BNP Paribas’ Shares Could Have Upside Potential

BNP Paribas’ shares are trading at a fraction of tangible book. If the bank can contain its cost of risk through this cycle and produce double-digit returns on tangible equity on the other side of this crisis, shareholders would do quite well in such a scenario. That said, we point out that Europe is overtraded when it comes to banking, which pressures earnings power at even the stronger banks like BNP Paribas. We’re paying close attention to the key banking players in Europe to assess the likelihood of a global financial contagion that may accompany the global pandemic that has become COVID-19.

By Matthew Warren

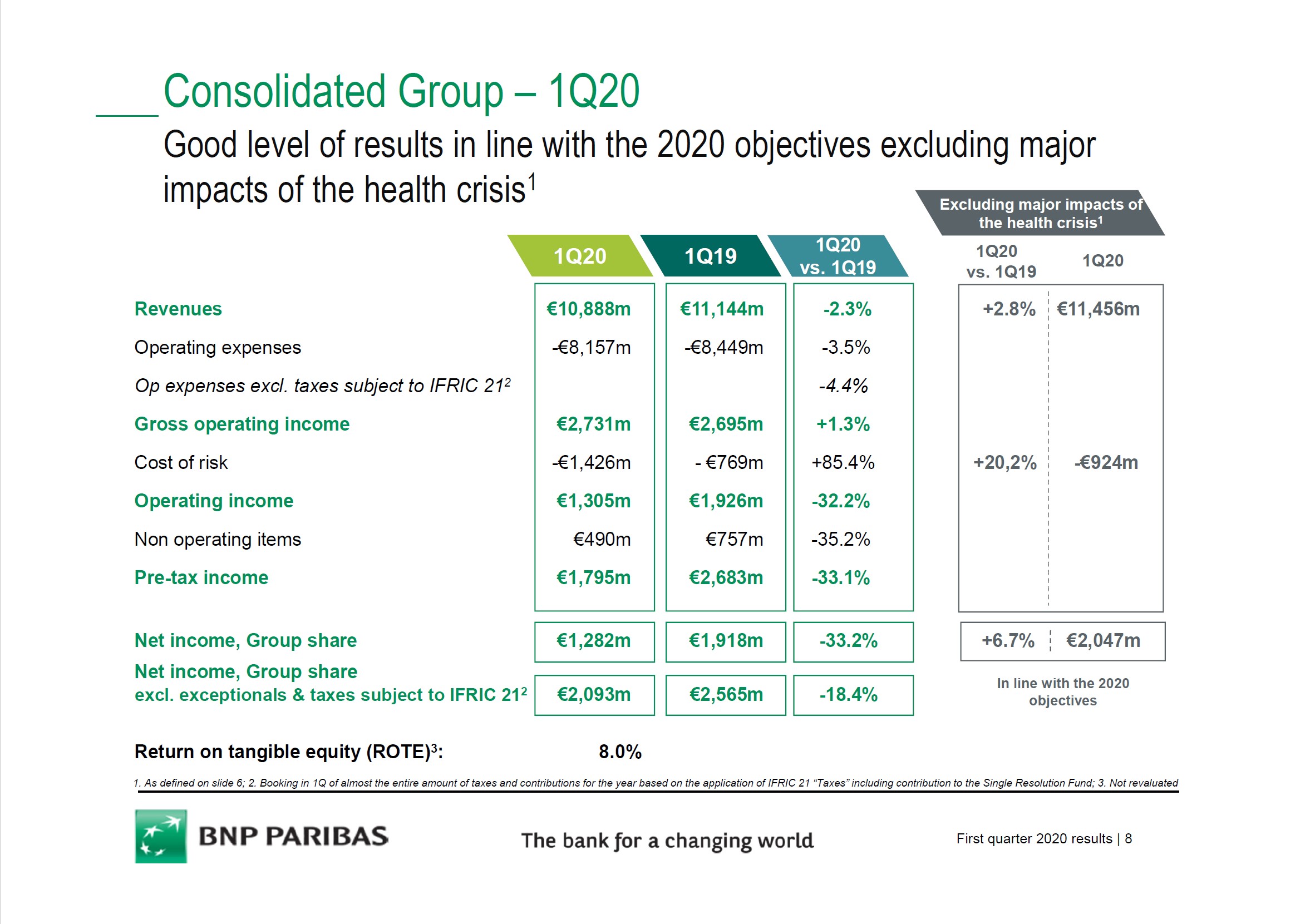

BNP Paribas SA (BNPQF, BNPZY) reported relatively better results than many large global bank peers, with revenues down only 2.3% and net income per group share down 33.2% during its first quarter, results released May 5. As one can see in the upcoming below graphic, operating expenses fell even more than revenues, helping the bottom line, and while the cost of risk (similar to provisions for loan losses under US GAAP reporting) was up 85.4%, this provision wasn’t nearly as large as that of some of its other global peers.

Image Source: BNP Paribas 1Q2020 Earnings Presentation

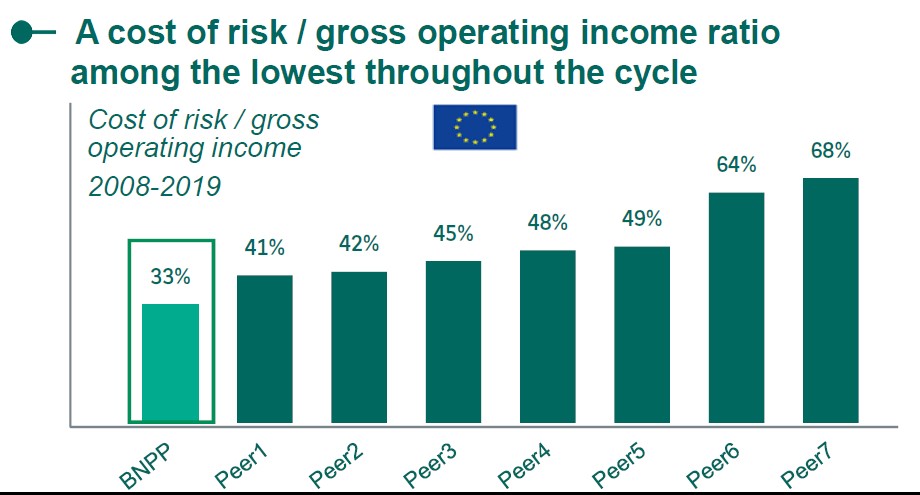

Given a reasonable 8% return on tangible equity for such a stressed period in the markets and the economy, BNP Paribas seems to be holding up well at this admittedly early stage in this large cycle. Is this view valid, however? A quick peek at the below graphic provides some evidence on BNP Paribas’s behalf, though it would be nice to see the peer banks named (Peer1, Peer2, as shown in the image below). Non-lending revenues help lower this metric, so BNP Paribas’ insurance and wealth management units, for example, help on this front, as compared to a more plain-vanilla deposit taker and lender.

Image Source: BNP Paribas 1Q2020 Earnings Presentation

The bank remains well capitalized with a common equity Tier I ratio of 12%, and considering that all European banks (EUFN) are prohibited from paying dividends or buyback shares at this time, we expect this metric to remain strong if not get stronger, as long as the balance sheet does not grow at an outrageous pace or risk weightings spike too much more than they already have.

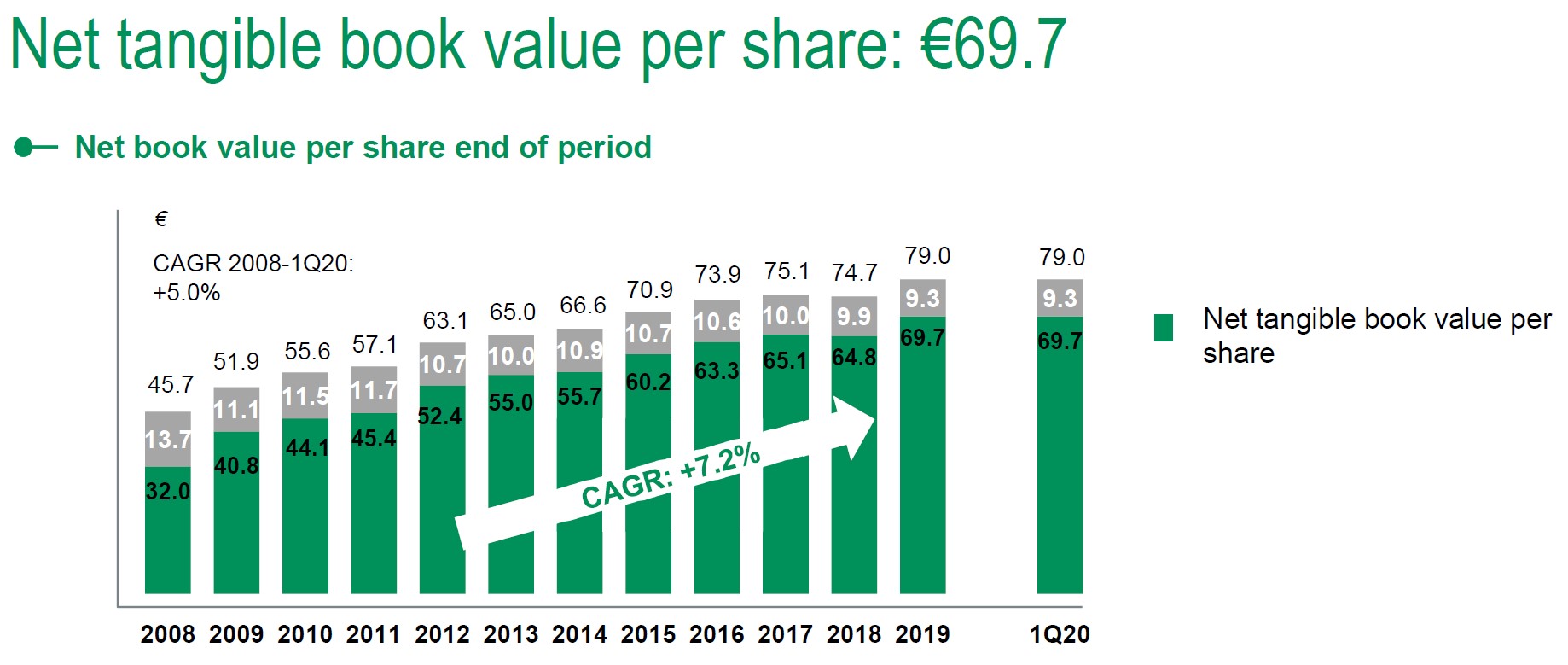

In another sign that BNP Paribas has acquitted itself quite well since the Great Financial Crisis, it has managed to grow its tangible book value per share by a 7.2% compound annual growth rate (CAGR) between 2008 and 2019, as one can see in the graphic below.

Image Source: BNP Paribas 1Q2010 Earnings Presentation

Given that the shares are trading at a fraction of tangible book, if BNP Paribas can contain its cost of risk through this cycle and produce double-digit returns on tangible equity on the other side of this crisis, shareholders would do quite well in such a scenario. We will be watching the losses closely as the cycle evolves. We would also point out that Europe is overtraded when it comes to banking, which pressures earnings power at even the stronger banks like this one. There is also the risk of sovereign spreads of peripheral countries blowing out again, which could cause serious problems such as counterparty risk.

Owning banks in Europe is not for the faint of heart.

---

Related articles:

Lloyds Banking Group Navigates Competitive Markets, May 4, 2020

Deutsche Bank Suffering From Lack of Earnings Power, April 30, 2020

Santander Remains Well-Capitalized, April 29, 2020

Canadian banks: TD, RY, BNS, BMO, CM

Related: RBS, BCS, SCGLF, CRARF, UNCFF, DB, ING, UBS, CS, BBVA, SC, ALIZF, BPESF, BSAC, HSBC, LYG

Related ETFs: EUFL, EWU, FXB, GBB, DBUK, FKU, DGBP, QGBR, HEWU, UGBP, FLGB, ZGBR

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment