Newsletter Portfolio Idea Chevron Focused on Returning Cash to Shareholders

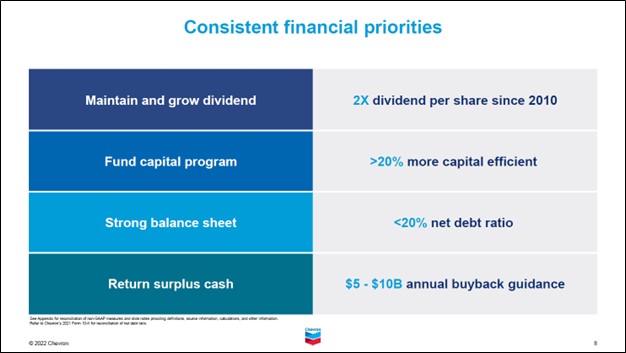

Image Shown: Newsletter portfolio idea Chevron Corporation is very shareholder friendly. We view its capital allocation priorities quite favorably. Image Source: Chevron Corporation – May 2022 IR Presentation

By Callum Turcan

Our newsletter portfolios remain overweight energy names as these companies are well-positioned to ride out inflationary pressures and geopolitical turbulence while generating substantial free cash flows and returning “gobs” of cash to shareholders. We include Chevron Corporation (CVX) in our Best Ideas Newsletter, Dividend Growth Newsletter, and High Yield Dividend Newsletter portfolios as the firm has placed a great emphasis on keeping its capital expenditures contained, improving its cost structure, and cutting down on its debt load while returning “gobs” of cash to shareholders.

Financial Overview

At the end of December 2020 (all the following net debt figures are inclusive of short-term debt), Chevron had $38.7 billion in net debt on the books, which dropped down to $25.7 billion by the end of December 2021. By the end of March 2022, Chevron’s net debt dropped further, falling to $17.6 billion. Its substantial free cash flows, a product of surging raw energy resources pricing, a recovery in demand for petroleum fuels and petrochemical products, and contained capital expenditure expectations were key to making this possible.

Chevron generated $21.1 billion in free cash flow in 2021 while spending $10.2 billion covering its total payout obligations (cash dividends to common shareholders plus net distributions to noncontrolling interests), allowing for $10.9 billion in “excess” free cash flows. Though Chevron announced it would resume significant share repurchases in July 2021 when reporting its second quarter earnings update, in the end the firm raised a modest amount of cash via net share issuances in 2021, meaning that its excess free cash flows went primarily towards net debt reduction.

Image Shown: An overview of Chevron’s capital allocation priorities. Image Source: Chevron – May 2022 IR Presentation

Please note that Chevron completed its ~$5 billion all-stock acquisition of Noble Energy in October 2020 which in the end led to Chevron purchasing its midstream spinoff, Noble Energy Partners, through an all-stock deal that closed in May 2021. During the second half of 2021, Chevron repurchased a decent amount of its stock, though the dilution from its past acquisitions saw the company’s weighted-averaged number of common shares outstanding on a diluted basis rise by just under 3% year-over-year in 2021 to 1.92 billion.

During the first quarter of 2022, Chevron generated $6.1 billion in free cash flow and spent just under $2.8 billion covering its total payout obligations allowing for over $3.3 billion in excess free cash flows. Management had this to say during Chevron’s first quarter of 2022 earnings call (emphasis added):

“A third consecutive quarter with free cash flow over $6 billion, enabled us to return $4 billion to shareholders and further pay down debt. In addition, during the quarter, we received over $4 billion in cash, with about 3,000 current and former employees exercise stock options.

This quarter's proceeds from option exercises were over 4x the historical annual average of around $1 billion per year. About 2/3 of the vest adoptions at year-end 2021 were exercised during the first quarter, lowering the potential future rate of dilution from the outstanding balance. Over time, we expect our share buybacks to more than offset the first quarter dilutive effect.” --- Pierre Breber, VP and CFO of Chevron

