Chevron’s Promising Cash Flow Growth Outlook

Image Source: Chevron Corporation – May 2021 IR Presentation

By Callum Turcan

The outlook for the global energy complex is bright and getting brighter as public health authorities utilize widespread coronavirus (‘COVID-19’) vaccine distribution efforts to put an end to the pandemic. We added shares of Chevron Corporation (CVX) to the Best Ideas Newsletter and Dividend Growth Newsletter portfolios on June 27 (link here) in order to gain exposure to the ongoing recovery in the global energy complex via a high-quality integrated oil major. Shares of CVX yield ~5.1% as of this writing.

Asset Overview

Chevron’s collection of upstream assets (involved in the extraction of raw energy resources from the ground) includes operations all over the world with some notable assets in the Permian Basin, the Gulf of Mexico, the Eastern Mediterranean region, Kazakhstan, Canada, and Australia. The company’s upstream asset base includes meaningful amounts of short- and long-cycle projects, meaning Chevron can capitalize on higher raw energy resources pricing in the short-term by stepping up its unconventional investments (“fracking” activities in the Permian Basin, Canada, and to a lesser extent, Argentina), while investing in low-cost long-term projects to maintain and grow its upstream production base (a major development in Kazakhstan is set to be completed in 2022/2023).

As it concerns its downstream operations (refineries and petroleum plants), Chevron has a meaningful presence along the US Gulf Coast after buying the Pasadena refinery in Texas back in 2019 for $0.35 billion (excluding working capital adjustments) from Brazil’s Petroleo Brasileiro (PBR). Chevron also owns a refinery in Pascagoula, Mississippi, a refinery in Salt Lake City, Utah, and various refineries along the US West Coast which represents its core refining footprint in the US. Reportedly, Chevron is considering purchasing Royal Dutch Shell’s (RDS.A) (RDS.B) refinery in Anacortes, Washington, which Shell has reportedly been attempting to sell for some time. Outside the US, Chevron has refineries in East Asia and Southeast Asia.

Its petrochemical operations are located all over the world with its core manufacturing regions including the US Gulf Coast, Middle East, East Asia, and Southeast Asia though Chevron has a sizable sales presence in Western Europe (and elsewhere). Putting this all together, we are big fans of Chevron’s diversified asset base as it has top tier operations in attractive regions that have either access to low-cost raw energy resources or access to vibrant demand hubs, and in some instances, both. The company’s midstream (energy infrastructure) operations support its existing upstream and downstream operations and support Chevron’s growth ambitions.

Financial Overview

During the worst of the COVID-19 pandemic, Chevron’s financials took a beating though we are impressed by the fact that the firm was still able to generate positive free cash flows in 2020 (to the tune of $1.7 billion). This was partially due to Chevron’s trading and retail divisions offsetting some of the headwinds facing its upstream and downstream businesses, highlighting why we are big fans of the name. While that did not come close to fully covering $9.7 billion in dividend obligations during this period, we are looking towards the future and the future is bright.

Sharp increases in raw energy resources pricing of late, particularly global crude oil and liquified natural gas (‘LNG’) prices, will go a long way in propping up Chevron’s cash flows going forward as will the ongoing recovering in demand for refined petroleum products (gasoline, diesel, kerosene) and petrochemical products (plastics, lubricants, adhesives, and more). The OPEC+ oil cartel continues to keep a sizable amount of crude oil supplies off the market, though the group is negotiating potential supply increases to keep up with demand growth.

In the first quarter of 2021, Chevron generated $2.5 billion in free cash flow and spent a similar amount covering its dividend obligations, though please note raw energy resources pricing improved considerably since then. Additionally, Chevron’s business took an estimated ~$0.3 billion hit from Winter Storm Uri in the first quarter of this year, and the negative impact of the storm should fade over the coming quarters.

At the end of March 2021, Chevron had ~$38.3 billion in net debt (inclusive of short-term debt) on the books, up significantly from the ~$21.2 billion net debt position (inclusive of short-term debt) that the firm had as of the end of 2019. That damage was primarily the result of the pandemic, and Chevron’s commitment to continue making good on its dividend obligations. In our view, Chevron should be able to generate ample “excess” free cash flows (free cash flows after covering its dividend obligations) in the current environment, something its second quarter earnings report should highlight. We would like to see Chevron utilize a portion of those “excess” free cash flows to pare down its net debt load.

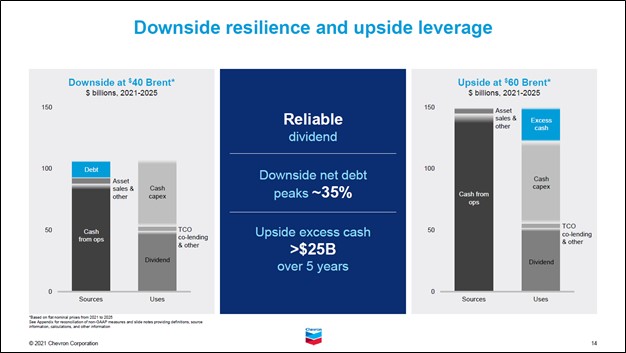

Image Shown: An overview of Chevron’s cash flow generating potential when Brent, the premier international crude oil pricing benchmark, is trading at $60 per barrel. Please note that near-term Brent futures, as of this writing, are trading north of $70 per barrel in the wake of recovering demand and supply curtailments from the OPEC+ oil cartel. We view Chevron’s cash flow growth outlook quite favorably, with an eye towards its enormous upstream division outperforming going forward. Image Source: Chevron – May 2021 IR Presentation

Capital Allocation Priorities

During Chevron’s first quarter of 2021 earnings call, management was asked a question about share repurchases in light of the aggressive improvements in the macro environment of late. For reference, Chevron spent $1.5 billion net buying back its stock in 2020 and issued $0.3 billion net in shares during the first quarter of this year. Chevron’s management team responded to the analyst’s questions with this statement (emphasis added, lightly edited):

“…I think you can infer in my comments, that, again, we're looking to future excess cash generation and the strength of the balance sheet to weather, the commodity price cycle. So I'm not going to give you a hard target, we're going to use judgment, because there's judgment on future excess cash generation, this is our first quarter actually, with current excess cash generation. We expect the next couple quarters to be potentially even better, because you've got oil prices above $60, refining and chemicals margins much stronger. So it could be even better.

At the same time, we don't have a sustained global economic recovery. So it's reasonable for us to be cautious, we want to be confident that when we start the [share buyback] program, we're going to continue it for multiple years. And we can sustain it through an oil price cycle. So I know that folks want a formula or a trigger, I know some of our competitors have those numbers, we're going to use judgment.

And we're going to consider what we see in front of us in terms of the likelihood of future excess cash generation, we're going to want the balance sheet in a strong enough position that if oil prices cycle down, we can continue the buyback program relying on the balance sheet. Our balance sheet is very strong right now. But yes, in the short-term, excess cash is going to go to the balance sheet. That's kind of by definition, but it also serves a dual purpose of lowering our net debt ratio and putting us in a better position for when we start if and when we start a buyback program.” --- Pierre Breber, Vice President and CFO of Chevron

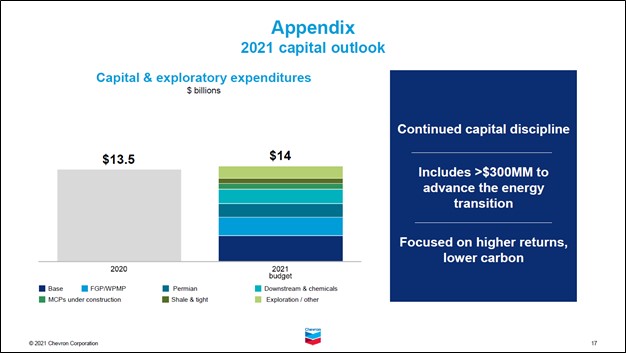

Chevron’s capital expenditure expectations have come in significantly in recent years compared to the level of investment seen in 2010-2015. While its capital expenditures will likely increase going forward versus 2020 levels, please note that Chevron materially reduced its investments last year to ride out the pandemic, so it is only natural for the company to resume a more “normalized’ level of investment in its asset base. Compared to its strategy in 2010-2015, Chevron’s ability to generate free cash flows is now much stronger because management is no longer chasing raw energy resources pricing higher via large capital expenditure increases.

Image Shown: Chevron’s planned capital expenditure increases for 2021 are relatively modest in nature, in our view, as management remains committed to fiscal discipline to maximize the firm’s free cash flow generating potential. Image Source: Chevron – May 2021 IR Presentation

We appreciate the company’s controlled capital expenditure expectations as it underpins Chevron’s relatively strong Dividend Cushion ratio which sits just below parity at 0.8 (the firm earns both a GOOD Dividend Safety and Dividend Growth rating). Should Chevron follow through with its stated deleveraging goals, the company’s Dividend Cushion ratio could steadily improve over the coming years.

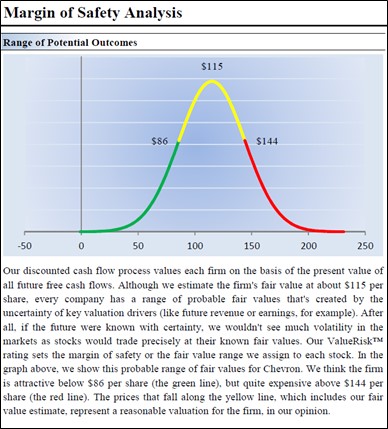

Our fair value estimate for Chevron sits at $115 per share with room for upside as the top end of our fair value estimate range sits at $144 per share. After improving its balance sheet, Chevron could generate shareholder value by buying back its stock, as its shares as of this writing are trading modestly below its intrinsic value under our base case scenario and meaningfully below its intrinsic value under our bull case scenario.

Image Shown: Shares of Chevron are trading below their intrinsic value as of this writing. Once its balance sheet improves, the company could generate shareholder value by buying back its stock, in our view. Image Source: Valuentum

Noble Energy Update

In October 2020, Chevron completed its acquisition of Noble Energy through a deal worth ~$13 billion by enterprise value. Here is what we had to say in our August 2020 piece, Our Thoughts on Chevron Buying Noble Energy, which can be viewed here (moderately edited):

In our view, this deal was entirely about Chevron gaining access to Noble Energy’s Mediterranean assets…

Noble Energy owns a significant working interest in the offshore Tamar and Leviathan natural gas fields in Israel. With the Leviathan field now operational (came online near the end of 2019), Noble Energy’s net production in the region is quite sizable even for a firm as large as Chevron, and its output should steadily ramp up in the region in the medium-term as production from the Leviathan field ramps up. For reference, production from the Tamar field came online back in 2013. Supplies from these two offshore natural gas fields are meeting regional demand… Combined, both fields contain tens of trillions of cubic feet of potentially recoverable natural gas resources.

There remains an enormous amount of room for upside in this region that could be unlocked by expanding the output capacity at producing fields and by developing other offshore gas fields in the area (like the Aphrodite and Dalit discoveries, which are not producing fields as things stand today).

The upcoming graphic down below highlights Chevron’s asset base in the Eastern Mediterranean region. Please note that the potential to significantly grow natural gas exports from its upstream operations in this region underpin these asset’s production growth upside.

Image Shown: We view Chevron’s footprint in the Eastern Mediterranean region quite favorably with an eye towards the immense natural gas production upside and the potential for significant natural gas exports to major demand centers. Image Source: Chevron – May 2021 IR Presentation

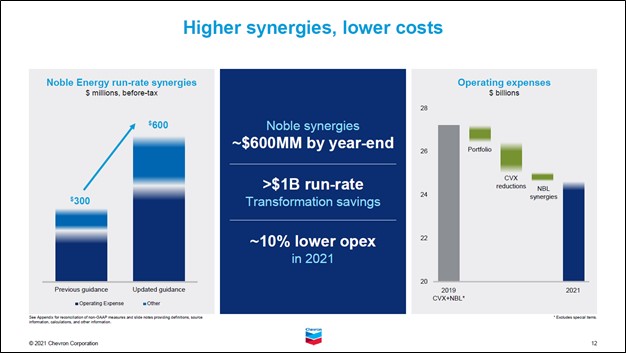

The combination is also expected to unlock sizable synergies, as you can see in the upcoming graphic down below, and things have been progressing well on this front so far as Chevron recently doubled its expected pre-tax run-rate synergies target.

Image Shown: The combination of Chevron and Noble Energy is expected to unlock sizable synergies going forward. Image Source: Chevron – May 2021 IR Presentation

Concluding Thoughts

Chevron’s outlook is bright and getting brighter. We are monitoring news regarding its potential purchase of Shell’s Anacortes refinery in Washington state, and generally like the move given its scale in the region, though increased environmental regulations are a perennial concern here. The company’s capital allocation strategy going forward is rock-solid, and we view Chevron as incredibly well-positioned to capitalize on the ongoing recovery in the global energy complex.

Members interested in reading more about our thoughts on the energy space are encouraged to check out our recent note (link here) on Exxon Mobil Corporation (XOM), another idea in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. On a final note, we also include Energy Select Sector SPDR Fund (XLE) as an idea in our Best Ideas Newsletter portfolio.

Downloads

Chevron’s 16-page Stock Report > >

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: BNO, PBR, RDS.A, RDS.B, USO, XLE, XOP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment