Image Source: Procter & Gamble

By Brian Nelson, CFA

Procter & Gamble (PG) reported better than expected second quarter results for fiscal 2025 on January 22, with revenue and non-GAAP earnings per share coming in ahead of the consensus forecasts. Net sales increased 2% in the quarter, while organic sales, which excludes M&A and foreign exchange impacts, advanced 3%. Organic sales growth was led by its “Baby, Feminine, and Family Care” unit, where organic sales increased 4%. Organic sales growth in its “Beauty” and “Grooming” segments was 2%, while organic sales in its “Health Care” and “Fabric & Home Care” divisions increased 3%. Core earnings per share were $1.88, an increase of 2% compared to the year-ago period.

Management had the following to say about the quarter:

The P&G team delivered an acceleration in organic sales growth, core EPS growth and strong cash return to shareowners in the second quarter. Our first-half results keep us on track to deliver within our guidance ranges on all key financial metrics for the fiscal year. We remain committed to our integrated growth strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organization. This strategy has enabled our solid results and is a foundation for balanced growth and value creation.

For the six months ended December 31, cash flow from operations came in at $9.13 billion, while capital spending was $1.92 billion, resulting in free cash flow generation of $7.21 billion, which handily covered cash dividends paid to shareholders of $4.9 billion over the same time period. At the end of the calendar year, P&G had $10.2 billion in cash and cash equivalents and $34.7 billion in short- and long-term debt.

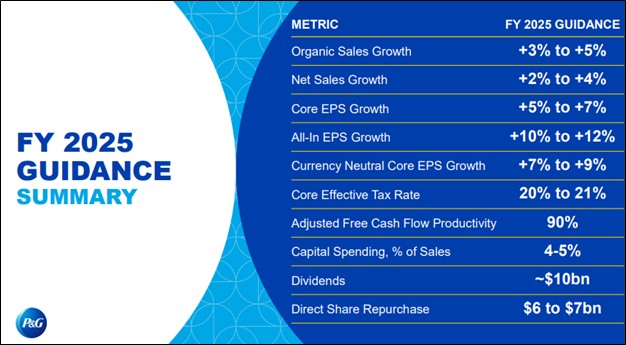

Looking to fiscal 2025 guidance, all-in sales growth is expected in the range of 2%-4% versus the prior year. Organic growth for the fiscal year is targeted in the range of 3%-5%. P&G reiterated its core earnings per share growth for the fiscal year to be in the range of 5%-7%, equating to a range of $6.91-$7.05, or a 6% increase at the midpoint. In fiscal 2025, P&G expects to pay around $10 billion in dividends and repurchase $6-$7 billion of common shares. At the time of this writing, shares of P&G yield ~2.5%.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.