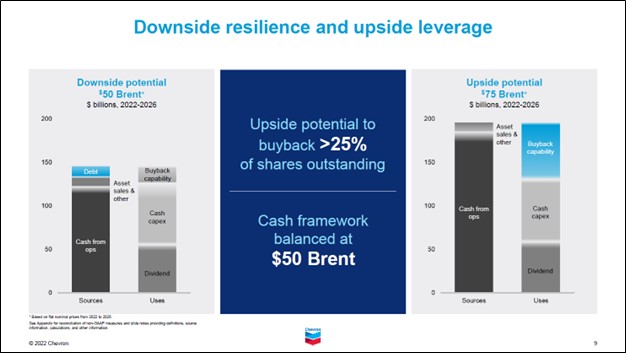

For this reason, Chevron raised $3.4 billion from net share issuances in the first quarter of this year even though it stepped up its annual share buyback goal from its initial ~$2-$3 billion target (announced in July 2021) to ~$3-$5 billion announced in December 2021 to ~$5-10 billion announced in March 2022. Looking ahead, Chevron’s share repurchases should begin to put substantial downward pressure on its outstanding share count as the dilutive effect of stock-based compensation shifts lower.

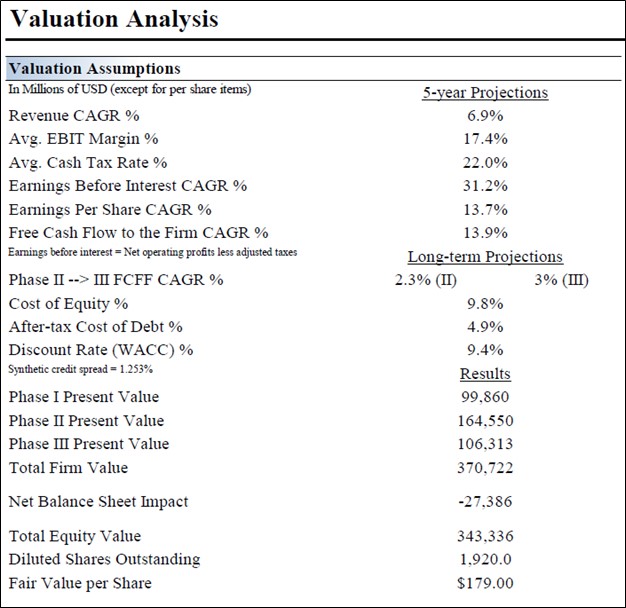

We view Chevron’s share buybacks as a good use of capital, in moderation, in the current environment. Our recently updated fair value estimate for Chevron sits at $179 per share with room for upside, as the top end of our fair value estimate range sits at $224 per share.

In the upcoming graphic down below, we highlight the key valuation assumptions used in our latest cash flow models covering Chevron to obtain our fair value estimate under our “base” case scenario. Should raw energy resources pricing remain elevated there is room for upside to this scenario, which forms the basis of our “bull” case scenario and the top end of our fair value estimate range. Even after the monster rally seen in shares of CVX over the past year, we still see room for substantial capital appreciation upside.

Image Shown: An overview of the key valuation assumptions we used to obtain Chevron’s fair value estimate of $179 per share. Chevron has room for additional capital appreciation upside going forward, should raw energy resources pricing remain elevated, with the top end of our fair value estimate range sitting north of $220 per share.

The company announced a 6% increase in its dividend on a sequential basis in January 2022 which marked Chevron’s 35th consecutive year of payout growth. The Dividend Aristocrat is incredibly shareholder friendly, and we view Chevron’s dividend growth upside quite favorably. Shares of CVX yield a nice 3.3% as of this writing.

Operations Update

Chevron noted during its first quarter earnings call that operations at its massive Tengizchevroil (‘TCO’) venture in Kazakhstan, which it owns 50% of alongside Exxon Mobil Corporation (XOM) which has a 25% stake in the venture (we are big fans of Exxon Mobil as well), were returning to normal as the Caspian Pipeline Consortium (‘CPC’) began to resume normal operations. Both Chevron and Exxon Mobil, among other firms, are also shareholders in the CPC. The CPC transports crude oil produced in Kazakhstan to the Black Sea for export, while the TCO venture produces oil and natural gas from the Tengiz and Korolev oilfields.

Storm damage at the CPC forced Kazakhstan, and the TCO venture, to significantly cut crude oil production levels in March and April. Now that the CPC and the related export infrastructure are up and running again, Chevron and Exxon Mobil can boost production at the TCO back up near peak capacity while continuing to pursue a major expansion of the Tengiz oilfield’s production capabilities. The Future Growth Project – Wellhead Pressure Management Project (‘FGP – WPMP’) is expected to cost $45.2 billion and was almost 90% complete as of May 2022 according to Chevron. Once completed, this endeavor is expected to see the free cash flows from the TCO venture surge higher over the coming years.

