Realty Income Signals Turbulence Ahead, Shores Up Liquidity Position

Image Source: Realty Income Corporation – First Quarter of 2020 Earnings IR Presentation

By Callum Turcan

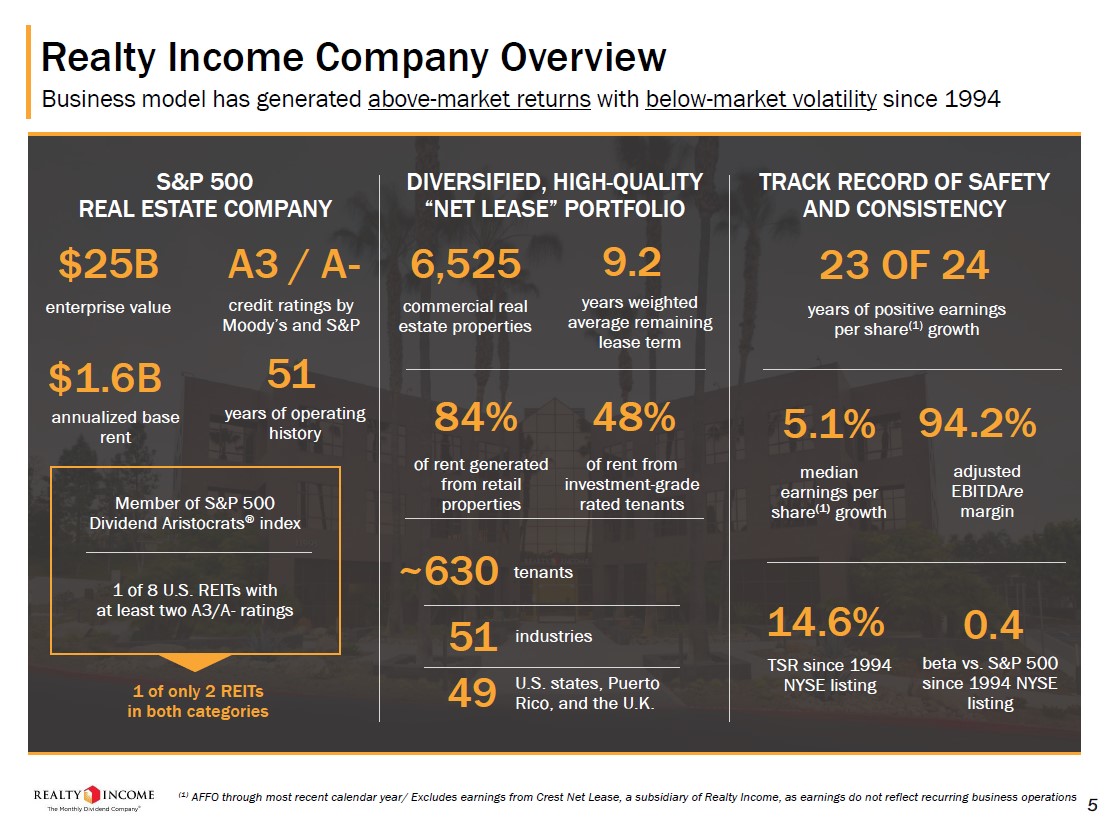

On May 4, the real estate investment trust (‘REIT’) Realty Income Corporation (O) posted first-quarter 2020 earnings that saw its adjusted funds from operations (‘AFFO’) per share jump by over 7% year-over-year, hitting $0.78 last quarter. Realty Income pays out a monthly dividend, and shares of O yield ~5.1% as of this writing. We like the REIT’s business model, which invests in single-tenant commercial properties, and we view Realty Income as well-positioned to ride out the ongoing coronavirus (‘COVID-19’) pandemic. However, we caution that its near-term financial performance will come under fire from some of its tenants no longer being able to (or willing to) pay rent due in part to the economic downturn.

As roughly half of its tenants carry investment-grade credit ratings, Realty Income is in a better position than some of its peers. Most of Realty Income’s tenants have continued to pay rent during the pandemic, at least during the early stages of the crisis, and the REIT is working with its troubled tenants to find a solution that suites the interests of both parties.

Financial Update

Most REITs, including Realty Income, invest heavily in growing their asset base by utilizing a combination of internally generated cash flows and externally generated funds via equity and debt issuances. Realty Income generated $0.2 billion in negative free cash flow last quarter, and spent another $0.2 billion on its common dividend obligations.

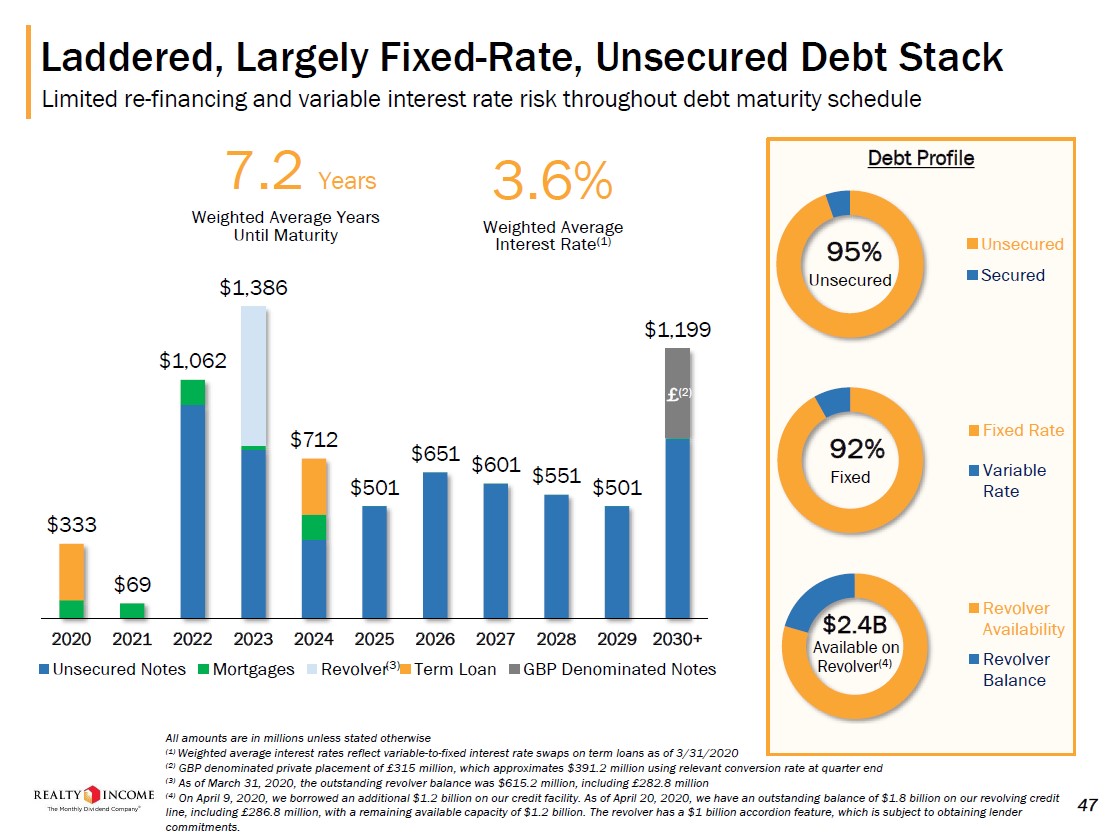

As a capital-market dependent entity, Realty Income must retain access to debt and equity markets at (ideally) attractive rates at all times. On May 6, Realty Income announced that it was issuing out $600 million in 3.25% senior unsecured notes that mature in January 2031, which was priced at 98.987% of par for an effective yield to mature of 3.364%. Those proceeds will likely be used to retire its $250 million term loan that matures in June 2020, along with paying down outstanding borrowings on its revolving credit line and for other general corporate purposes.

This news indicates that Realty Income continues to possess access to debt markets at attractive rates, which we appreciate. Please keep in mind Realty Income carries high quality investment grade credit ratings (A3/A-) and is one of only a handful of REITs that carries A-rated credit ratings.

Realty Income noted that as of May 1, the REIT retained $1.1 billion in borrowing capacity under its $3.0 billion revolving credit line (which matures in March 2023) and ~$1.2 billion in cash on hand, according to its latest earnings press release. That, combined with its recent debt issuance, should provide Realty Income with ample liquidity and access to liquidity to ride out the pandemic. In April 2020, Realty Income drew down a large portion of its revolving credit line to bolster its liquidity position as the REIT prepared itself for temporary but material volatility in its financial performance.

Additionally, Realty Income redeemed all of its $0.25 billion in outstanding 5.750% Notes due January 2021 during the first quarter of 2020 to further improve its liquidity position. The REIT raised $0.75 billion though equity issuances last quarter (at an average price of $77.37 per share). While Realty Income’s share price has dropped since then, the REIT still maintains access to equity markets if needed.

Considering Realty Income’s recent financing decisions and its staggered debt maturity schedule, as depicted in the upcoming graphic down below, the REIT should be able to continue making good on its dividend obligations while also possessing the funds needed to refinance upcoming debt maturities and invest in the business (though we think slowing down its growth trajectory would be prudent given the ongoing crisis around the world).

Image Shown: Realty Income has the funds to refinance its 2020 and 2021 debt maturities without ruining its liquidity position. Image Source: Realty Income – First Quarter of 2020 Earnings IR Presentation

International Push Continues

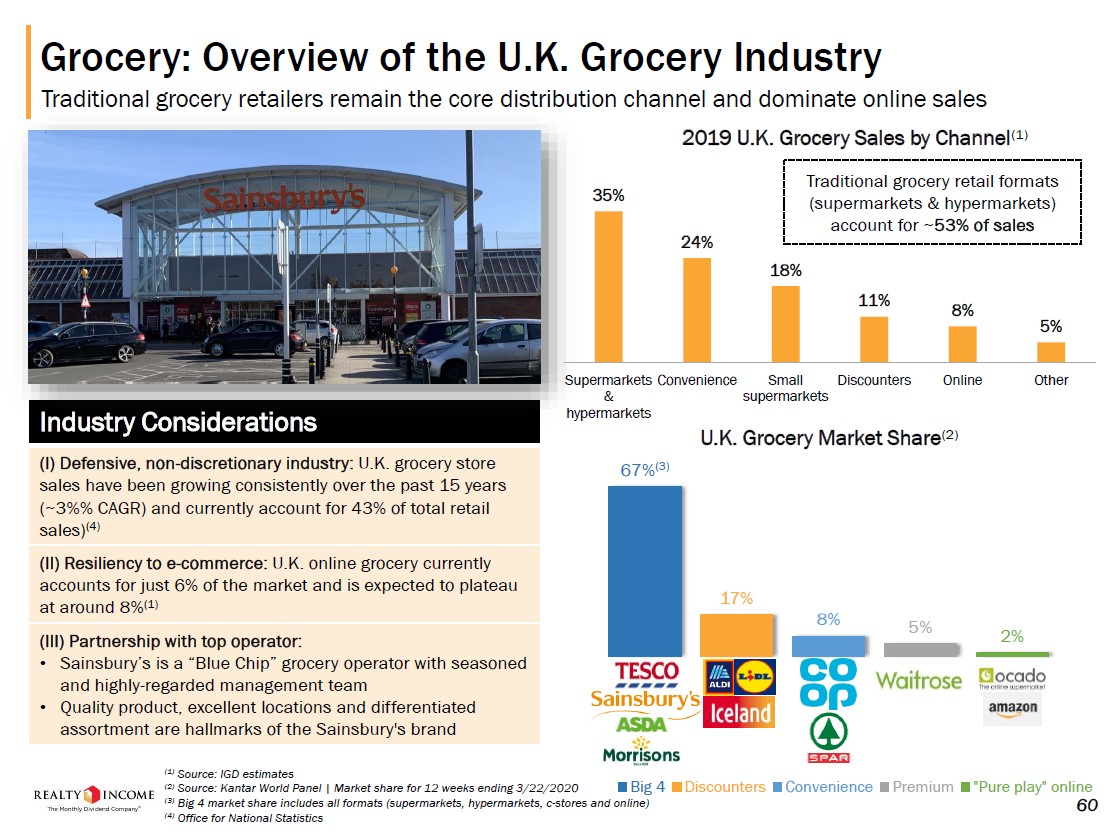

We’ve covered Realty Income’s push into international markets in the past, specifically in the UK, and we will highlight that the REIT continued to grow its UK presence last quarter by acquiring four additional properties for approximately USD$166 million. While we are living through challenging times at the moment, over the long haul, having another country to expand in that has similar characteristics to the US in terms of the business environment and culture will favorably augment Realty Income’s growth runway. During Realty Income’s latest quarterly conference call, the REIT mentioned that one of its new tenants in the UK was an investment grade pharmaceutical company with the property located in an industrial hub.

Realty Income alluded to wanting to push into the UK’s grocery market and included the below slide in its earnings presentation covering its first quarter of 2020 performance. In particular, the REIT appears to be focusing on supermarkets, convenience stores, and grocery stores in terms of new commercial property acquisition opportunities in the UK.

Image Shown: Realty Income appears to be considering pushing deeper into the UK commercial property market by acquiring properties that cater to grocery stores, convenience stores, supermarkets, and similar entities/operations. Image Source: Realty Income – First Quarter of 2020 Earnings IR Presentation

Operational Update

Realty Income hasn’t been immune to the ongoing pandemic. Though the REIT’s occupancy rate stood at 98.5% at the end of March 2020, Realty Income’s rental revenues came under pressure in April as stay-at-home orders and the negative impact the pandemic is having on consumer spending and business investment levels prompted some of the REIT’s tenants to not pay rent. Here’s a quote from management from Realty Income’s first quarter earnings press release (emphasis added):

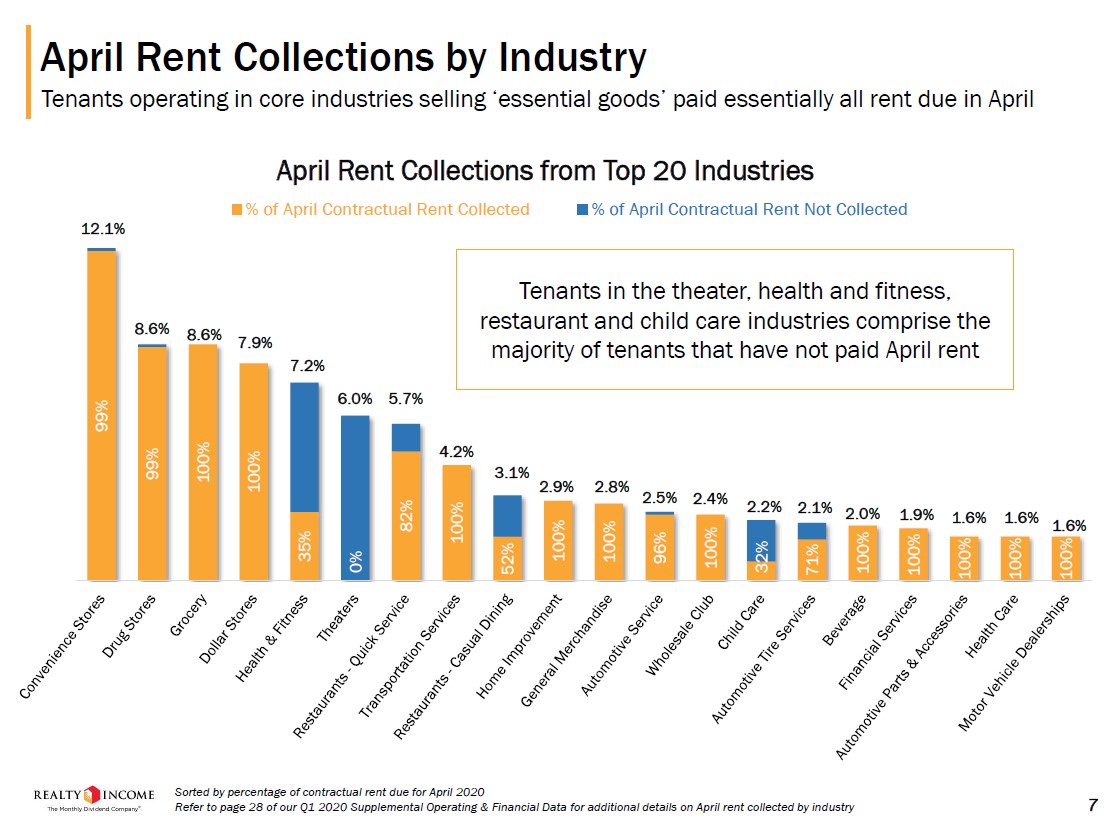

“We have constructed our real estate portfolio, the majority of which is leased to leading national or multi-national operators, with a focus on economic resiliency. In April 2020, we collected approximately 83% of expected contractual rent, with substantially all the non-collected rent attributed to tenants in the theater, health and fitness, restaurant and child care industries, each of which have been disproportionately impacted by government-mandated closures. We will continue to partner with our tenants to achieve mutually beneficial outcomes during these challenging circumstances and remain committed to creating long-term value for our shareholders.” --- Sumit Roy, CEO of Realty Income

Those that didn’t pay rent were primarily tenants whose operations were hit the hardest, both operational and financially, from the pandemic according to Realty Income’s management team. Additionally, management noted that the REIT may see some more of its automotive services tenants seek rent relief in May, as highlighted during Realty Income’s latest quarterly conference call.

Its tenants operating in other sectors and industries appeared to continue paying in a timely fashion, a dynamic aided by Realty Income’s exposure to grocery stores (~5% of annualized revenues at the end of March 2020), dollar stores (~8% of annualized revenues), drug stores (~9% of annualized revenues), and convenience stores (~12 of annualized revenues), venues that remain in high demand. In the upcoming graphic down below, Realty Income provides an overview of which type of tenants paid rent and which type of tenants were unable or unwilling to pay rent in April 2020.

Image Shown: Realty Income collected rent from most of its tenants in April, however, many or all of its theater, health & fitness, restaurants, and child care tenants did not pay rent that month. Image Source: Realty Income – First Quarter of 2020 Earnings IR Presentation

Management noted that Realty Income was in the process of negotiating with troubled tenants and additionally, that virtually all of the REIT’s investment-grade rated tenants paid rent in April. While the near-term situation remains highly fluid and the liquidity position for some of its tenants has likely deteriorated somewhat, Realty Income appears to be in a position to continue generating rental revenues on the vast majority of its properties.

Concluding Thoughts

Realty Income possesses the financial strength to ride out the storm, though its near-term financials will come under pressure from the ongoing pandemic as some of its tenants have stopped paying rent. We will continue monitoring the space going forward, and for now, we see Realty Income being able to continue meeting its monthly dividend obligations. This may change in a hurry, however.

-----

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: VNQ, SCHH, SRVR, SPY, RTL, NETL

Other: ADC, SITC, UE, VER, STOR, NNN, SRC, KIM, SKT, MAC, EPR, WSR, BRX

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Real Estate ETF (VNQ) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust and Vanguard Real Estate ETF are also both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment