Microsoft Churns Out Gobs of Free Cash Flow

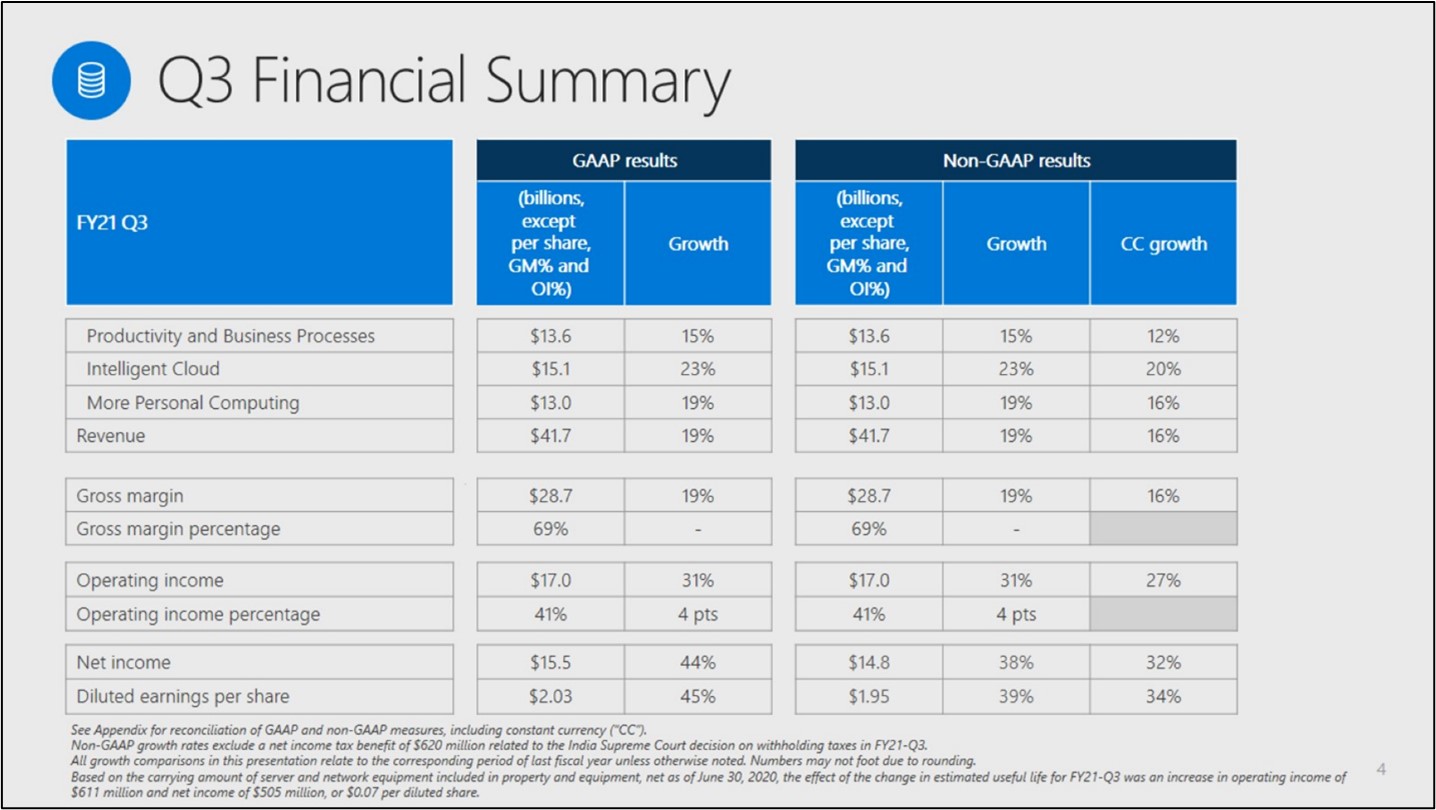

Image Shown: An overview of Microsoft Corporation’s performance last fiscal quarter. Image Source: Microsoft Corporation – Third Quarter of Fiscal 2021 IR PowerPoint Presentation

By Callum Turcan

On April 27, Microsoft Corporation (MSFT) reported third quarter fiscal 2021 earnings (period ended March 31, 2021) that smashed past both consensus top- and bottom-line estimates. Revenue growth came in strong across the board. Its cloud computing Azure segment posted 50% revenue growth, its business-facing Dynamics 365 segment posted 45% revenue growth, and its consumer-facing Xbox content and services segment posted 34% revenue growth on a year-over-year basis last fiscal quarter. Though not a large part of its business, Microsoft’s digital advertising revenues also grew nicely in the fiscal third quarter. Foreign currency tailwinds supported the sales performance at most of Microsoft’s reporting segments last fiscal quarter, and recent acquisition activity helped grow its video game business.

Quarterly Update

Company-wide, Microsoft’s GAAP revenues grew 19% year-over-year in the fiscal third quarter while its GAAP operating income climbed higher by 31% year-over-year, aided by economies of scale. We continue to be huge fans of Microsoft and include the company as an idea in both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Microsoft’s fortress-like balance sheet, stellar free cash flow generating abilities, and promising growth outlook (supported by secular growth tailwinds, such as the ongoing proliferation of cloud computing offerings) underpin our favorable view towards the name. The top end of our fair value estimate range sits at $317 per share of Microsoft.

In the third quarter of fiscal 2021, Microsoft generated $17.1 billion in free cash flow, up from $13.7 billion in the same period a year ago. That fully covered $4.2 billion in dividend payouts and $6.9 billion in share repurchases last fiscal quarter with room to spare. At the end of March 2021, Microsoft had a net cash position of ~$67.3 billion (inclusive of short-term debt). This figure does not include $5.4 billion in equity investments the firm had on hand at the end of this period.

Acquisition Updates

Microsoft completed its acquisition of ZeniMax Media in March 2021. The deal added the video game publisher Bethesda to its portfolio, the firm behind the incredibly popular Fallout and Elder Scrolls franchises. In Microsoft’s latest 10-Q SEC filing, the firm notes that it paid $8.1 billion for ZeniMax Media, mostly in cash, and that it acquired just under $0.8 billion in cash and cash equivalents from the deal. We covered why we view this acquisition favorably in a September 2020 article (link here). Microsoft is adding top-tier video game content to its portfolio to bulk up its subscription offerings (including Xbox Live Gold, Xbox Game Pass and Xbox Game Pass Ultimate) that among other things allow gamers to play a large library of video games on Xbox consoles or PCs for a modest monthly fee and/or allow gamers to access certain multiplayer content. Please note these are incredibly lucrative revenue streams that complement the high-margin subscription revenues Microsoft generates at its key offerings including Office 365, Azure, and Dynamics 365.

On April 12, Microsoft announced it would buy Nuance Communications Inc (NUAN), which bills itself as a leader in conversational AI and ambient intelligence, through an all-cash deal worth $19.7 billion when including Nuance’s net debt. Nuance is heavily focused on the health care and enterprise AI space. Microsoft offered $56 per share in share for each share of NUAN, and the deal is expected to close in calendar year 2021. According to Microsoft, this acquisition will double its total addressable market (‘TAM’) in the health care sector to $500 billion,and the firm sees its scale and existing cloud computing capabilities complementing Nuance’s expertise in the health care arena. Nuance and Microsoft already have an existing partnership that was announced back in October 2019.

Here is an excerpt from the recent press release announcing the acquisition:

Nuance is a pioneer and a leading provider of conversational AI and cloud-based ambient clinical intelligence for healthcare providers. Nuance’s products include the Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting, all leading clinical speech recognition SaaS offerings built on Microsoft Azure. Nuance’s solutions work seamlessly with core healthcare systems, including longstanding relationships with Electronic Health Records (EHRs), to alleviate the burden of clinical documentation and empower providers to deliver better patient experiences. Nuance solutions are currently used by more than 55% of physicians and 75% of radiologists in the U.S., and used in 77% of U.S. hospitals. Nuance’s Healthcare Cloud revenue experienced 37% year-over-year growth in Nuance’s fiscal year 2020 (ended September 2020).

Moving deeper into the health care sector will further extend Microsoft’s growth runway, and we are intrigued by the potential upside this acquisition could generate. While the price tag is meaningful, Microsoft has the financial capacity to make large acquisitions such as these while maintaining its fortress-like balance sheet as the company continues to churn out gobs of free cash flow.

Concluding Thoughts

We continue to like Microsoft as an idea in both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of Microsoft initially sold off during after hours trading on April 27, possibly due to some profit taking activity, though its shares are still up comfortably year-to-date. As of this writing, shares of MSFT yield ~0.9%, and we expect Microsoft will keep pushing through substantial payout increases over the coming years, aided by its growing free cash flows. Microsoft’s capital appreciation upside is substantial, and the firm is well-positioned to capitalize on various secular tailwinds which underpins its promising cash flow growth outlook.

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for NUAN, XLK, MSFT

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Microsoft Corporation (MSFT), and Health Care Select Sector SDPR Fund (XLV) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment