$1.54 in constant currency and non-GAAP earnings per share expected to grow between 4%-6% and be between $1.47-$1.51 in USD. For the fiscal year 2025, management noted that it remains confident in full year total revenue growing double-digit and full year total Cloud Infrastructure growing faster than the 50% reported last year.

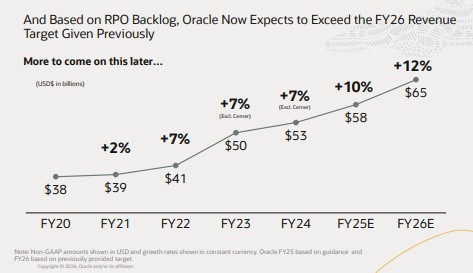

We particularly liked Oracle’s growth in total remaining performance obligations (RPO) in the quarter, which were up 49% in USD and 50% in constant currency year-over-year. During the past twelve months, Oracle’s operating cash flow came in at $20.3 billion, while free cash flow was $9.5 billion. The company ended the quarter with $11.3 billion in cash and marketable securities and $88.6 billion in notes payable and other borrowings. Though Oracle has a hefty net debt position and capital spending is expected to double in fiscal 2025, we still like the company’s cloud opportunity, and it remains a key holding in both the simulated Dividend Growth Newsletter portfolio and simulated ESG Newsletter portfolio.

—–

Tickerized for ORCL, MSFT, ADBE, NOW, CRM

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.