Procter & Gamble Remains a Great Free Cash Flow Generator

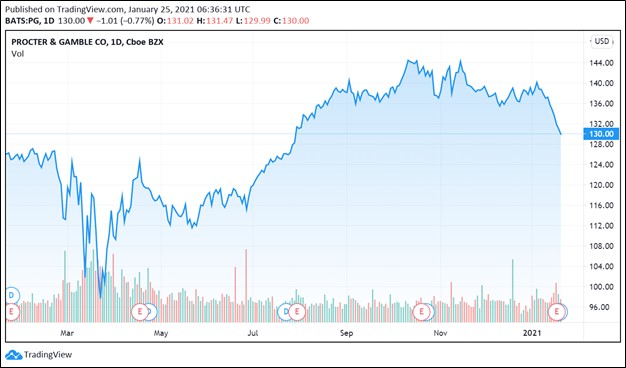

Image Shown: Shares of Procter & Gamble Co have started to shift back down towards the top end of our fair value estimate which sits at $120 per share of PG. In our view, investors have begun to factor in expectations that the firm’s growth rate of late will be incredibly hard to sustain over the coming years. Procter & Gamble is a solid company with great free cash flow generating abilities, but the run up in its share price during the second half of the 2020 calendar year was a tad overdone, in our view.

By Callum Turcan

On January 20, Procter & Gamble Co (PG) reported solid earnings for the second quarter of fiscal 2021 (period ended December 31, 2020) as its GAAP revenues grew by 8% year-over-year while its GAAP operating income climbed higher by 20%, aided by economies of scale and GAAP gross margin expansion. The company reported strong organic sales growth across all of its core product categories, with its ‘Fabric & Home Care’ and ‘Health Care’ products leading the way. Pricing strength combined with organic volume growth and a favorable product mix played a big role in boosting Procter & Gamble’s margins. It appears consumers are willing to pay up for its products, which tend to be the more expensive items in supermarkets, grocery stores, convenience stores, and similar venues.

Outlook

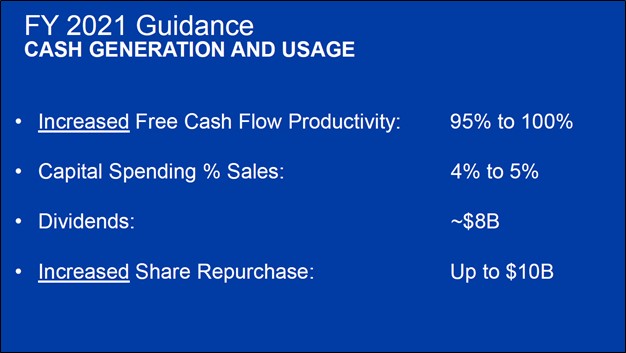

Looking ahead, Procter & Gamble increased its guidance for fiscal 2021. P&G forecasts it will post annual sales growth (on both a net and organic basis) of 5%-6% and annual diluted EPS growth of 8%-10% this fiscal year, underpinned by its strong performance during the first half of fiscal 2021. Procter & Gamble also boosted its free cash flow guidance and planned share buybacks for fiscal 2021. Management had this to say during the firm’s latest earnings call (moderately edited, emphasis added):

“…[W]e're further increasing our fiscal year guidance for organic sales growth, core earnings per share growth, adjusted free cash flow productivity and cash return to shareowners… The outlook assumes a quarter-to-quarter step-down in the second half as retail inventories are fully replenished and as category consumption levels moderate. We saw a sequential deceleration in U.S. consumption in our categories in December and January. These trends are incorporated into our new higher guidance range…

We will continue our long track record of significant cash generation and cash return to shareowners. We're raising our target for adjusted free cash flow productivity… to a range of 95% to 100%. We continue to expect to pay approximately $8 billion in dividends and are further increasing our outlook on share repurchase… up to $10 billion. Combined, a plan to return around $18 billion of cash to shareowners this fiscal year, over 125% of all-in earnings.” --- Jon Moeller, CFO of Procter & Gamble

However, investors might have concerns about whether Procter & Gamble will be able to maintain its recent pace of growth over the long haul. Elevated unemployment rates in the US and the drag that would normally have on consumer spending power is being offset by massive fiscal stimulus efforts. While there is a good chance additional fiscal stimulus packages will get signed into law in the coming quarters to counter headwinds created by the coronavirus (‘COVID-19’) pandemic, Procter & Gamble is already reporting that its domestic sales growth is starting to slow down. Fiscal stimulus efforts will eventually end, and pandemic-induced stockpiling will eventually fade.

Image Shown: An overview of Procter & Gamble’s guidance for fiscal 2021. Image Source: Procter & Gamble – Second Quarter of Fiscal 2021 Earnings IR Presentation

Financial Update

At the end of 2020, Procter & Gamble had $11.9 billion in cash and cash equivalents on the books versus $8.6 billion in short-term debt and $22.5 billion in long-term debt. Considering Procter & Gamble generated $8.7 billion in free cash flow during the first half of 2021, we view its net debt burden as manageable. We caution that Procter & Gamble intends to aggressively buy back its stock going forward, however.

During the first half of fiscal 2021, the firm spent $4.1 billion covering its dividend obligations and another $5.0 billion buying back its stock. According to guidance from management, Procter & Gamble intends to spend another $5.0 billion buying back its stock during the second half of fiscal 2021. In our view, Procter & Gamble would be better served paying down debt instead of repurchasing its shares.

Shares of Procter & Gamble are starting to shift back down towards the top end of our fair value estimate range, which sits at $120 per share. Procter & Gamble is a solid company, though we would like to stress that most of the value of equities comes from the mid-cycle and perpetuity part of the business phase (Year 6+). Elevated growth rates that are ephemeral, generally speaking, do not have as large of an impact on a company’s intrinsic value compared to sustained increases in the firm’s growth rate. As Procter & Gamble’s growth rates of late are unlikely to be sustained over the coming fiscal years, particularly for its organic sales growth, investors appear to be recalibrating their models to take that into consideration.

Concluding Thoughts

We love the company, but we're not interested in Procter & Gamble's shares at this time on the basis of valuation. Readers looking for exposure to the consumer staples arena may look to consider more diversified offerings. For example, the High Yield Dividend Newsletter portfolio (more here) includes the Vanguard Consumer Staples Index Fund (VDC) which has a 30-day SEC yield of ~2.4% as of this writing. Procter & Gamble is included the in VDC as a top-weighted holding.

Shares of PG yield ~2.4% as of this writing, and we view its forward-looking dividend coverage favorably as Procter & Gamble’s Dividend Cushion ratio sits at 1.8, earning the firm a “GOOD” Dividend Safety rating. These metrics incorporate our expectations that Procter & Gamble will push through meaningful dividend increases going forward. Using its strong free cash flows to pay down debt, instead of buying back its stock, would be a wise move, in our view.

More info on the High Yield Dividend Newsletter >>

-----

Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY

Related: VDC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.