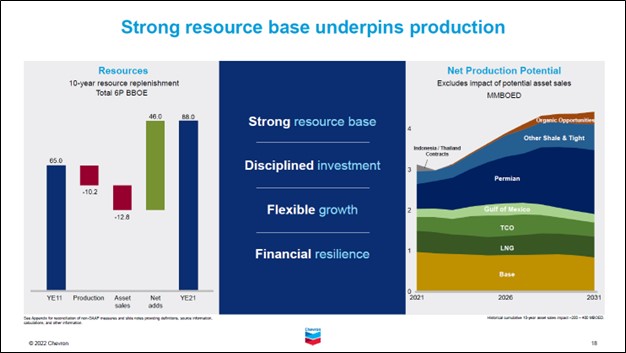

Image Shown: The FGP – WPMP endeavor at the TCO venture provides Chevron, and its partner Exxon Mobil, a major cash flow growth catalyst. Image Source: Chevron – May 2022 IR Presentation

Management noted during Chevron’s first quarter earnings call that affiliate dividends are expected to be substantially higher than initially estimated this year due to elevated raw energy resources pricing. For reference, management guided for ~$2-$3 billion in affiliate dividends during Chevron’s fourth quarter of 2021 earnings call, though during its first quarter of 2022 earnings call, management noted that affiliate dividends are expected to come in ~$1 billion above that guidance this year. Additionally, Chevron’s management noted that as of April, the TCO venture had yet to declare a dividend for 2022.

Liquified natural gas (‘LNG’) prices have been quite dear of late, which supports the outlook for the Angola LNG venture which Chevron has a ~36% interest in. During Chevron’s first quarter earnings call, management had this to say on the venture:

“We anticipate a return of capital between $250 million and $350 million from Angola LNG in the second quarter. This cash is reported through cash from investing and not cash from operations. In the first quarter, Angola LNG returned over $500 million of capital.” --- VP and CFO of Chevron

We appreciate that Chevron’s global asset base is now firing on all-cylinders as that puts the firm in a prime position to capitalize on elevated raw energy resources pricing while being able to return substantial cash to shareholders.

Image Shown: Chevron’s impressive resource base underpins its promising oil and gas production growth outlook over the next decade and beyond. Image Source: Chevron – May 2022 IR Presentation

Earnings Update

Chevron reported its first quarter 2022 earnings on April 29, which missed both consensus top- and bottom-line estimates, though that did not stop shares of CVX from marching higher over the following weeks as investors looked towards the future. Its upstream production base (upstream operations are involved in extracting raw energy resources from the ground) declined by 2% year-over-year to reach 3.1 million barrels of oil equivalent per day (BOE/d) on a net basis in the first quarter, though its sales of refined products rose by 10% year-over-year as its refining inputs rose by 8% year-over-year due to a recovery in global petroleum fuels and petrochemical products demand.

The company’s unconventional oil & gas production (raw energy resources produced via “fracking” activities) in the Permian Basin (the prolific play that stretches from Southeastern New Mexico to West Texas) hit a record of 692,000 BOE/d in the first quarter. In conjunction with Chevron’s first quarter earnings update, management raised the firm’s unconventional Permian production guidance for 2022 up to 700,000 – 750,000 BOE/d, equal to more than 15% annual growth.

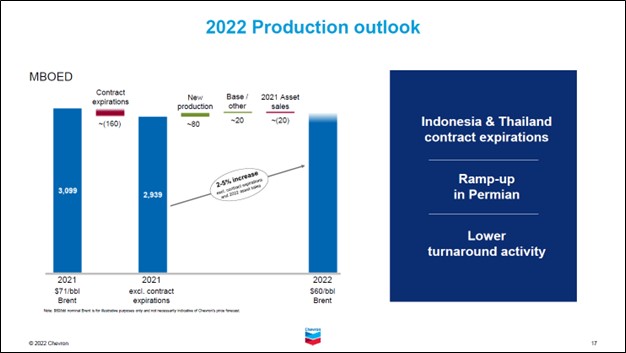

When removing contract expirations, asset sales, and other factors from the picture, Chevron forecasts that its upstream production base will grow by an adjusted 2%-5% in 2022 over 2021 levels.

Image Shown: This year, Chevron forecasts that its adjusted upstream production base will grow by 2%-5% on an annual basis, aided by growth at its unconventional Permian Basin operations. Image Source: Chevron – May 2022 IR Presentation

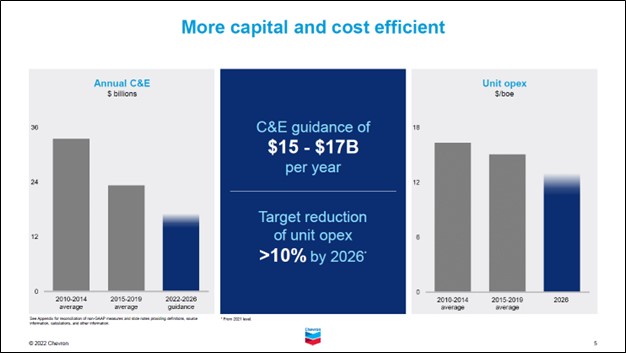

Chevron’s upstream production base is expected to benefit from the company stepping up its capital investments, in a reasonable manner, this year keeping in mind that its capital investments were incredibly subdued during the worst of the coronavirus (‘COVID-19’) pandemic. For reference, Chevron intends to spend ~$15 billion on capital expenditures and exploratory activities in 2022, up sharpy from 2020-2021 levels (its annual capital expenditures averaged ~$8.5 billion and its annual exploration expenses averaged ~$1.0 billion during this period).

However, that remains well below the ~$34.8 billion it spent on average per year from 2012-2014 on capital expenditures during a previous oil pricing boom, and that does not include certain exploration costs that were expensed during this period (which averaged ~$1.9 billion per year from 2012-2014).

In 2019, Chevron spent $14.1 billion on capital expenditures and recorded $0.8 billion in exploration expenses, highlighting the reasonably tame nature of its investment expectations for 2022. Given the bright outlook for raw energy resources pricing and the incredibly strong crack spreads (refining margins) seen of late, stepping up its capital investments is a good use of shareholder capital, in our view.

Another way Chevron is improving its business is by reducing its operating costs on a per barrel of oil equivalent (‘BOE’) basis. From the 2010-2014 to the 2015-2019 period, Chevron’s operating expenses on a per BOE basis declined significantly as you can see in the upcoming graphic down below. By 2026, Chevron aims to reduce its per barrel of oil equivalent operating expenses by over 10%. Efforts to improve its cost structure have gone a long way in supporting its cash flow generating abilities in any environment and should continue to do so going forward.

Image Shown: Chevron has significantly improved its cost structure over the past several years. The firm intends to continue improving its cost structure going forward. Image Source: Chevron – May 2022 IR Presentation

Pending Acquisition

Chevron announced it would acquire Renewable Energy Group Inc (REGI) for $61.50 per share in cash in February 2022 through a deal worth ~$3.15 billion. On May 17, Renewable Energy Group announced that its shareholders had approved the deal, which is expected to close during the middle of this year. We covered our thoughts on this acquisition in a March 2022 article that we encourage our members to check out (link here).

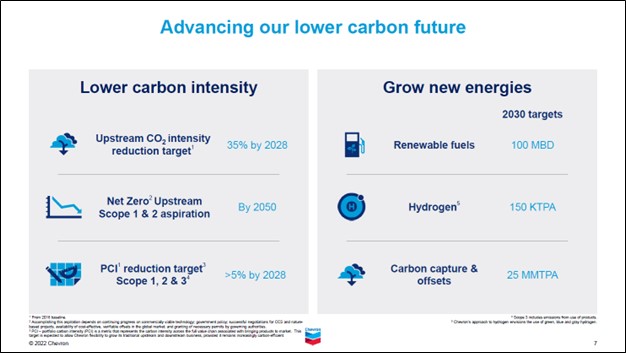

Renewable Energy Group is a biofuel producer with roughly a dozen biofuel refineries located across the US and Europe (ten in the US, nine or which are operational, and two in Germany). Acquiring this firm will help Chevron achieve its goals of building out a sizable alternative energy producing unit capable of producing around 100,000 barrels of renewable fuel per day by 2030.

Image Shown: Chevron is using acquisitions to grow its alternative energy producing unit. Image Source: Chevron – May 2022 IR Presentation

Concluding Thoughts

We continue to be huge fans of Chevron. Investors clearly like Chevron’s approach as shares of CVX on a price-only basis are up ~66% over the past year as of this writing, and we see room for additional upside. On a final note, Chevron has no direct exposure to Russia as we covered in our March 2022 article that can be viewed here. There is a lot to like about Chevron.

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, SHEL, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: REGI, XLE

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and simulated High Yield Dividend Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment