Risk Management: Diversified Stock Selection or Modern Portfolio Theory?

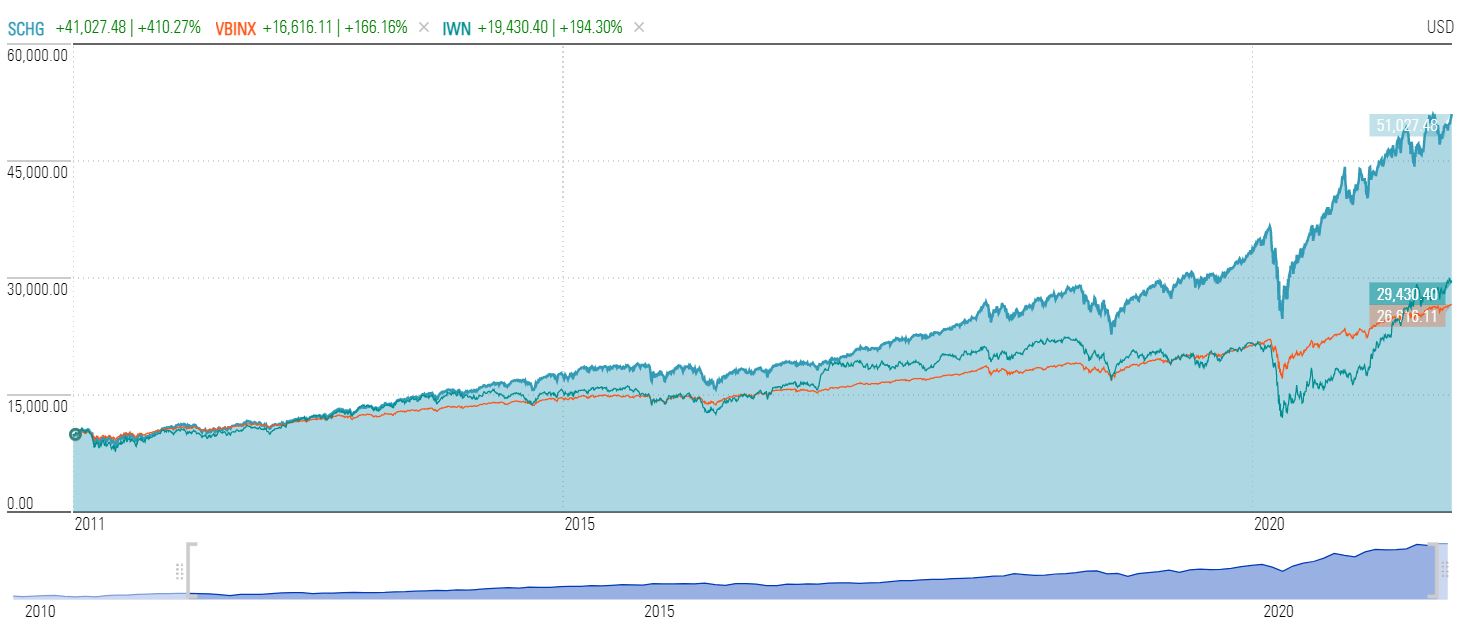

Image Shown: If one had concentrated in large cap growth the past 10 years (blue fill), or basically in undervalued stocks that had strong momentum, one would have outperformed the category of small cap value (IWN, second best in chart) and the 60/40 stock/bond portfolio (VBINX, orange) by an incredible 200+ percentage points. Image Source: Morningstar.

By Brian Nelson, CFA

I hosted a small estate sale late last week. Hours in the blistering sun brought a number of interested buyers and some small change, but that several people and families found use for my brother’s things has left a feeling in me that’s priceless.

It’s been a while since one of our emails hit your inbox, but things have been slow in the markets. Many of you asked about Vertex Pharma (VRTX) late last week, and our team wrote up our thoughts on its latest developments here.

There were also a few questions about how to think about fair value estimates and how to play Bitcoin/blockchain, and I addressed them in the June Best Ideas Newsletter, but that article can also be found here.

When I trained stock analysts at Morningstar, I always used to say that, while it’s important to do the number crunching and analysis, it’s even more important to make some time for deep thinking. The estate sale offered just that for me.

I then ran the numbers.

If one had concentrated in large cap growth the past 10 years, or basically in undervalued stocks that had strong momentum, one would have outperformed the category of small cap value (IWN) and the 60/40 stock/bond portfolio (VBINX) by an incredible 200+ percentage points (see image above).

Most of the financial industry continues to think “inside the box” of modern portfolio theory (MPT), trying to smooth volatility, and it has cost investors greatly. The $64 billion Pennsylvania pension fund is even under attack because it missed out on the huge bull market in U.S. stocks.

Stock selection is key, but stock exposure is paramount.

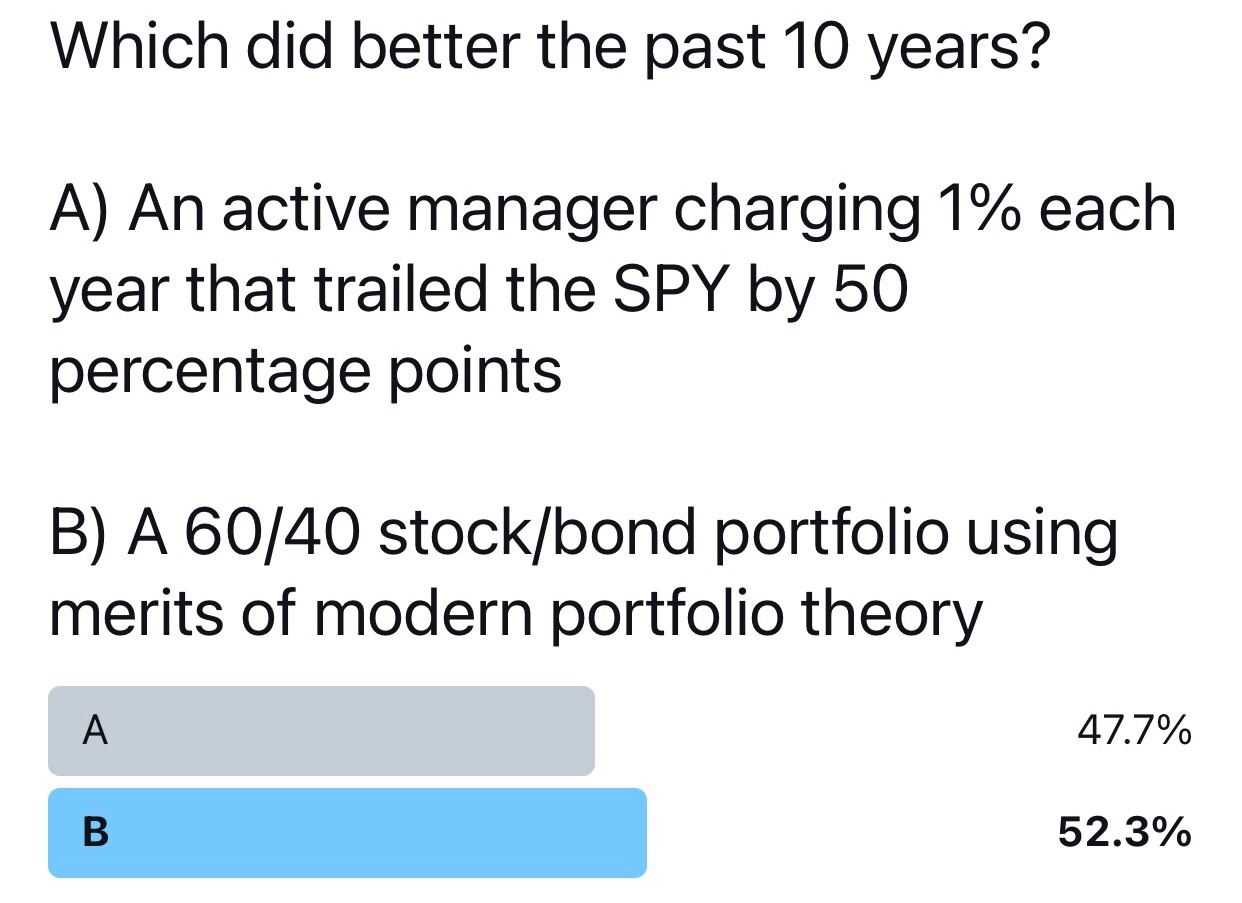

It wasn’t until recently that I found out how many investors are getting lured into the marketing narrative behind MPT without asking the tough questions. Last week, I ran a survey asking whether an active manager charging 1% each year that trailed the S&P 500 by 50 percentage points during the past 10 years did better than a 60/40 stock/bond portfolio using the merits of modern portfolio theory.

To my disbelief, the majority thought the latter did better. 52.3% of respondents!

Image Shown: Many investors are not aware of how well diversified stock selection has done compared to modern portfolio theory during the past 10 years. 88 votes.

According to data from Morningstar, the S&P 500 SPDR (SPY) has outperformed the Vanguard Balanced Index Inv (VBINX) by over 130 percentage points the past 10 years. That leaves a lot of room for active management fees and underperformance.

The financial industry seems to be too busy promoting index funds and over-benchmarking with “holdings-based” analysis than to look at the big picture. Here’s the bottom line: Diversified stock selection has been absolutely phenomenal for investors the past 10 years, and it has been a far better risk management tool than asset allocation rebalancing.

This one should hit home. Investors that had invested $100,000 in S&P 500 stocks during the past 10 years could have pulled out their entire $100,000 original investment today, and they still would have more money in the market than the 60/40 stock/bond portfolio (~$30,000 more).

Solid results from the 60/40 stock/bond portfolio? No way.

Of course, nobody can predict the future volatility of any portfolio with any sort of precision--whether a diversified one with S&P 500 companies or an indexed and rebalanced 60/40 stock/bond portfolio--but the reality is that most of the volatility of stocks versus the 60/40 stock/bond portfolio the past 10 years has been of the upside variety.

Volatility has always been a terrible measure of risk in that regard. It’s an imperfection of quant analysis that has left a path of financial devastation across investor portfolios. What’s worse is the investors, themselves, don’t know just how much they are trailing diversified stock selection strategies.

Here’s perhaps the biggest takeaway: Even if you were a terrible stock picker and trailed the S&P 500 by over 100 percentage points the past 10 years, one would still have done better than the widely acclaimed 60/40 stock bond portfolio that most advisors put to use (and this, before fees).

Instead of providing you with this great information, however, the financial industry instead warns you against stock selection, timing the market, and/or trying to outperform. You don't have to be a great stock picker. To do better than most in the financial industry, it seems you can pretty much be one of the worst stock pickers out there!!!

I believe that we can all make the financial industry a better place for investors, but it starts with sincerity and evaluating portfolios through an objective lens such as the S&P 500 and not over-benchmarking so the results fit some quant narrative that may not even be valid. There are many definitions of risk out there, and volatility may be the worst one.

With all this said, the S&P 500 recently notched a new high this week, and we continue to be bullish on the stock market for the long run. Thank you for giving our team a chance to offer up a new perspective on the very tired narrative that has become quant research, from the failed "value" factor to modern portfolio theory and beyond. Stocks for the long run.

Yours sincerely!

-----

The Best Ideas Newsletter portfolio >>

The Dividend Growth Newsletter portfolio >>

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson's household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment