Macy’s Secures Additional Financing

Image Shown: Shares of Macy’s Inc have started to recover some of their lost ground after the company secured additional financing to ride out the storm created by the ongoing coronavirus (‘COVID-19’) pandemic. Store closures have decimated the company’s bottom-line, but the reopening of the US economy and many of the retailer’s stores has improved Macy’s outlook.

By Callum Turcan

Back on April 21, 2020, we published a note on Valuentum (link here) highlighting why it would be hard for Macy’s Inc (M) to unlock the (fair) value of its real estate assets. We are following up on that piece given recent events that we will cover in this article, and we strongly encourage our members to check out that first article.

Financing Maneuvers

On May 27, Macy’s announced the pricing of an upsized (from $1.1 billion previously) bond issuance of $1.3 billion in 8.375% senior secured notes due June 2025 (that is a hefty coupon, highlighting the wariness of creditors as it concerns lending to distressed retailers). On June 8, Macy’s announced it had closed on that deal. Please note that (from the press release concerning the aforementioned senior secured notes due June 2025):

The notes were issued by Macy’s, Inc. and are secured on a first-priority basis by (i) a first mortgage/deed of trust in certain real property of subsidiaries of Macy’s that were transferred to subsidiaries of Macy’s Propco Holdings, LLC, a newly created direct, wholly-owned subsidiary of Macy’s (“Propco”) and (ii) a pledge by Propco of the equity interests in its subsidiaries that own such transferred real property.

Macy’s also announced on June 8 that it had closed on a new $3.15 billion asset-based credit agreement. With those proceeds “the company has amended and substantially reduced the credit commitments of its existing $1.5 billion unsecured credit agreement. The company intends to use the proceeds of the notes offering, along with cash on hand, to repay the outstanding borrowings under the existing $1.5 billion unsecured credit agreement.” Furthermore (emphasis added), “with the closing of these financings, the company expects to have sufficient liquidity to address the needs of the business, including funding operations and the purchase of new inventory for upcoming merchandising seasons, resolving its accrued payables obligations, and repaying upcoming debt maturities in fiscal 2020 and fiscal 2021.”

This represents a major turnaround for Macy’s liquidity position, though there are several key changes to keep in mind. As it relates to its previous $1.5 billion revolving credit line due May 2024, the borrowing capacity on that credit facility was cut down from $1.5 billion to $75 million as part of these financing maneuvers.

Additionally, the $3.15 billion asset-based credit agreement includes a short-term financing option with $0.3 billion in borrowing capacity that matures in December 2020. The borrowing capacity of the asset-based credit agreement matures in May 2024 (it isn’t clear from the press release whether the $3.15 billion in new total borrowing capacity includes the short-term facility or not), with the option to increase that capacity by an additional $0.75 billion. In return, Macy’s put up the “newly formed Macy’s Inventory Funding LLC” (meaning all of Macy’s Inventory Funding LLC’s common equity and assets) to secure the asset-based credit agreement, and the entity owns “the vast majority of the company’s inventory, and which is the borrower under the new asset-based credit agreement.” Macy’s did not announce the interest rate(s) on the new asset-based credit agreement within the press release.

Financial and Operational Update

Given the sharp improvement in the embattled retailer’s liquidity position due to these maneuvers, the outlook for Macy’s has improved considerably (albeit off of a very low base). On June 9, Macy’s provided a preliminary update on its sales and earnings results for the first quarter of fiscal 2020 (period ended May 2, 2020).

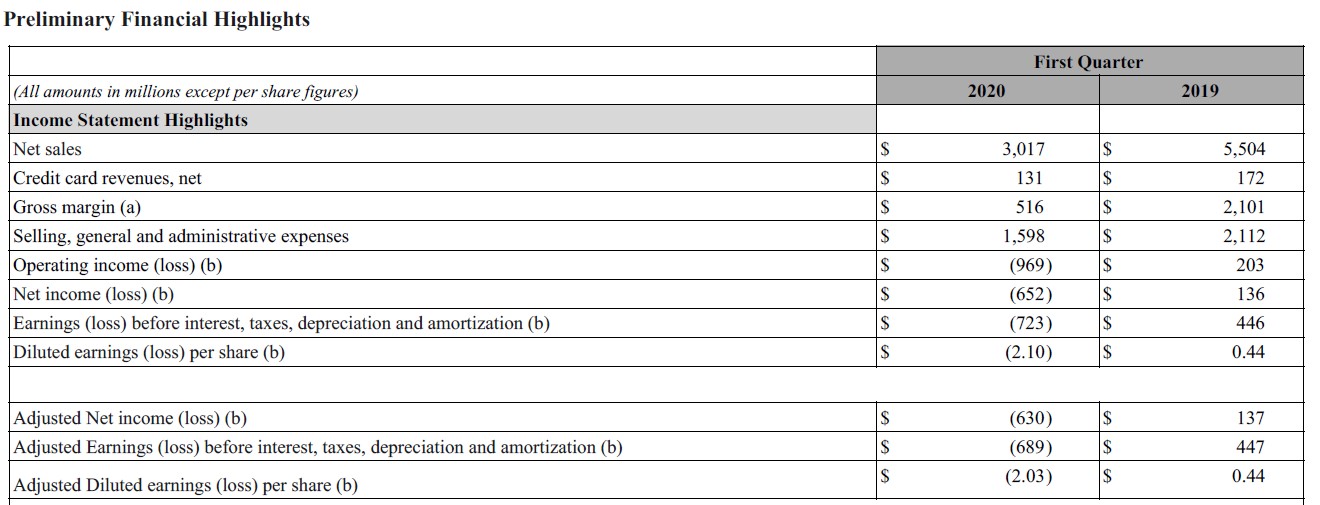

As one can see in the upcoming graphic down below, Macy’s saw its (these figures are preliminary and likely not GAAP compliant, and some certainly are not) net sales drop by 45% year-over-year which played a key role in its $1.0 billion net operating loss given the firm’s hefty fixed costs. Store shutdowns due to the pandemic and the inability to replace those sales with e-commerce revenues were the primary culprit. While the firm’s digital sales channels reported meaningful improvement, according to Macy’s, that was clearly not enough. The figures down below do not factor in goodwill or long-lived asset impairment charges which Macy’s noted “are expected to have a material impact on the company’s reported results.” Macy’s plans to report its fiscal first quarter results on July 1.

Image Shown: Store shutdowns to contain the pandemic had an extremely negative impact on the retailer’s financial results, which were already stressed by competitive headwinds and structural changes in consumer purchasing habits (i.e. the rise of e-commerce in the US). Image Source: Macy’s – 8-K SEC Filing

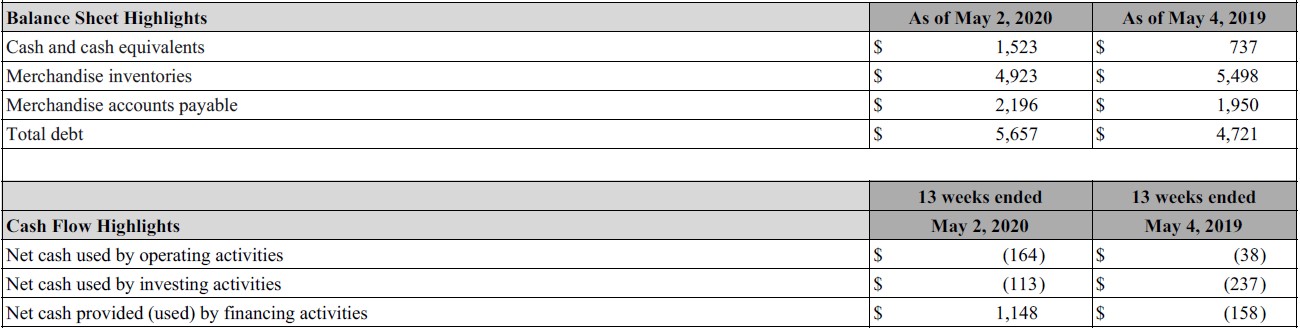

In the upcoming graphic down below, Macy’s provides an overview of its balance sheet at the end of the fiscal first quarter and its cash flow profile during the fiscal first quarter. According to Macy’s, its free cash flows were negative during this period as its net operating cash flows were negative. Please note that the firm’s balance sheet has changed materially since the end of the fiscal first quarter due to the previously mentioned financing maneuvers in the fiscal second quarter.

Image Shown: Macy’s noted it generated negative free cash flow during the first quarter of fiscal 2020 as its net operating cash flows were negative. Image Source: Macy’s – 8-K SEC Filing

Concluding Thoughts

Shares of M have shifted materially higher recently after announcing its new financing arrangements and due to the melt up in US equities (SPY), but the firm is far from being out of the woods. The interest rate on its new senior secured bonds is quite high, relatively speaking. One final note, Macy’s noted it had reopened approximately 450 of its stores by June 1. We will have more to say on Macy’s once the retailer reports its fiscal first quarter earnings.

----------

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: AMZN, FDS, SPY

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Cracker Barrel Old Country Store Inc (CBRL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment