Newmont Reports Challenging 3Q, But the Stock Is a Key Diversifier in the Dividend Growth Newsletter Portfolio

Image Source: Newmont Mining

By Brian Nelson, CFA

Gold has not necessarily lived up to its merits as an inflation hedge recently, with the SPDR Gold Trust ETF (GLD) falling nearly 10% so far this year, but that doesn’t mean it still doesn’t have valuable diversification qualities; the market, as measured by the SPDR S&P 500 Trust ETF (SPY), is down over 19% through November 1. Our favorite gold miner and Dividend Growth Newsletter portfolio holding, Newmont Corp (NEM) has fared worse this year, but we still like it as a key diversifier in the newsletter portfolio.

Newmont Corp reported third-quarter results November 1 that weren’t great, but management noted that it remains on track to “achieve full-year guidance of 6.0 million ounces of attributable gold production with Gold CAS (Cost Applicable to Sales) of $900 per ounce and Gold AISC (All-in Sustaining Costs) of $1,150 per ounce, as well as 1.3 million gold equivalent ounce production from copper (CPER), silver (SLV), lead and zinc." As with many companies today, Newmont is not immune to inflationary pressures from higher labor costs to increased commodity input costs (higher energy-related expenses).

During the period, revenue dropped 9% as a result of lower metal prices and reduced volumes, while adjusted net income fell $483 million, to $212 million. Operating cash flow dropped 59%, while capital expenditures advanced 33% as Newmont continues to develop areas across several continents with a prime focus in Australia, Africa, North America, and South America. Free cash flow fell into negative territory in the period, to -$63 million (negative $63 million), a huge drop from the $735 million in the prior-year quarter. Newmont finished the third quarter with $3.1 billion in cash and a net debt to adjusted EBITDA ratio of 0.5x.

Image Source: Newmont Mining

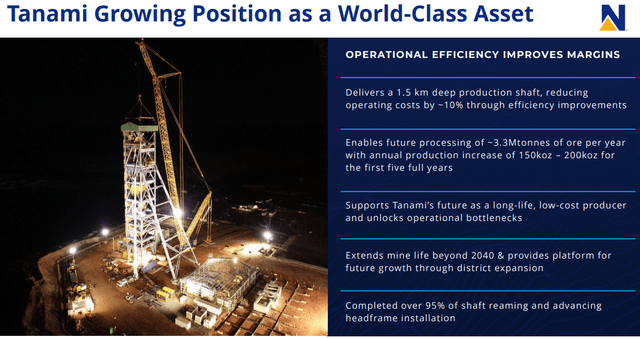

We expect good things from its Tanami Expansion 2 project in Australia, which is targeted to increase annual gold production by ~150,000-200,000 ounces per year over its first five years, while Ahafo North in Africa is targeted to add ~275,000-325,000 ounces per year over its first five years. The firm is evaluating the project economics in its investment in the Yanacocha Sulfides in South America, while investments in Pamour (North America) and the Cerro Negro District (South America) continue. With free cash flow facing pressure during the third quarter, we expect management to exercise more discipline with respect to spending, but we also like that it is investing for the long haul.

Concluding Thoughts

Image Source: Newmont Mining

Clearly, Newmont’s performance in the third quarter of 2022 is not what we would be looking for in one of our best ideas. We prefer strong free cash flow generators and those with hefty net cash positions, but as one of the rare ideas in the metals and mining arena in the Dividend Growth Newsletter portfolio, we’re not rushing to remove it.

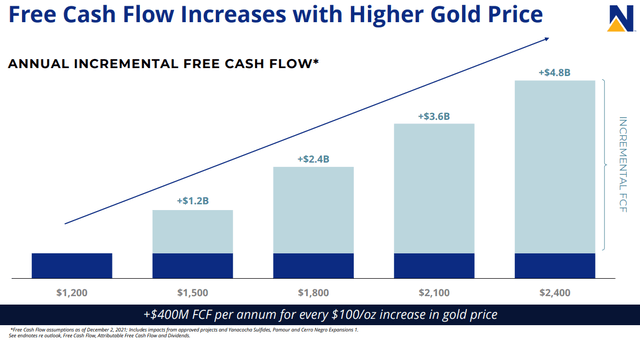

Newmont boasts a solid investment-grade credit rating, and while the near term has been tough for shares, it offers a unique dividend policy that embraces a base annualized dividend of $1.00 per share, payable at $1,200/oz gold price, with an incremental dividend payment targeting 40%-60% of incremental attributable free cash flow above the base gold price assumption.

Newmont’s free cash flow generation and dividend payment are heavily tied to the price of gold, and while costs have increased at the mining giant in this inflationary environment, the company remains one of the best dividend plays to gain exposure to potentially rising gold prices in an inflationary environment, in our view.

We continue to like its diversification benefits in the simulated Dividend Growth Newsletter portfolio.

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment