Image Source: Microsoft

By Brian Nelson, CFA

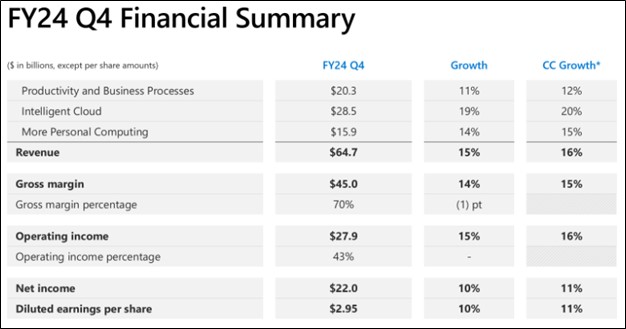

On July 30, Microsoft reported better-than-expected calendar second quarter (fiscal fourth quarter) results with revenue and GAAP earnings per share beating the consensus forecasts. Revenue jumped 15% (16% in constant currency), while operating income advanced at a similar year-over-year pace. Net income of $22 billion increased 10% (11% in constant currency) on a year-over-year basis. Diluted earnings per share also increased 10% (11% in constant currency). Management was upbeat in the press release:

Our strong performance this fiscal year speaks both to our innovation and to the trust customers continue to place in Microsoft. As a platform company, we are focused on meeting the mission-critical needs of our customers across our at-scale platforms today, while also ensuring we lead the AI era…We closed out our fiscal year with a solid quarter, highlighted by record bookings and Microsoft Cloud quarterly revenue of $36.8 billion, up 21% (up 22% in constant currency) year-over-year.

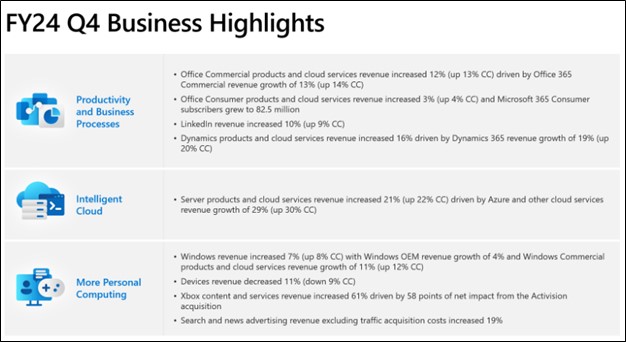

Sales in its ‘Productivity and Business Processes’ unit increased 11% (12% in constant currency) thanks to strength across the board, including in Commercial and Consumer products and cloud services revenue, as well as strength in LinkedIn and Dynamics products and cloud services revenue. Revenue in its ‘Intelligent Cloud’ business unit increased 19% (20% in constant currency) thanks to Azure and other cloud services revenue growth of 29% (30% in constant currency). Revenue in its ‘More Personal Computing’ division increased 14% (15% in constant currency), benefiting from Windows revenue and its acquisition of Activision.

Image Source: Microsoft

Looking to fiscal 2025, management had the following to say about Azure:

In Azure, we expect Q1 revenue growth to be 28% to 29% in constant currency. Growth will continue to be driven by our consumption business, inclusive of AI, which is growing faster than total Azure. We expect the consumption trends from Q4 to continue through the first half of the year. This includes both AI demand impacted by capacity constraints and non-AI growth trends similar to June. Growth in our per-user business will continue to moderate. And in (the second half of the year), we expect Azure growth to accelerate as our capital investments create an increase in available AI capacity to serve more of the growing demand.

Microsoft ended the June quarter with $75.5 billion in total cash and cash equivalents and $51.6 billion in short- and long-term debt on the books, good for a nice net cash position. In the three months ended June 30, cash flow from operations surged to $37.2 billion from $28.8 billion in the same period a year ago, while capital spending totaled $13.9 billion in the June quarter versus $8.9 billion in last year’s quarter. Free cash flow increased 17.7% in the quarter, coming in at $23.3 billion versus $19.8 billion in the same period a year ago. During the quarter, Microsoft returned $8.4 billion to shareholders in the form of dividends and buybacks. Shares yield 0.7% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.