Visa Reports That Global Spending Levels May Have Started to Stabilize in April

Image Source: DeclanTM

By Callum Turcan

One of our favorite companies and a top-weighted holding in our Best Ideas Newsletter portfolio, Visa Inc (V), reported second-quarter earnings for fiscal 2020 (period ended March 31, 2020) which beat both consensus top- and bottom-line estimates. Going forward, while Visa’s very lucrative travel-related businesses (which includes payment processing and foreign currency transaction solutions) will take a hit from reduced travel worldwide due to the ongoing coronavirus (‘COVID-19’) pandemic, management is focused on controlling expenses to offset exogenous headwinds. Specifically, management noted that Visa would pull back on “discretionary spending especially related to personnel, travel, professional services, and marketing” which we appreciate.

Outlook Commentary

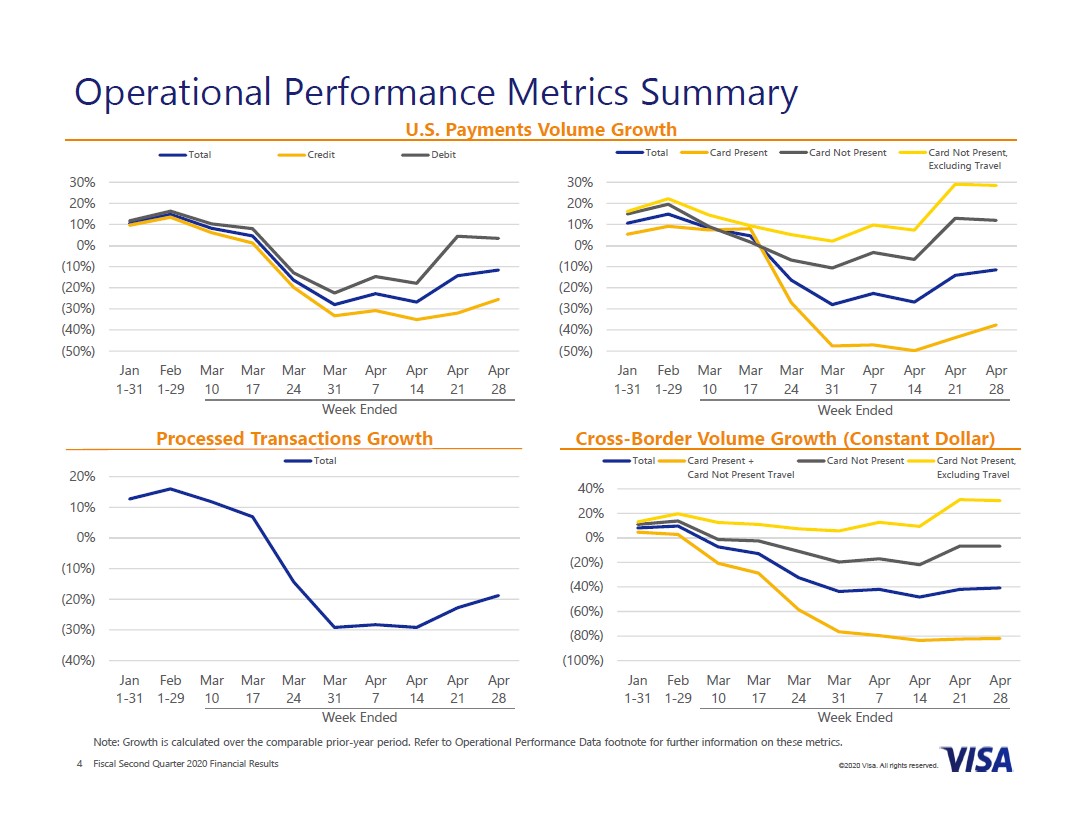

In the fiscal second quarter, Visa reported a 7% increase in its GAAP revenues and a 4% increase in its GAAP net income year-over-year. While cross-border volumes dropped 2% (on a constant-currency basis), that was more than offset by 5% payment volumes growth and 7% payment transactions growth year-over-year. During Visa’s latest quarterly conference call, management mentioned that the firm’s key businesses weren’t negatively impacted by the COVID-19 pandemic until March (with cross-border volumes weakening in February which carried on into March, primarily in Asia). Going forward, Visa’s quarterly performance will take a hit as cross-border volumes (on a constant-currency basis), payment volumes, and processed transactions all started tanking late in the firm’s fiscal second quarter as one can see in the upcoming graphic down below.

Image Shown: As the pandemic spread worldwide, spending levels across Visa’s network dropped substantially which will be reflected in its upcoming quarterly earnings reports. Image Source: Visa – Second Quarter of Fiscal 2020 Earnings IR Presentation

Keeping in mind the outlook for consumer and business spending levels is challenging in the near- to medium-term, this outlook did improve somewhat by April in part due to fiscal stimulus measures in the US propping up purchasing power for various entities (consumers, businesses, healthcare providers, and governmental agencies/entities). The areas benefiting the most from this support in the US, according to Visa’s management team, include retailers that cater to home improvement, business supplies and equipment needs along with healthcare, education, and government-related spending. However, spending on travel, fuel, restaurants, and entertainment-related activities remains heavily depressed in large part due to stay-at-home orders and the “cocooning” of households.

While stay-at-home orders can be lifted over time (various US states are already doing so, though we caution that this runs the risk of a second wave of infections), whether households and consumers continue to spend at similar levels on similar activities in the past remains to be seen. Additionally, over 30 million Americans have filed for unemployment over the past six weeks as of late-April, and that figure will likely continue to grow. Rising unemployment levels will severely weaken consumer spending power, and it will take time for the US economy to recover (and the same holds true globally). On a global basis, here’s what management had to say in regard to the trajectory of spending levels during Visa’s latest quarterly conference call (emphasis added):

“Starting with US payments volume, after strong growth in January and February, payments volumes dropped precipitously in the second half of March as lockdowns went into effect across the US. By the last week of March, payments volumes were declining 28%.

Credit spending was harder hit than debit, and declines have been more than 25% every week in April. On the other hand, debit was down in the mid-teens through the first two weeks of April and spiked into positive territory in both week three and week four as the first wave of economic impact payments were distributed. It is too early to tell if this up trend in the second half of April is a start of a recovery, a new plateau, or will fade in a couple of weeks.

Through April 28, US payments volumes are down 19%, debit is down 6%, and credit is down 31%. As may be expected, there is a drastic difference in card present and card not present performance, with card not present or e-commerce volume excluding travel up 18% in April and card present volume down 45%...

Looking across some key international markets where we process the majority of transactions, major markets in Europe as well as Canada have trends similar to the US, both in terms of the trajectory and the depth of the decline. Australia appears to have weathered lockdown better with a shallower decline. Much like the US, debit in all these markets is outperforming credit, and there has been a pickup in the second half of April.

Within Asia, there are variations. Hong Kong dropped in early February along with the rest of China, and appears to be recovering in April. Singapore dipped early, then stabilized, and has dropped sharply again under more stringent restrictions. Japan is on a downward trend as a lockdown goes into effect. India had a very rigorous and sudden lockdown and experienced one of the fastest and deepest declines. Elsewhere, Brazil is doing relatively better so far.” --- Vasant Prabhu, CFO of Visa

Please keep in mind that the trajectory of global spending levels could revert and start shifting lower once again, as Visa’s management team noted that it wasn’t clear in certain markets (like the US) whether spending levels would continue recovering after the bump from fiscal stimulus efforts (such as direct deposits into certain US consumer’s bank accounts) fades. We intend to continue monitoring this space and will keep our members informed of how global spending activity is planning out going forward. E-commerce remains a bright spot as households increasingly turn to ordering goods online, especially food.

With that in mind, management noted that about one-fifth of Visa’s US payment volumes come from purchases at food and drug stores during the company’s latest quarterly conference call. Spending at this segment was up by ~20% year-over-year in April and “essentially all the growth is coming from online spending” meaning that major retailers with strong digital/online presences appear to be better positioned than others to ride out the storm. Amazon Inc (AMZN) and Walmart Inc (WMT) are good examples of this dynamic in action.

Financial Strength Maintained

One of the reasons why we like Visa is due to its strong balance sheet and high-quality cash flow profile. At the end of March 2020, the firm carried $9.7 billion in cash and cash equivalents along with $2.4 billion in short-term investment securities and $1.1 billion in long-term investment securities versus $4.0 billion in short-term debt and $13.9 billion in long-term debt.

Visa generated $5.3 billion in net operating cash flow and spent $0.4 billion on its capital expenditures during the first half of fiscal 2020, allowing for $4.9 billion in free cash flow which fully covered $1.3 billion in dividend payments. However, the company also spent $5.5 billion repurchasing its Class A common stock during the first half of fiscal 2020, which was partially funded by the balance sheet.

Please note Visa tapped debt markets in the fiscal third quarter of 2020 to bolster its liquidity position and take advantage of low interest rates. According to the firm’s 8-K filing, the firm sold $1.5 billion in 1.900% Senior Notes due 2027, $1.5 billion in 2.050% Senior Notes due 2030, and $1.0 billion in 2.700% Senior Notes due 2040 which were issued out on April 2, 2020. We appreciate Visa’s access to debt markets at very attractive rates. Furthermore, its $5.0 billion unsecured revolving credit line that matures in July 2024 offers Visa additional access to liquidity as needed.

Here’s what management had to say about the firm’s financial trajectory and outlook during Visa’s latest quarterly conference call (emphasis added):

“Moving on to cash flow, liquidity, dividends, and buybacks, our free cash flow in the first half of fiscal year 2020 has been tracking ahead of expectation. However, given the anticipated revenue decline in the second half, our free cash flow this fiscal year will be below what we had planned last October. Despite the COVID-19 impact, given the cash characteristics of our business, we still expect to generate a very healthy level of free cash flow this year under any scenario.

We ended the quarter with $13 billion of cash, cash equivalents, and investment securities on hand. Since the end of the quarter, we have added to our cash balance with our $4 billion debt issuance. We issued debt in three tranches, 7-, 10-, and 20-year maturities at a weighted average coupon rate of 2.16%. We have ample liquidity with cash on hand as well as access to the commercial paper market on favorable terms and a $5 billion revolver which remains undrawn.

Our dividend policy remains unchanged.In the second quarter, we bought back 17.8 million shares for $3.2 billion at an average price of $180.10. Year to date, we have bought back 30.9 million shares for $5.6 billion at an average price of $179.94. Our plan to buy back over $9 billion in stock this fiscal year remains unchanged.” --- Vasant Prabhu, CFO of Visa

Given that our fair value estimate for shares of Visa stands at $190 per share (well above where shares of V are trading at as of this writing), repurchasing stock (as long as it doesn’t stress the firm’s financial status or place the company on an unsustainable financial trajectory) is a good use of capital. The company’s free cash flows will take a hit this fiscal year, but management appears confident that Visa will continue to be very free cash flow positive in any scenario. Visa carries very low, relatively speaking, capital expenditure requirements meaning that the firm needs to only make modest capital expenditure investments to generate massive net operating cash flows.

In Visa’s second quarter of fiscal 2020, the diluted outstanding share count of Class A common stock fell by over 2% year-over-year. That helped grow its GAAP diluted EPS by over 5% year-over-year (management reported a 6% year-over-year growth rate apparently due to a few rounding considerations), which reached $1.38 last fiscal quarter (from $1.31 in the second quarter of fiscal 2019).

Visa is in the process of acquiring Plaid, a financial tech company that allows mobile apps to connect and communicate with banking institutions. When the deal closes, assuming it does, Visa will pay $4.9 billion in cash and $0.4 billion in retention equity and deferred equity consideration. We covered the news back on January 15 through this article here. In that note, we had this to say:

Plaid’s customers include firms such as Acorns (specializes in micro-investing and robo-investing), Betterment (an online investment company based), Chime (an online bank), TransferWise (a British online money transfer service), and the widely-popular mobile payment service Venmo, owned by now top weighted Best Ideas Newsletter portfolio holding PayPal Holdings Inc (PYPL). Generally speaking, these start-ups and subsidiaries are experiencing high levels of growth given the rising popularity of less traditional banking and investing institutions. Here’s a key excerpt from the press release (please note some of the upcoming data that’s cited by Visa comes from the multinational consultancy and professional services firm Ernst and Young):

Connectivity between financial institutions and developers has become increasingly important to facilitate consumers’ ability to use fintech applications. 75 percent of the world's internet-enabled consumers used a fintech application to initiate money movement in 2019 versus 18 percent in 20151. Plaid has been a leader in enabling this connectivity at scale. Today, one in four people with a U.S. bank account have used Plaid to connect to more than 2,600 fintech developers across more than 11,000 financial institutions…

1 Source: https://www.ey.com/en_us/ey-global-fintech-adoption-index

We continue to like the deal and see the move favorably augmenting Visa’s long-term growth outlook. The aforementioned debt issuance was likely to ensure Visa would retain its solid liquidity position after closing this deal, which is expected to close by the end of Visa’s fiscal 2020.

Concluding Thoughts

Visa’s near-term outlook is contending with serious exogenous headwinds, but its long-term growth trajectory remains bright. The company is reporting that there are signs spending levels started to stabilize worldwide in April, and major fiscal stimulus measures announced around the world combined with Visa’s ability to continue reducing its outstanding share count in a sustainable manner (given its very strong free cash flows) will improve Visa’s outlook over time. We continue to like Visa as a top-weighted holding in the Best Ideas Newsletter portfolio, and shares of V yield a modest ~0.7% as of this writing (offering incremental upside to its material capital appreciate upside).

-----

Financial Tech Services Industry – MA MELI PYPL VRSK V

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: AMZN, IYG, IPAY, IYF

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment