We Continue to Be Big Fans of Ameresco

Update: We first covered Ameresco in detail through an article published back in August 2020 (link here) and followed up on that work in a subsequent article published in November 2020 (link here) and provided a brief update on the firm in a piece published in January 2021 (link here). Shares of AMRC have more than doubled since we published our first article covering the name as of mid August 2021, and we think there is ample room for additional capital appreciation upside.

Image Source: Ameresco Inc – August 2021 IR Presentation

By Callum Turcan

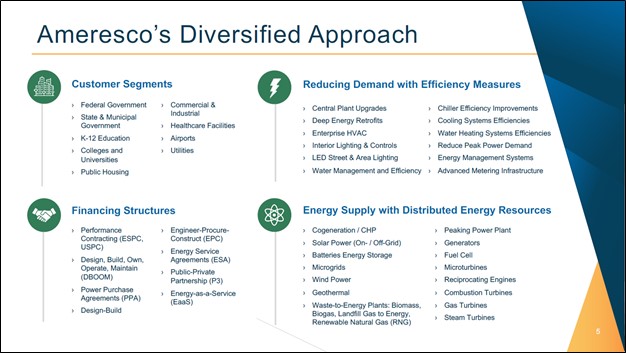

Ameresco Inc (AMRC) provides its customers with an expansive slate of clean energy and energy efficiency solutions ranging from upgrades to energy infrastructure (e.g., battery storage, lighting improvements and smart metering) to the development, construction, and operation of renewable energy projects (e.g., biogas and solar PV power plants) at the facilities of its clients. Ultimately, Ameresco’s goal is to help reduce its clients' ongoing operating expenses by delivering material energy-related cost savings. Ameresco’s offerings cover a lot of ground in the clean energy arena. The lion’s share of its revenues come from its activities in the US as of 2020.

Ameresco helps develop bespoke energy solutions for airports, public housing authorities, commercial, industrial, educational, and healthcare customers, and various local, state, and federal government entities in North America and the UK. The clean energy solutions provider also helps its clients secure the financing needed to fund these endeavors, including providing the financing itself, and will at times own and operate the power plants developed at or near its clients’ facilities. At the end of December 2020, Ameresco owned and operated 130 power plants, primarily biogas and solar facilities.

Image Shown: An overview of Ameresco’s expansive slate of energy efficiency and green energy solutions, and the various financing structures it offers its customers. Image Source: Ameresco – August 2021 IR Presentation

We first covered Ameresco in detail through an article published back in August 2020 (link here) and followed up on that work in a subsequent article published in November 2020 (link here) and provided a brief update on the firm in a piece published in January 2021 (link here). Shares of AMRC have more than doubled since we published our first article covering the name as of mid August 2021, and we think there is ample room for additional capital appreciation upside.

The company is uniquely well-positioned to capitalize on the “green energy revolution” through a variety of ways. Ameresco has ample expertise navigating the sea of forever changing local, state, and federal subsidies and the prowess required to adapt to the ever-changing regulatory environment when it comes to energy efficiency and renewable energy developments. Additionally, Ameresco has a lot of expertise operating renewable energy power plants. Most importantly, the core of Ameresco’s value offering to its customers is focused on reducing their operating cost structure; any public relations win for its customers is purely an incremental bonus.

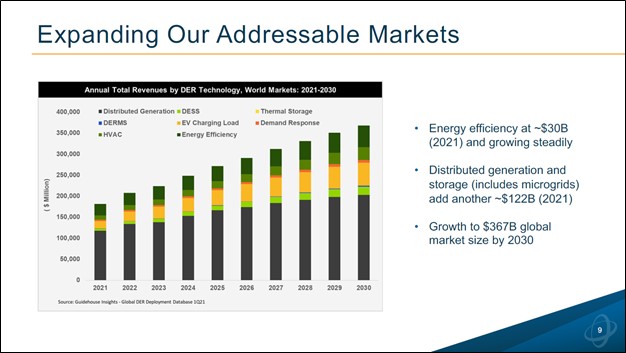

Image Shown: Ameresco is catering to several market opportunities that are in high demand and are expected to grow at a brisk pace over the coming decade. Image Source: Ameresco – August 2021 IR Presentation

Financial Resilience

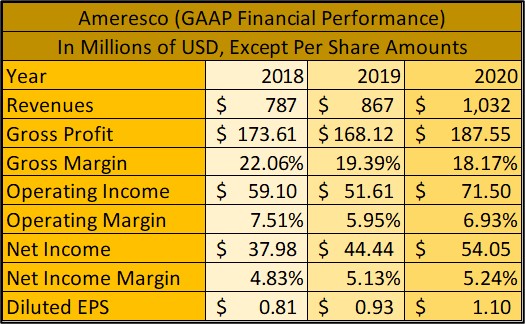

Ameresco has put up tremendous growth over the past several years. The company’s GAAP revenues grew 31% from 2018 to 2020 while its GAAP operating income climbed higher 21% during this period. Please note that Ameresco’s outstanding diluted share count grew by almost 5% during this period due primarily to stock-based compensation and the firm’s preference to invest in the business, as compared to buying back its stock. In the upcoming graphic down below, we highlight Ameresco’s GAAP financial performance from 2018 to 2020.

Image Source: Valuentum, Company Financials

Here, we must stress the improvement in the company’s performance during the 2019 to 2020 period, even in the face of the coronavirus (‘COVID-19’) pandemic. This trend continued into 2021. Ameresco’s GAAP revenues grew 21% year-over-year during the first half of 2021 while its GAAP gross margins expanded by ~115 basis points year-over-year and stood at roughly 19.1% during this period. Within its second quarter 2021 earnings press release, Ameresco’s management noted that (emphasis added):

“We grew our portfolio of operating Energy Assets by 33 megawatt equivalents (‘MWe’) during the quarter, continuing the expansion of this higher margin, recurring revenue business, which provides great long-term visibility. Our Projects business continued to benefit from the ongoing shift to more comprehensive projects that utilize a broad portfolio of advanced clean energy technologies in which Ameresco has substantial expertise providing us a competitive advantage.

We also are gaining traction in our Energy-as-a-Service (‘EaaS’) offering. Our recent EaaS win at Northwestern University highlights the growing interest in these “no up-front capital” solutions that address deferred maintenance, escalating energy costs, resiliency and customer commitments to lowering their carbon footprints. We are all seeing a heightened awareness of the importance of resiliency and sustainability across all markets, and we believe this is not only impacting our business in the short-term, but that it is paving the way for outstanding long-term growth.” --- George Sakellaris, President and CEO of Ameresco

The company’s GAAP operating income rose 77% year-over-year and its GAAP operating margin stood at approximately 7.6% during the first half of 2021, up ~240 basis points year-over-year. While the COVID-19 pandemic created significant noise, we appreciate Ameresco’s enduring resilience and its pivot towards more lucrative offerings with greater visibility given the recurring nature of these revenues (with an eye towards its ‘Energy Assets’ segment). Ameresco’s GAAP diluted EPS grew to $0.48 during the first half of 2021, up from $0.22 during the same period in 2020.

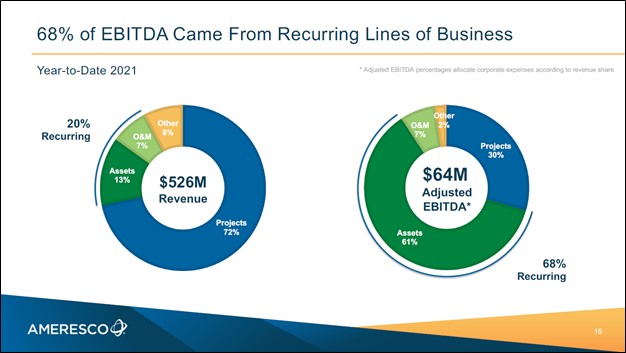

Ameresco’s non-GAAP adjusted EBITDA grew by 42% year-over-year in the second quarter of 2021, reaching over $34 million. As we noted in our previous articles covering Ameresco, the company’s cash flow statement is a messy read due primarily to factors relating to its sizable financing operation, specifically energy savings performance contracts (‘ESPCs’) which interested members can learn more about on the US Department of Energy’s (‘DOE’) website (link here).

In short, ESPCs “allow federal agencies to procure energy savings and facility improvements with no up-front capital costs or special appropriations from Congress. An ESPC is a partnership between an agency and an energy service company (‘ESCO’). Since the inception of U.S. Department of Energy (‘DOE’) indefinite-delivery, indefinite-quantity (‘IDIQ’) ESPCs in 1998, agencies have used the ESPC contracting vehicle since 1998 to significantly reduce energy and operating costs and make progress toward meeting federal sustainability goals” according to the US federal agency’s website. In the UK, Canada and elsewhere, there are different considerations as it relates to economic benefits from the relevant government body or bodies, but the general concept is the same (i.e., government entities increasingly are offering economic incentives to encourage energy efficiency and green energy initiatives). Ameresco is well-versed in this arena.

At the end of June 2021, Ameresco had a net debt position just north of $0.3 billion (inclusive of short-term debt and long-term financing lease liabilities, exclusive of restricted cash), and maintaining access to capital markets is part of its business model. Given the stellar performance of shares of AMRC of late combined with its rock-solid financial performance, we expect Ameresco will retain quality access to capital markets at attractive rates going forward. During the first half of 2021, the firm raised over $0.1 billion through a secondary offering (specifically, Class A common stock).

The company’s near term liquidity needs can be met through its cash on hand ($59 million at the end of June 2021, exclusive of restricted cash) and its senior secured revolving credit line that matures in June 2024. In June 2021, Ameresco’s credit line had its borrowing capacity upsized to $180 million from $115 million, and the facility had $141 million in remaining borrowing capacity at the end of the second quarter. Furthermore, Ameresco noted in its latest 10-Q SEC filing that (financial figures are in thousands of USD):

On July 27, 2021, we entered into a $44,748 non-recourse solar debt financing with a group of lenders. The financing consists of a 25-year 3.25% fixed rate term loan of $40,683, a 9-year $4,065 floating rate term loan and additional funding available of up to $60,000..

Management noted during Ameresco’s second quarter earnings call that “using this [non-resource] facility [mentioned above], we drew down approximately $45 million to finance over 10 solar projects nationwide across multiple customer classes.” We appreciate that Ameresco appears to retain an attractive cost of capital as this will be key to supporting its impressive growth trajectory going forward.

Backlog and Outlook

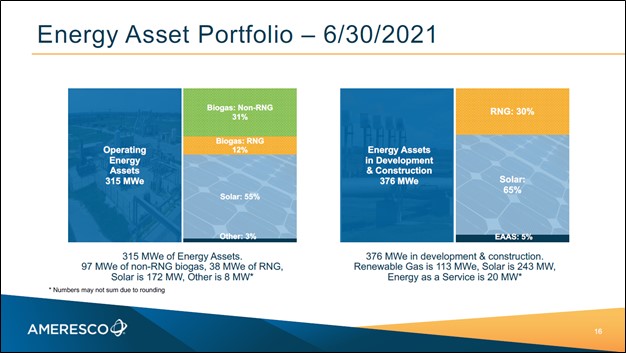

Ameresco had a total project backlog of $2.2 billion at the end of June 2021, represented by $1.4 billion in awarded project backlog and $0.8 billion in contracted project backlog. The company’s operating and maintenance (‘O&M’) revenue backlog stood at $1.1 billion at the end of the second quarter. Ameresco had 376 MWe in ‘Energy Assets’ under development after the firm added 23 MWe gross developments to its assets under development portfolio last quarter, keeping in mind it brought 33 MWe into operation. The company’s ‘Energy Asset Visibility’ is defined as “estimated contracted revenue and incentives throughout PPA [power purchase agreements] term on our operating energy assets” and that figure stood at $1.0 billion at the end of the second quarter.

Please note that the COVID-19 pandemic created sizable headwinds for Ameresco’s ability to grow its backlog, though things are improving on this front. Management noted during the firm’s second quarter earnings call that “we are very pleased to report that we have already converted $98 million of awarded backlog to contracted backlog since the end of the quarter.” Additionally, management noted that “we are continuing to grow our higher-margin recurring revenue businesses, providing us with considerable long-term visibility” which speaks favorably to Ameresco’s cash flow outlook.

Image Shown: Ameresco is focused on growing its recurring revenues streams. Image Source: Ameresco – August 2021 IR Presentation

In August 2021, the US Department of Defense (‘DoD’) announced Ameresco, as part of a broader group, had been “awarded an indefinite-delivery/indefinite-quantity multiple award design-build (‘DB’)/design bid build (‘DBB’) construction contract for large general construction projects located primarily in the Naval Facilities Engineering Systems Command (‘NAVFAC’) Mid-Atlantic area of operations (‘AO’). The maximum dollar value including the base period and four option years for all eight contracts combined is $950,000,000.” Please note that the size of the contract awarded to Ameresco and its economic impacts to the firm going forward were not made readily available. We appreciate that Ameresco continues to win key contracts as the firm continues to extend its already long growth runway.

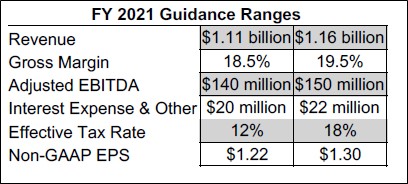

Ameresco provided near term guidance in its second quarter earnings press release. This guidance was the same as the forecast put out during its previous earnings update, though please note Ameresco boosted its guidance during its first quarter update versus the forecast laid out in within its fourth quarter 2020 earnings report.

The company now aims to grow its revenue by 10% and its non-GAAP adjusted EBITDA by 23% in 2021 on a year-over-year basis at the midpoint of its guidance. Ameresco also expects to post non-GAAP adjusted EPS growth of 20% this year at the midpoint of guidance when excluding the impact of certain one-time favorable tax benefits realized last year. During the second half of 2021, Ameresco forecasts that it will bring another 22 MWe-42 MWe of ‘Energy Assets’ online, which will help make this growth story possible.

Image Shown: An overview of Ameresco’s guidance for 2021. Image Source: Ameresco – Second Quarter of 2021 Earnings Press Release

Looking farther ahead, Ameresco aims to commission three renewable natural gas (‘RNG’) plants in 2022 and another four in 2023 according to recent management commentary. Ameresco brought the McCarty Road RNG facility online last quarter which had ~12 MWe of capacity, representing a little over a third of the MWe capacity at its ‘Energy Assets’ that were turned online in the second quarter. As an aside, the company also brought four solar power plants online in the second quarter. RNG facilities are more important than initial glances would first suggest.

Please note that RNG production generates renewable identification numbers (‘RINs’) that enable traditional refineries in the US to maintain compliance with the Renewable Fuel Standards (‘RFS’) program (in short, the RFS aims to boost domestic production of biofuels, such as ethanol). For reference, RINs can be sold to traditional refineries that process crude oil into refined petroleum products (such as gasoline and diesel) that do not produce enough biofuel themselves to fully comply with the RFS program. Additionally, importers of gasoline and diesel also need RINs to comply with the RFS program. Members that are interested in learning more about the RFS program and the economics behind RINs are encouraged to check out this article here that we published back in February 2021.

While many traditional domestic refiners and importers of refined petroleum products have their own US biofuel production operations that generate RINs, generally speaking, those operations do not produce enough RINs to enable those firms to fully comply with the RFS program. The production of RINs at US enterprises that are not traditional refineries and/or importers of gasoline and diesel, and thus do not need to utilize theirs RINs to comply with the RFS program, can sell those RINs at market prices which in turn creates a sizable economic benefit for Ameresco and its partners.

RINs pricing has been strong recently according to recent management commentary from Ameresco and data provided by the US Environmental Protection Agency (‘EPA’). Domestic refined petroleum product demand has aggressively recovered from the worst of the COVID-19 pandemic according to the US Energy Information Administration (‘EIA’), aided by the return of the daily commute and the rebound in domestic air travel.

Ameresco has some exposure to this dynamic as management recently noted “we contract a portion of our anticipated production to support healthy project financing and reduce volatility. The remaining production is sold on a merchant basis, which allows us to take advantage of upside from positive price movements,” regarding Ameresco’s RNG operations and RIN production. This strategy has been working out favorably for Ameresco of late and was cited as a reason for its strong financial performance in the second quarter of this year. Management also noted that Ameresco’s RNG operations benefited from efficiency gains at its facilities during the firm’s latest earnings call.

Image Shown: An overview of the composition of Ameresco’s operational ‘Energy Assets’ portfolio and the various ‘Energy Assets’ assets currently under development. Image Source: Ameresco – August 2021 IR Presentation

Here, we would like to stress again that Ameresco is incredibly well-versed in maximizing the economics of its green energy projects through a combination of rock-solid operational execution and a great understanding of the relevant subsidy and regulatory regimes. Should these regimes change, Ameresco has the prowess required to adapt quickly for the benefit of its customers, its business, and its shareholders.

New Director

In July 2021, Ameresco announced the appointment of Claire Hughes Johnson to its board of directors. She is an independent director with “more than two decades of experience directing product innovation, go-to-market and operational strategy for a range of technology industry leaders;” Johnson currently works as an executive at the fintech firm Stripe and previously worked at Alphabet Inc’s (GOOG) (GOOGL) Google for a decade. Ameresco announced in conjunction with this update that longtime board member and Ameresco co-founder David Anderson was stepping away from the company. We wish both of them the best in their future endeavors.

We are highlighting this news to showcase that Ameresco is refreshing its boardroom and bringing in outside expertise at a crucial time in its business. Having fresh faces in the boardroom can be quite important, and we are big fans of companies that add independent voices to its board of directors as those members can provide input and strategic directives from a new perspective. Furthermore, greater independent director representation at a company’s board of directors helps ensure that the board is better aligned with shareholder priorities over the long haul.

Concluding Thoughts

The economic and investment landscape is changing, and Ameresco is well-positioned to capitalize on the “green energy revolution” and growing interest in environmental, social, and governance (‘ESG’) investing standards. Ameresco’s focus on reducing operating costs for its clients while bolstering their green energy credentials and helping secure financing for the relevant projects underpins the value proposition of the company’s offerings. We continue to be huge fans of Ameresco and are keeping a close eye on the firm as we get ready to launch the inaugural edition of our new ESG Newsletter publication this upcoming September 15 (more on that here).

-----

Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, DOCU, ESTY, UBER, BYND, SFIX, CVNA, TER, GPN, PANW, VRSN, MELI, PRLB, FSLR, JD, CRSP, PINS, NDAQ, FVRR, SNAP, GME, CROX, NOW

Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Utilities (Mid/Small) Industry - AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Related: AMRC, GOOG, GOOGL, XLU

Callum Turcan does not own shares in any of the securities mentioned above. Alphabet Inc Class C shares (GOOG) and Vertex Pharmaceuticals Inc (VRTX) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Republic Services Inc (RSG) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Utilities Select Sector SPDR Fund (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

2 Comments Posted Leave a comment