General Mills Prepares for Cost Inflation, Pet Business Growing Rapidly

Image Source: General Mills Inc – Third Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

On March 24, General Mills Inc (GIS) posted third quarter earnings for fiscal 2021 (period ended February 28, 2021) that beat consensus top- and bottom-line estimates on a GAAP basis, though its adjusted non-GAAP bottom-line performance missed consensus estimates. General Mills has seen demand surge higher for its products in the wake of the coronavirus (‘COVID-19’) pandemic as households stockpiled goods and started eating at home more often. The company posted a solid fiscal third quarter earnings report, though its outlook is facing headwinds as General Mills is contending with cost inflation concerns. Shares of GIS yield ~3.4% and are trading just above our fair value estimate as of this writing, after selling off in the wake of its latest earnings report.

Earnings and Near-Term Outlook Update

General Mills reported 8% year-over-year GAAP revenue growth in the fiscal third quarter on the back of a modest foreign currency tailwind and organic (non-GAAP) net sales growth of 7% on a year-over-year basis. Its GAAP operating income surged higher 27% year-over-year last fiscal quarter, aided by General Mills posting an ~80 basis point expansion in its GAAP gross margin and due to its operating expenses shifting lower during this period. General Mills’ GAAP diluted EPS hit $0.96 last fiscal quarter, up 30% versus year-ago levels.

In the fiscal third quarter, organic net sales growth was driven by solid performance at almost all of General Mills’ core business operating segments: ‘North America Retail’ (up 9% year-over-year due to volume growth), ‘Pet’ (up 14% year-over-year with volume growth offsetting unfavorable pricing/mix), ‘Europe & Australia’ (up 7% year-over-year supported by volume growth and favorable pricing/mix effects) and ‘Asia & Latin America’ (up 14% year-over-year due to a combination of volume growth and favorable pricing/mix effects). General Mills reported that its ‘Convenience Stores & Foodservice’ business operating segment saw a 10% year-over-year decline in organic net sales in the fiscal third quarter due to a reduction in volumes and unfavorable pricing/mix effects. Headwinds from the COVID-19 pandemic continue to weigh negatively on this segment’s performance.

Looking ahead, General Mills expects demand for consumer staples products will remain elevated though cost inflation concerns are building. Please note that the firm’s organic net sales performance is facing a very tough comparison this fiscal quarter on a year-over-year basis as General Mills benefited during this same period last year from pandemic-induced stockpiling. Here is what the firm had to say regarding its near-term outlook in latest earnings press release (emphasis added):

General Mills expects that the COVID-19 pandemic will drive continued elevated consumer demand for food at home, relative to pre-pandemic levels, through the remainder of fiscal 2021. The company expects full-year organic net sales to increase approximately 3.5 percent, reflecting strong year-to-date growth, partially offset by a difficult comparison in the fourth quarter reflecting the initial pandemic-driven surge in at-home food demand as well as the extra month of results in the Pet segment.

On the bottom line, better-than-expected first-half adjusted operating profit margin results are now expected to be offset by higher input cost inflation and higher logistics costs in the second half. As a result, full-year fiscal 2021 adjusted operating profit margin is expected to be approximately in line with fiscal 2020 levels, consistent with the guidance the company outlined at the beginning of the year.

Cost Inflation Concerns

During General Mills’ fiscal third quarter earnings call, management was asked a question about cost inflation, a theme that is becoming increasingly common. Raw materials and energy prices are on the rise and that is coinciding with various logistical hurdles seen of late (such as ongoing US West Coast port delays and high shipping container rates, the winter storm that hit Texas and other parts of the US particularly hard this past February, and a massive container ship getting stuck in the Suez Canal starting in late March).

Management noted during the earnings call that when General Mills first issued guidance (for what appears to be fiscal 2021) regarding its cost inflation expectations the company was “rounding up to about 3%, and we are in a position now where we will be rounding down to about 3% inflation.” That indicates General Mills expects its cost inflation headwinds this fiscal year will be larger than initially forecasted. Additionally, General Mills has been positioning itself “in anticipation of higher inflation as we step into [fiscal 2022]” according to recent management commentary. Pricing strength can be used to offset these headwinds, at least to a degree, though there are limits to what General Mills can do given the competitive environment the company operates in.

Financial Update

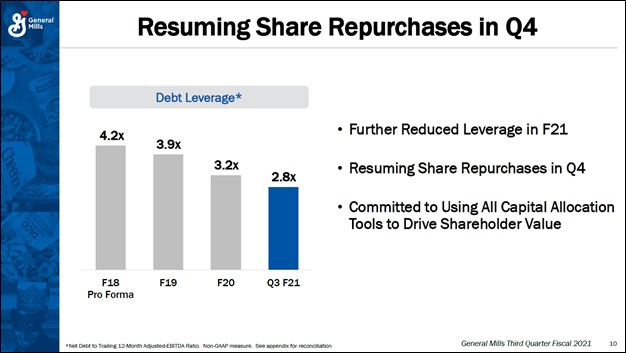

During the nine month period that concluded at the end of February 2021, General Mills generated $1.9 billion in free cash flow and spent $0.9 billion covering its dividend obligations along with a negligible amount buying back its stock. Here we would like to highlight that General Mills has done a stellar job paring down to leverage ratio over the past several fiscal years (defined as net debt to adjusted EBITDA over a trailing twelve month period), aided by its strong free cash flow generating abilities.

In February 2018, General Mills announced it was acquiring pet food maker Blue Buffalo in an all-cash deal worth about $8.0 billion by enterprise value, which closed in April 2018. This deal significantly grew General Mills’ net debt load and resulted in a pro forma leverage ratio of ~4.2x in fiscal 2018. However, by the third quarter of fiscal 2021, General Mills had brought its leverage ratio down to ~2.8x. As of the end of February 2021, General Mills had $11.1 billion in net debt on the books (inclusive of short-term debt) though its $2.8 billion cash and cash equivalents position combined with its strong cash flow profile provides the firm with the means to manage that burden going forward, in our view.

Image Shown: General Mills has steadily improved its leverage ratio over the past few fiscal years. Image Source: General Mills – Third Quarter of Fiscal 2021 IR Earnings Presentation

Keeping this in mind, General Mills announced that it was resuming its share repurchase program (likely meaning the resumption of substantial share buybacks) in conjunction with its latest earnings update. As shares of GIS are trading near our fair value estimate as of this writing, in our view, it would be wise for General Mills to continue paring down its leverage ratio instead of buying back its stock. Though its leverage ratio has come down considerably over the past few fiscal years, General Mills still has ample (net) debt on the books which limits its financial flexibility considerably.

Though General Mills has a Dividend Cushion ratio of 0.6, we still view its forward-looking dividend coverage favorably given the company’s apparent ability to tap capital markets at attractive rates for refinancing needs and its strong cash flow profile. General Mills has a “GOOD” Dividend Safety rating though we caution that this rating could change if it were to make another major acquisition. We are not changing our Dividend Safety rating in light of the announcement that General Mills is shaking up its capital allocation priorities, though we are keeping a close eye on the firm. The company noted it was considering bolt-on acquisitions during its latest earnings report.

Pet Update

General Mills was seeking a growth engine with long legs when it acquired Blue Buffalo. The “humanization of pets” trend seen in the US and elsewhere supports the outlook for pet food sales and other pet-related product sales over the long haul, providing General Mills a way to capitalize on a secular tailwind. Recent growth rates at several of General Mills’ business operating segments are unlikely over the coming fiscal years to be sustained given the nature of the consumer staples business, though its Pet segment is well-positioned to continue growing at a brisk clip going forward. In prepared remarks, General Mills’ management team had this to say on the acquisition and recent trends during the company’s latest earnings report (moderately edited, emphasis added):

“When General Mills acquired Blue Buffalo, we highlighted five compelling strategic and financial benefits: the business operated in an attractive growth category; BLUE was a leading brand with a loyal consumer base that we believed was still in its early stages of growth; it had proven to be successful in both existing and emerging channels; it was a scaled platform with strong growth and operational efficiency; and it would contribute meaningfully to General Mills’ growth and margin profile…

The shift to high-quality, natural food also accelerated during the pandemic. Average pet food spend per household was up 6% as pet parents traded up and switched to more premium foods like BLUE.We also saw shopping patterns shift. BLUE’s strong presence across channels allowed us to be available wherever pet parents wanted to shop. Together, these trends drove strong, profitable growth for BLUE, with organic net sales up 13% so far in Fiscal ’21 and broad-based market share growth across key segments and retail channels.

Looking forward, BLUE is well positioned for continued growth. Pet food is a great category, BLUE leads in the most attractive segment, and we have a clear plan for growth. Since we acquired Blue Buffalo, the U.S. pet food category has grown about 4% a year, and recent trends point to continued mid-single-digit growth for the category going forward. Natural pet food, which represents around 30% of total pet food sales today, has led the category with 9% growth in calendar 2020. Because we know pet parents want natural, high-quality ingredients for their pets, we expect the Natural segment to continue to drive category growth in the years ahead.” --- Bethany Quam, Group President of General Mills’ Pet division

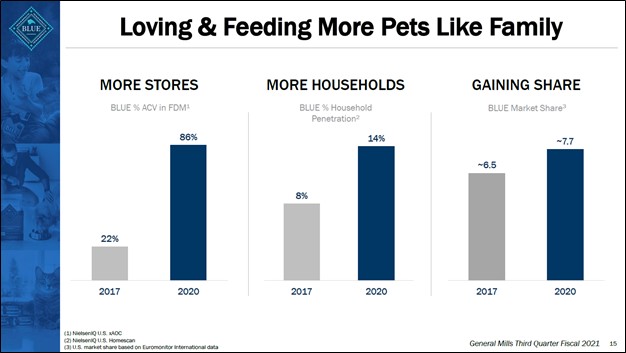

Blue Buffalo operates in what could be considered the “premium” side of the pet food industry. Given that this part of the industry is growing at a faster rate than the pet food industry overall in the US, General Mills views its Blue Buffalo operation as uniquely well-positioned to capitalize on secular tailwinds going forward. The upcoming graphic down below highlights how General Mills was incredibly effective at expanding the reach of its Blue Buffalo business since acquiring the firm a few years ago. We appreciate that Blue Buffalo is gaining market share in the pet food space.

Image Shown: General Mills views the growth trajectory of its Pet segment quite favorably. Image Source: General Mills – Third Quarter of Fiscal 2021 IR Earnings Presentation

Portfolio Optimization Update

Most consumer staples firms tend to be continuously engaged in acquisition and divestment activities as management teams aim to capitalize on growing and lucrative parts of the sector while shedding assets in terminal decline. A day before publishing its latest earnings report, General Mills announced that it had agreed to sell its 51% controlling stake in Yoplait S.A.S to the French dairy cooperative Sodiaal in return for full ownership of the Canadian Yoplait business and a reduction in the royalty rate regarding the use of the Yoplait and Liberté brands in the United States and Canada (General Mills would be able to distribute these products in the US and Canada on a royalty-free basis according to the press release). This deal is expected to close by the end of this calendar year.

Generally speaking, simplifying corporate structures is a good move as it enables firms to remove unnecessary complexities and potentially enables improvements in cost structures over the long haul. This deal will see General Mills acquire Sodiaal’s 49% stake in Yoplait Canada Holding Co, making that entity a wholly-owned subsidiary of General Mills. In the press release, General Mills noted that “this transaction improves our growth profile, enhances our margins, and creates value for our shareholders. Additionally, it increases our focus on the brand platforms that have the greatest growth potential.” We are intrigued by the move.

Concluding Thoughts

General Mills is a solid company though we are not interested in adding the company to any of the newsletter portfolios at this time. As of this writing, shares of GIS appear to be fairly valued. In the High Yield Dividend Newsletter portfolio, we include Vanguard Consumer Staples Index Fund ETF (VDC) as an idea to gain broad exposure to the consumer staples sector. Click here to learn more about the High Yield Dividend Newsletter.

-----

Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY

Tickerized for GIS, BRFS, NOMD, POST, SJM, THS, DAR, SAFM, SMPL, CPB, SYY, CAG, KHC, MDLZ, BRBR, HSY, TWNK, NSRGY, FLO, MKC, STKL, K, BGS, HAIN, BYND, UNFI, SPTN, CHEF, PFGC, HRL, PPC, TSN, JJSF, CVGW, CHWY, VDC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples Index Fund (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment