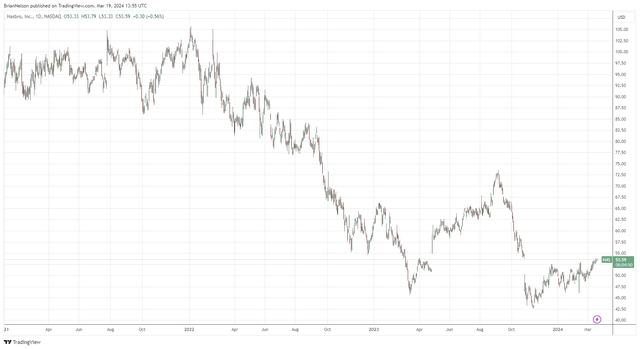

Image: Hasbro’s shares have faced considerable pressure during the past few years.

By Brian Nelson, CFA

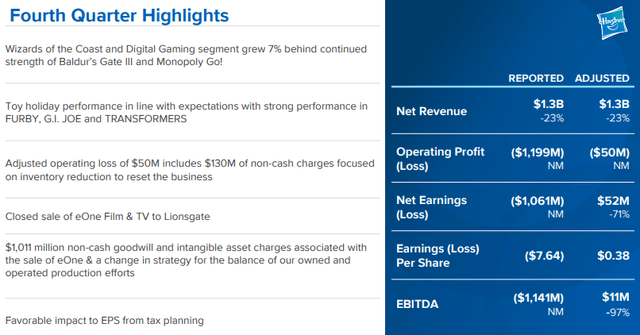

Hasbro’s (HAS) recently reported fourth-quarter results weren’t great and showed revenue declining 23% as it experienced material weakness in its Consumer Products segment (-25%) and Entertainment division (-49%) in the quarter. On an adjusted basis, backing out large impairment charges, the firm’s operating loss came in at $50 million in the quarter, while it recorded adjusted net earnings of $0.38 per share. Hasbro continues to navigate a difficult demand environment for physical toys, but the company’s free cash flow remains robust and was in excess of cash dividends paid during 2023. Shares yield ~5.3% at the time of this writing.

Image: Hasbro had a challenging fourth quarter, despite strong performance in FURBY, G.I. JOE and TRANSFORMERS.

In light of significant competition from streaming and gaming alternatives to physical toys, Hasbro has fallen on some difficult times. These days, children are tuning into Youtube channels for entertainment or pursuing video gaming options for just about any vertical. Kids may be watching shows such as Paw Patrol, PJ Masks, or Blaze and the Monster Machines, or playing video games such as At Dead of Night or Palworld instead of physical toys, and Hasbro will continue to have a difficult time finding a way to connect with youngsters that are seeking more engaging content. That said, Hasbro is working hard to right the ship, as management noted in its fourth-quarter press release:

Guided by our strategy of “Fewer, Bigger, Better,” we had important wins across both toys and games while making progress in our transformation during a challenging 2023. Despite the macroeconomic backdrop, we are entering 2024 with a healthier balance sheet, a leaner cost structure, and a diverse portfolio of industry-leading toy and game brands that support our capacity to invest in the business and maintain our commitment to returning cash to shareholders via our category-leading dividend. Our refreshed leadership team is bringing innovative new products to our fans. At the same time, we are taking the necessary actions to transform Hasbro and deliver long-term profitable growth starting with driving significant profit growth across our segments in 2024 and building momentum in our innovation pipeline between now and 2025.

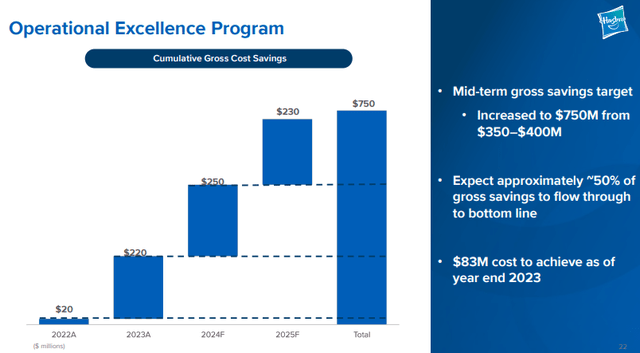

Management’s outlook for 2024 continues to reveal that the near-term demand environment will be difficult. The company expects its Consumer Products Segment revenue to be down 7%-12% on the year, while sales in its Wizards of the Coast Segment are expected to fall by 3%-5%. Revenue in its Entertainment segment is expected to fall modestly on a proforma basis on the year. Total adjusted EBITDA, however, is targeted in the range of $925 million to $1 billion for 2024, as Hasbro continues to pursue efficiency initiatives, targeting a gross savings target of $750 million by the end of 2025, as shown in the image below.

Image: Hasbro is targeting considerable cost savings by 2025.

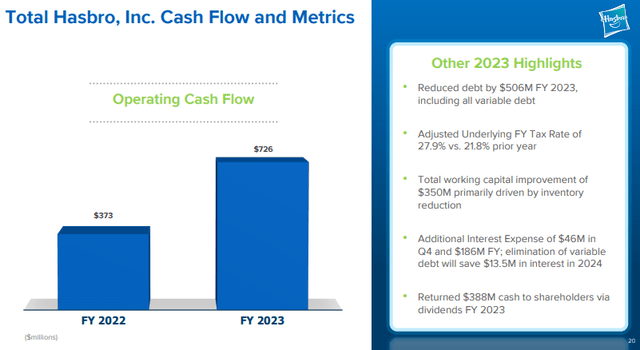

Image: Hasbro’s operating cash flow remains robust and was bolstered by better inventory management in 2023.

Hasbro currently has a net debt position, but it is working to deleverage its balance sheet, while maintaining an investment grade credit rating. The company’s free cash flow generation of $516.3 million during 2023 covered cash dividends of $388 million on the year, so while operating performance remains difficult, Hasbro’s free cash flow generation has been sufficient to cover the dividend payment thanks to better inventory management. For income investors seeking a turnaround story, Hasbro may fit the bill, though the road ahead looks to be a bumpy one.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for HAS, MAT, FNKO, RBLX, NTDOY, EA, TTWO, GME, SONY, GAMR, ESPO, NERD

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.