Big Cap Tech and Large Cap Growth Remain Safe Havens

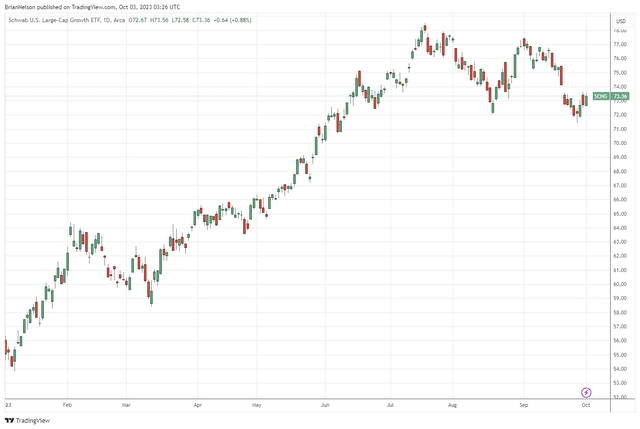

Image: The stylistic area of large cap growth, which is heavily represented in the Best Ideas Newsletter portfolio, is doing fantastic so far in 2023.

Hi everyone:

Brian here. I wanted to check in to see how everyone is doing. As expected, many of the interest-rate sensitive names are getting hammered. This should not be surprising by any stretch. The utilities sector (XLU) is down more than 20% this year. We’ve emphasized why we’re not fans of utilities in this article. The consumer staples (XLP) sector is down nearly 8% so far in 2023. We’ve emphasized why we’re not expecting much from consumer staples in this article. Equity REITs (VNQ) are down more than 8% year-to-date, and we’ve emphasized why REITs are risky in this article. Though it is discouraging to see these areas face pressure, the reality is that their weakness is consistent with the enterprise valuation process. If you have not read the second edition of Value Trap, we implore you to do so.

What we want you to understand is that these sectors, which many have been trained to believe are safe havens, are not. The utilities and REIT sectors are extremely capital intensive. Utilities shell out tons of capital to power their operations, while REITs are always wheeling and dealing. Realty Income (O) is in dire straits, in our view, and many view it as one of the highest quality REITs out there. We plan to do a report refresh of our REIT coverage soon, and for those waiting for an update on NextEra Energy (NEE), it will be forthcoming as well. When it comes to consumer staples, many are experiencing organic volume declines, while their businesses suffer from tremendous net debt positions. Stock prices and returns are based on the cash-based sources of intrinsic value: net cash on the balance sheet and strong expectations of future free cash flow.

The areas where these two cash-based sources of intrinsic value are overflowing are in big cap tech and large cap growth, and we’ve pounded the table and pounded the table again on these areas. Don’t be lured by a company’s dividend alone. The dividend is independent of a company’s valuation, and don’t ever forget that the stock price of a company is adjusted down by the dividend payment on the ex-dividend date. An ETF that measures the stylistic area of large cap growth (SCHG) is up over 33% so far in 2023. Its top weightings approximate several of the top weightings within our Best Ideas Newsletter portfolio, which is holding up great so far this year, while other areas suffer. Big cap tech and large cap growth generally have huge net cash positions on their balance sheets and have expectations to generate tremendous amounts of free cash flow. These make them safe havens--not utilities, consumer staples or REITs.

In any case, I wanted to write this brief note to check in with you as the market continues to be a bit jittery following the highs it reached in late July. The Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio put up a great year of relative outperformance during 2022 versus the market-cap weighted S&P 500, and their exposure to the areas of big cap tech and large cap growth have helped them follow through during 2023. It’s easy to fall into the trap of relying just on valuation multiples and dividend yields, but we have to continue to emphasize that it is our view that enterprise valuation is the key determinant of equity prices and returns, and it should not be surprising that big cap tech and large cap growth, with their huge net cash positions and strong expected free cash flows, have dominated returns so far in 2023.

NOW READ: Report Updates -- Did You Throw the Baby Out with the Bathwater?

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment