Our Thoughts on Magellan Midstream’s Latest Earnings

Image Shown: Keeping the many headwinds facing the energy infrastructure space in mind, Magellan Midstream Partners LP remains one of our favorite midstream master limited partnerships. Image Source: Magellan Midstream Partners LP – October 2020 IR Presentation

By Callum Turcan

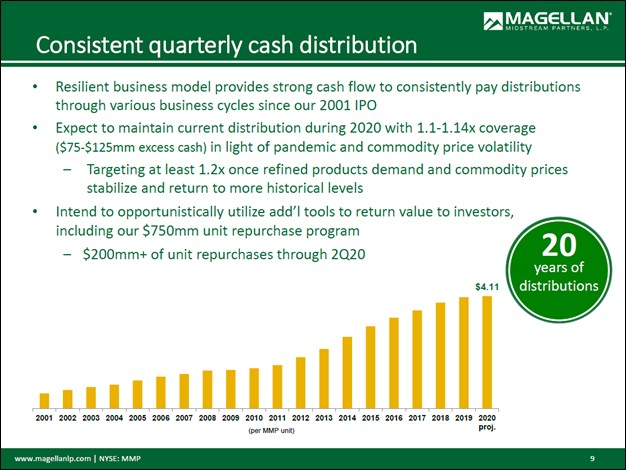

On October 30, Magellan Midstream Partners LP (MMP) reported third quarter 2020 earnings that beat both top- and bottom-line consensus estimates. The midstream master limited partnership (‘MLP’) space has faced enormous headwinds due to the ongoing coronavirus (‘COVID-19’) pandemic, though the firm was still able to generate sizable free cash flows during the first nine months of 2020. Magellan Midstream is a modestly-weighted holding in the High Yield Dividend Newsletter portfolio, and as of this writing, units of MMP yield ~11.1%. Though that yield is quite high, given that the firm’s free cash flows should grow significantly going forward, we are optimistic the firm will be able to continue making good on its payout obligations for the time being.

Cash Flow Update

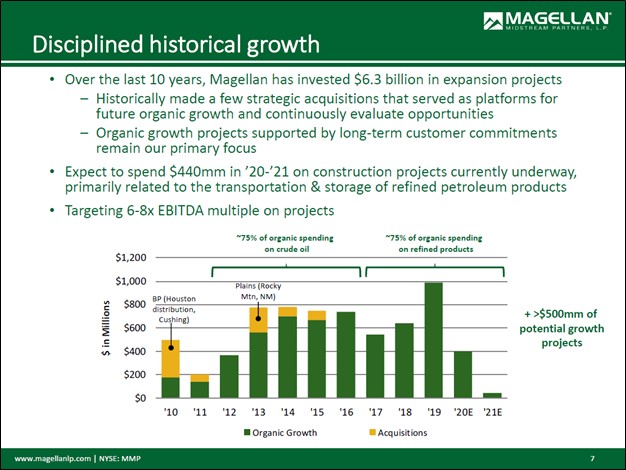

Magellan Midstream generated almost $0.5 billion in free cash flows during the first nine months of 2020, up from $0.2 billion in the same period in 2019. That increase was largely due to a sharp decline in Magellan Midstream’s capital expenditures. While that did not fully cover $0.7 billion in ‘distributions paid’ during the first nine months of 2020, please note Magellan Midstream’s capital expenditures are expected to continue shifting materially lower over the coming years as the firm lets growth-related spend roll off.

However, should the midstream MLP approve new major projects in the future, its capital expenditure expectations would increase, though management has communicated in the recent past that the days of large growth investments are over. Management had this to say during the firm’s latest earnings call (emphasis added):

“Our current expansion spending estimates for approved projects are $400 million this year, with $310 million of that already spent through September 30 and $40 million in 2021. We continue to evaluate several attractive, relatively smaller potential growth projects that may be approved in the near term. But to be clear, we anticipate significantly reduced capital spending programs over the next few years. For instance, if we include these potential projects that may be approved in the near term, we would expect the actual 2021 growth spending likely to be in the range of $100 million.” --- Michael Mears, Chairman of the Board, President and CEO of the General Partner

The upcoming graphic down below highlights the expected downward shift in Magellan Midstreams’ capital expenditures. What makes this so important is that the midstream MLP could finally be in a position to generate meaningful free cash flows after a decade of making major growth investments. Please note that Magellan Midstream will need to invest enough it maintenance-related capital expenditures to preserve the functionality of its asset base, though those capital expenditures are much more modest in nature (the midstream MLP forecasts its 2020 capital expenditures will come in at ~$95 million, compared to ~$400 million in forecasted growth-related capital expenditures in 2020).

Image Shown: Magellan Midstream’s capital expenditures are expected to slide meaningful lower going forward. However, the midstream MLP may approve additional growth-oriented projects which in turn would raise its future capital expenditure expectations, though off a low base as things stand today. Image Source: Magellan Midstream – September 2020 IR Presentation

The midstream MLP also repurchased ~$0.25 billion of its common units during the first nine months of 2020, though we would prefer the company consider deleveraging activities instead. Reducing its net debt load, which stood at $4.9 billion at the end of September 2020 (no short-term debt on the books), and capital expenditure expectations would go a long way in improving Magellan Midstream’s dividend coverage on a forward-looking basis. Management remains committed to rewarding investors, but fiscal prudence is paramount when contending with the volatile environment the energy sector is currently facing.

Image Shown: Magellan Midstream has steadily increased its distribution per unit since 2001. Image Source: Magellan Midstream – October 2020 IR Presentation

Recent Divestments

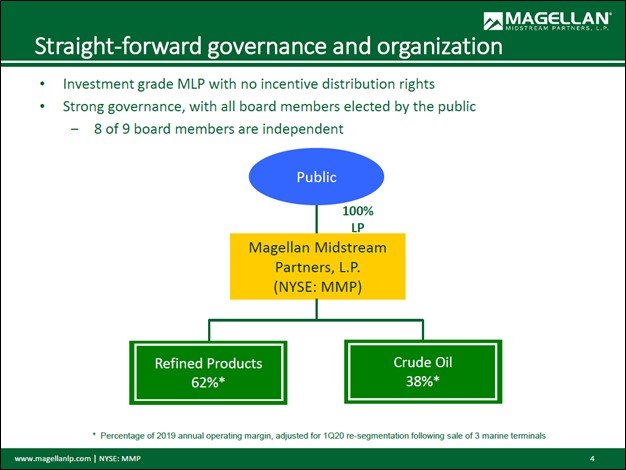

At the start of this year, Magellan Midstream announced it was selling off three of its marine terminals to now privately-held Buckeye Partners for $250 million in cash (those terminals are in Connecticut, Delaware, and Louisiana), a deal which has since closed. Magellan Midstream announced a structural change in its business reporting units following that sale to just two; ‘Crude Oil’ and ‘Refined Products.’ The two marine terminals in the East Coast region were not in a very geographically relevant area in terms of North America’s energy complex.

Magellan Midstream will retain its sizable marine terminal presence along the US Gulf Coast region, particularly in Texas, which has grown significantly over the past few years. For instance, Magellan Midstream teamed up with Valero Energy Corporation (VLO) back in 2017 through a 50/50 joint-venture to expand a marine terminal and related storage operations in Pasadena, Texas. The second phase of the growth project was completed by the first quarter of 2020, and the Pasadena marine terminal is situated along the Houston Ship Channel (this region is a major export/import hub for raw energy resources, refined petroleum products, and petrochemicals). Magellan Midstream also owns the Galena Park marine terminal which is situated along the Houston Ship Channel, and that marine terminal has become a much bigger operation in the recent past as significant growth developments were completed.

Additionally, Magellan Midstream sold off a 10% stake in the Saddlehorn crude oil pipeline (transports crude oil from the DJ Basin and Powder River Basin to the oil hub in Cushing, Oklahoma) to Black Diamond Gathering LLC, majority owned by Noble Midstream Partners LP (NBLX), earlier this year for $80 million in cash. Magellan Midstream retained a 30% stake in the Saddlehorn pipeline.

Balance Sheet Update

Proceeds from these divestments are being utilized to fund its unit repurchases (Magellan Midstream announced a $0.75 billion unit buyback program in conjunction with the sale of the three aforementioned marine terminals). Liquidity needs are being met through Magellan Midstream’s $1.0 billion revolving credit line (matures May 2024) and debt markets, as the midstream MLP historically has not issued out a significant amount of equity. In May 2020, Magellan Midstream issued out $0.5 billion in 3.25% senior notes due 2030 (99.98% of par), and the company used those proceeds to retire $0.55 billion in senior notes due 2021.

In our view, Magellan Midstream retains quality access to capital markets at attractive rates, particularly debt markets. On a final note here, the firm has a $1.0 billion commercial paper program (~$0.25 billion in commercial paper was outstanding at the end of September 2020) which can be used to meet its near-term liquidity needs. According to Magellan Midstream, “the maturities of the commercial paper notes vary, but may not exceed 397 days from the date of issuance.” Maintaining access to capital markets is essential given Magellan Midstream’s need to refinance its debt and cover its payout obligations.

Going forward, Magellan Midstream would be wise to build up a sizable cash position on the books (which was negligible at the end of September 2020). Here is a key quote from management during the firm’s latest earnings call (emphasis added):

“Moving to capital allocation, balance sheet metrics and liquidity. During the quarter, we repurchased nearly 1.4 million units at an average purchase price of $36.87, for a total spend of $50 million. That brings the total number of units repurchased year-to-date to 5 million units at a total cost of $252 million. As we have consistently noted in discussions of our repurchase program, the timing, price and volume of any unit repurchases will depend on a number of factors, including but not limited to: our expected expansion capital spending, excess cash available, balance sheet metrics, legal and regulatory requirements as well as market conditions and the trading price of our common units.

In terms of liquidity and leverage, we continue to have $1 billion credit facility available to us through mid-2024, with $248 million drawn on our commercial paper program at September 30. Our next bond maturity isn't until 2025, and our leverage ratio remains strong at 3.2x for compliance purposes at the end of the quarter, well below our long-stated limit of 4x.” --- Jeff Holman, CFO of Magellan Midstream

We appreciate that Magellan Midstream does not have a significant amount of debt coming due for several years. Its leverage appears manageable and remains well below its long-term target. Should the firm build up its cash position, it would become a lot less dependent on capital markets going forward, especially if it focuses more so on growing its free cash flows instead of growing its asset base (which appears to be the case). Though the midstream industry’s outlook is quite dour as things stand today given the sharp decline in raw energy resources production in the US and subdued global demand for refined petroleum products (among other things), Magellan Midstream’s outlook is significantly brighter.

Concluding Thoughts

Out of all the publicly-traded midstream MLPs out there, Magellan Midstream is clearly one of the best. As global energy demand returns, Magellan Midstream’s financial performance should improve considerably over the coming years, supported by a reduction in its capital expenditures. We continue to like Magellan Midstream, at a modest-weighting, in our High Yield Dividend Newsletter portfolio and in our view, the firm should be able to continue making good on its payout obligations going forward.

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP

Related: AMLP, NBLX, XLE, XOP, BNO, USO, UNG

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares or units in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment