Has the Stock Market Crash Begun?

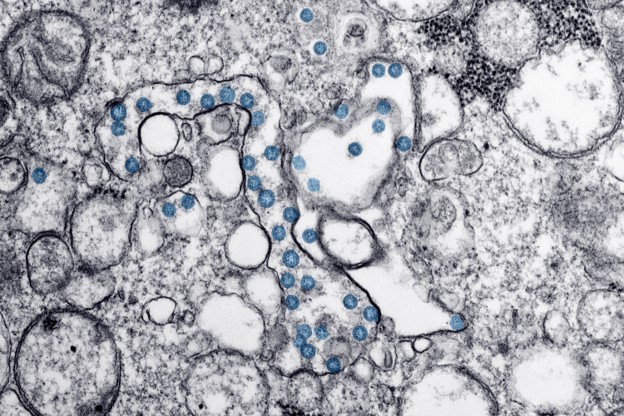

Image: CDC. Transmission electron microscopic image of an isolate from the first U.S. case of COVID-19, formerly known as 2019-nCoV. The spherical viral particles, colorized blue, contain cross-section through the viral genome, seen as black dots.

Dear members:

This article is our fourth update on COVID-19. The previous three installments can be found here (Feb 22), here (Feb 7) and here (Jan 31).

We trust you and yours are well during this global crisis. It’s hard to turn on the television these days without hearing about COVID-19, a novel coronavirus and respiratory illness that continues to spread from person to person around the world. COVID-19 is deadly, and particularly deadly among those 60 years of age and older and those with cardiovascular disease and diabetes, among other pre-existing conditions. By some estimates, for example, the death rate of those aged 70 and older is 8%+, and those with cardiovascular disease is 10%+. COVID-19 is a serious illness.

According to the latest Situation Report from the CDC, dated February 25, there are now more new cases reported from countries outside of China (FXI, MCHI, KWEB) than from China. Globally, there are currently 80,000+ confirmed cases in nearly 40 countries, with China, South Korea (EWY), Italy (EWI) and Iran the major hotspots. Up until now, investors have been anxiously waiting for the other shoe to drop (i.e. community spread in the United States), with the CDC even saying, “It's not so much a question of if this will happen anymore, but rather more a question of exactly when this will happen and how many people in this country (United States) will have severe illness.”

Well, that “when” is now. The CDC just confirmed February 26, 2020, a possible instance of community spread of COVID-19 in the US:

The Centers for Disease Control and Prevention (CDC) has confirmed an infection with the virus that causes COVID-19 in California in a person who reportedly did not have relevant travel history or exposure to another known patient with COVID-19.

At this time, the patient’s exposure is unknown. It’s possible this could be an instance of community spread of COVID-19, which would be the first time this has happened in the United States. Community spread means spread of an illness for which the source of infection is unknown. It’s also possible, however, that the patient may have been exposed to a returned traveler who was infected.

According to CNBC, “the individual is a resident of Solano County and is receiving medical care in Sacramento County.” Without a doubt, this is a big deal because it is the first known instance of potential community spread in the United States, meaning that COVID-19 could literally be spreading untraced throughout California and beyond as we speak. We could see hundreds of new cases in California and neighboring states and from airports in other major US cities in the coming weeks. As of this writing, the Dow Jones Industrial Average is indicated down another 300 points after falling 2,000+ points so far this week.

As we alerted members last Saturday, “Is a Stock Market Crash Coming?,” and with our multiple alerts sent Monday morning here and here, we sincerely hope and believe that we have the most prepared members out of any newsletter provider, any investment bank and any investment research company out there. Over a month ago on January 13, we positioned both the Best Ideas Newsletter portfolio and the Dividend Growth Newsletter portfolio defensively for 2020, removing Apple (AAPL) among other changes. As profit warnings from Mastercard (MA), Microsoft (MSFT), United Airlines (UAL), and others continue to add up, we could be at the beginning of one of the biggest market events since the stock market crash of 1987.

Here’s what we’re looking at. In our Saturday, February 22 note, we said that a contraction of the S&P 500 to a 16x forward multiple on earnings estimates only 10% lower than current forecasts would imply an S&P 500 of 2,566, or a swoon of about 15%-25% from current levels of 3,116 --and that would just get us down to 16x still-respectable forward numbers (the market could still overreact from that point!). How quantitative-driven price-agnostic trading may impact this scenario is not known either… It would not be surprising to me if we tripped the circuit breakers at some point. Markets remain severely overpriced in light of current conditions, and panic selling might ensue as fear takes hold.

We released a notification alert to members Monday morning February 24 pre-market, ALERT: Adding Market Crash ‘Protection,’ Removing MSFT, BKNG, where among other moves, we added September 18, 2020, deep out of the money put options with strike $250 on the S&P 500 ETF (SPY). At last quote, these options contracts are now trading at $3.82, up significantly from when they were added to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Keep your seatbelts fastened. We could be in for stock market history in the coming days and weeks.

0 Comments Posted Leave a comment