Image Source: General Mills Inc – Third Quarter Fiscal 2020 Earnings IR Presentation

By Callum Turcan

On March 18, General Mills Inc (GIS) reported third quarter fiscal 2020 (period ended February 23, 2020) earnings that provided the market with an idea of how major consumer staples brands were performing before the ongoing novel coronavirus (‘COVID-19’) pandemic started spreading around the world. In the fiscal third quarter, General Mills GAAP net sales were broadly flat year-over-year as was its GAAP operating income. The firm’s GAAP gross margin took a hit (from higher supply chain costs and input cost inflation) but that was offset by reduced restructuring costs and the lack of a major loss on divestment, allowing for its GAAP operating margin to stay broadly flat year-over-year. All-in-all, a fairly uneventful and uninspiring quarter, but General Mills’ forward guidance caught our eye.

Guidance Update

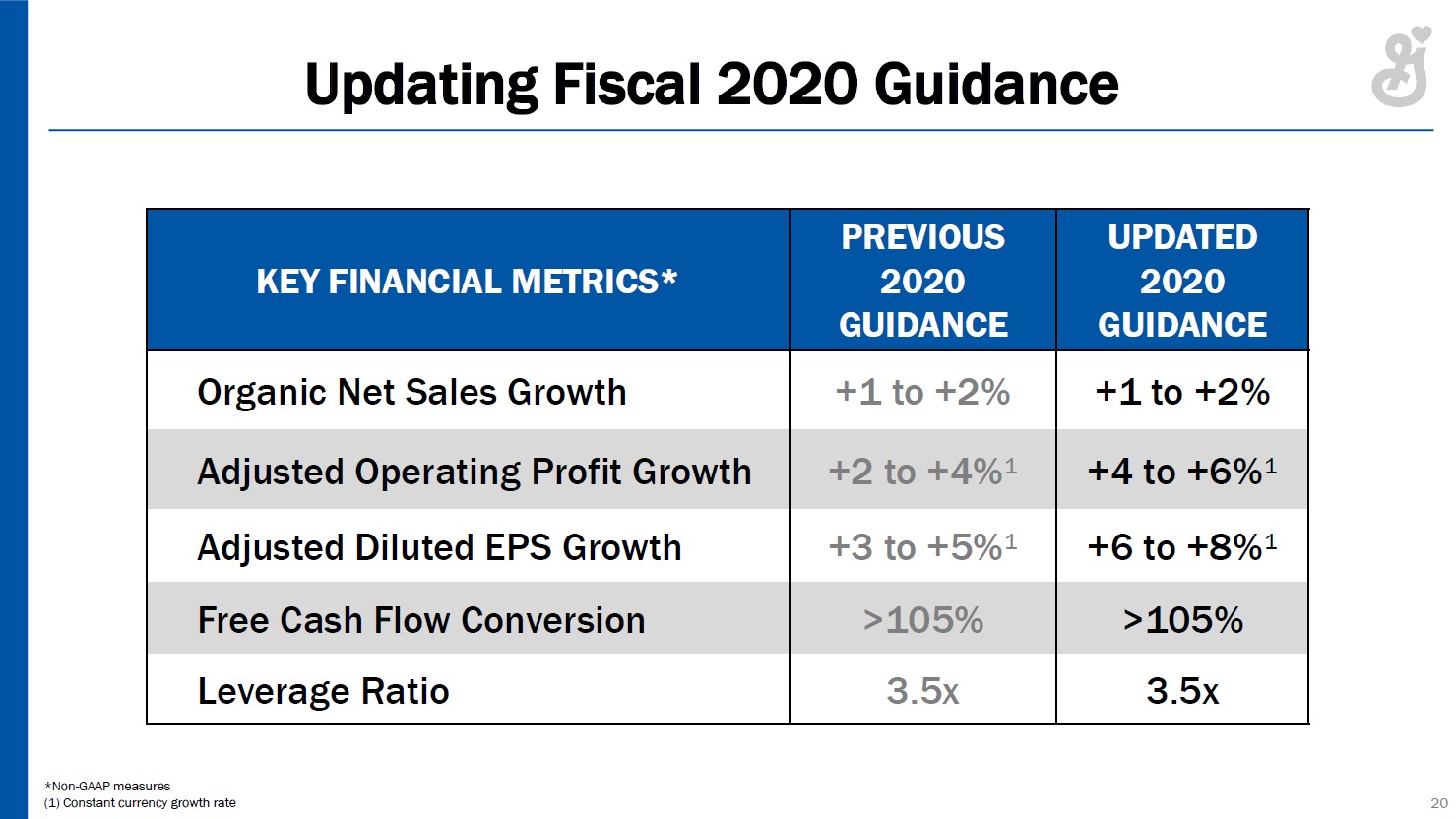

Looking ahead, General Mills noted that subsequent to the end of its fiscal third quarter, the firm noticed a pickup in sales to retail buyers in North America and Europe “in response to increased consumer demand for food at home” which will be somewhat offset by “headwinds in Häagen-Dazs shops and other foodservice channels resulting from lower consumer traffic” and potentially other factors if pandemic containment efforts become more draconian. Assuming only minimal supply chain disruptions occur (which is General Mills’ view, at least during the fourth quarter of fiscal 2020), the firm is targeting for 1%-2% in ‘organic net sales growth’ for all of fiscal 2020. Please note there’s some noise here as fiscal 2020 will be positively impacted by a 53rd week in fiscal 2020 (meaning an extra week of sales over fiscal 2019) and negatively impacted by past divestment activity.

What makes this 1%-2% year-over-year growth target significant is that during the first nine months of fiscal 2020, General Mills’ organic net sales growth came in flat company-wide, indicating a meaningful amount of net sales growth is expected this fiscal quarter. For a variety of factors, the company “expects to see a step up in organic net sales growth” during the fourth quarter and some of that include the favorably uplift from the “panic buying” mentality seen across the US and elsewhere (on top of the extra week of sales and other factors such as the inclusion of an extra month of its ‘Pet’ segment’s performance to align that business with General Mills’ company-wide reporting practices).

Beyond the expected return of organic net sales growth, General Mills also communicated to investors that the gains from its Holistic Margin Management program (a strategy built upon incremental productivity, efficiency, and cost saving improvements) would help the firm’s ‘adjusted operating profit’ (a non-GAAP figure) grow by 4%-6% this fiscal year versus previous guidance calling for 2%-4% growth. Keeping a tight lid on corporate-level expenses, namely SG&A, is key here (those expenses were up 1% year-over-year during the first nine months of fiscal 2020).

Image Shown: A look at General Mills’ updated guidance for fiscal 2020. Image Source: General Mills – Third Quarter Fiscal 2020 Earnings IR Presentation

Deleveraging Activities

Growth at General Mills’ Pet segment underpins management’s long-term plans for the company. In April 2018, General Mills completed its ~$8.0 billion deal by enterprise value for pet food maker Blue Buffalo, which greatly increased the company’s net debt load. General Mills has been slowly bringing its leverage down, seen through its net debt load (inclusive of short-term debt) falling from $14.0 billion at the end of May 26, 2019, down to $13.0 billion at the end of February 23, 2020. General Mills notes it plans to carry a nice free cash flow conversion ratio north of 100% as you can see in the graphic up above, but further deleveraging is needed given rising exogenous headwinds, in our view.

During the first nine months of fiscal 2020, General Mills generated $2.2 billion in net operating cash flow and spent $0.3 billion on capital expenditures, allowing for $1.9 billion in free cash flow. Dividend obligations totaled $0.9 billion during this period, and share buybacks were negligible. Management continues to note deleveraging is a top priority, which we appreciate, and the lack of material share buybacks indicates that General Mills is serious about this endeavor.

Image Shown: A look at three of General Mills’ top priorities; sales growth, margin enhancement, and deleveraging. We like management’s strategy, but we also caution General Mills’ remains heavily indebted which is concerning as exogenous headwinds are building aggressively worldwide. Image Source: General Mills – Third Quarter Fiscal 2020 Earnings IR Presentation

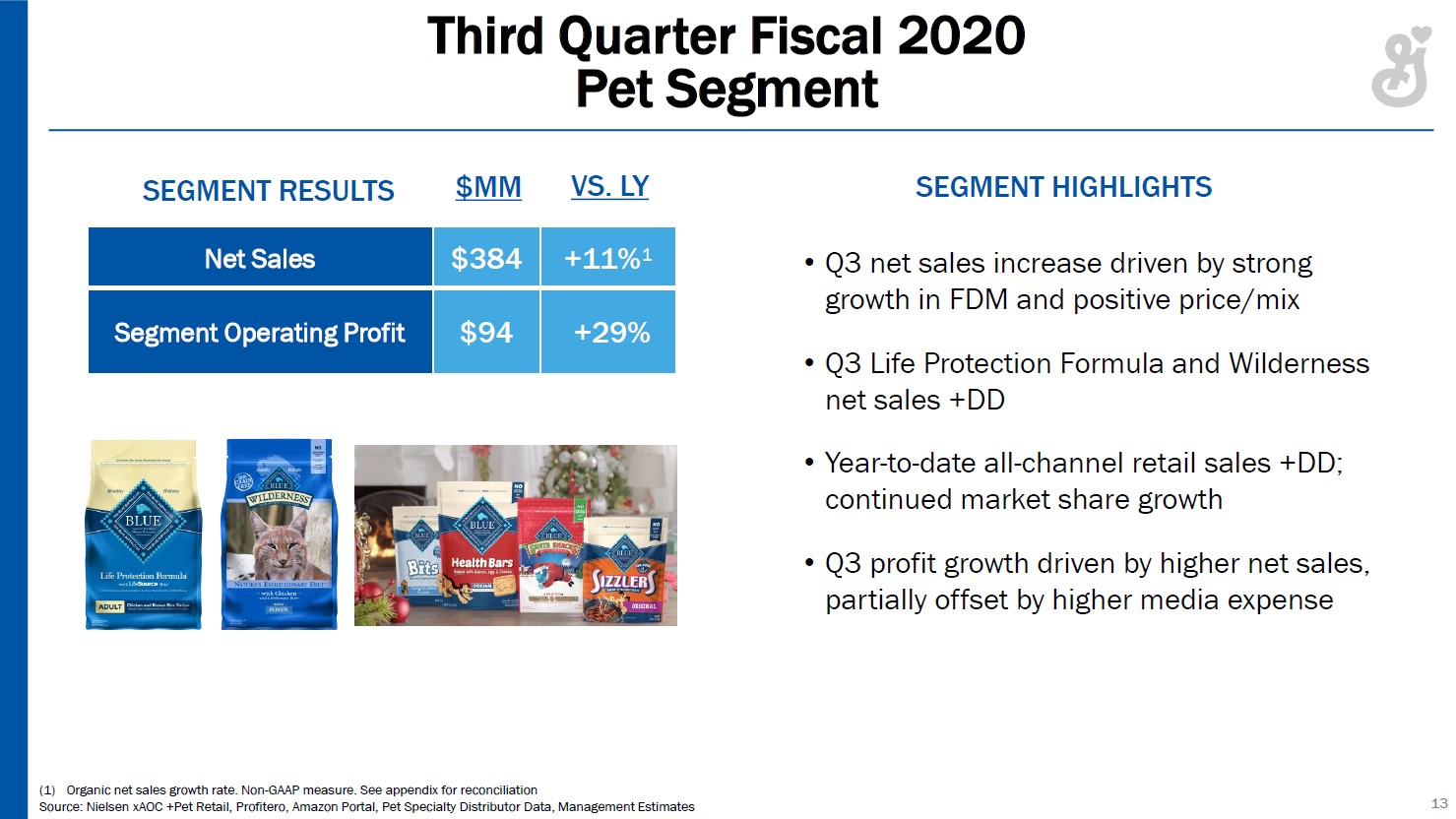

Significance of General Mills’ Pet Segment

General Mills’ Pet segment reported strong double-digit net sales and segment-level operating profit growth during the third quarter of fiscal 2020 on a year-over-year basis. A favorable product mix and pricing power, made possible by investments in the brand (including higher media spend to keep Blue Buffalo out in front of key consumers), enabled this segment to report meaningful operating margin expansion last fiscal quarter (seen through operating profit growth coming in at more than double net sales growth).

Image Shown: General Mills has a lot riding on its Blue Buffalo acquisition, as its Pet segment is key to offset weakness elsewhere at the “sleepier” parts of General Mills’ portfolio. Image Source: General Mills – Third Quarter Fiscal 2020 Earnings IR Presentation

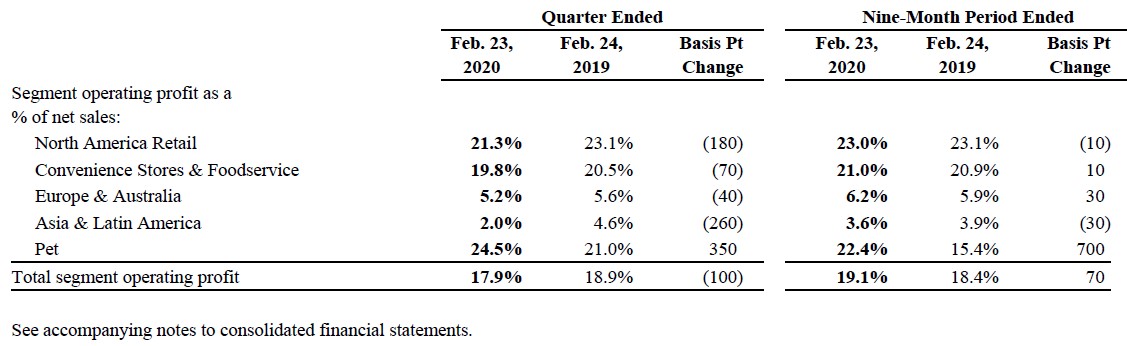

Within General Mills’ earnings report, management highlighted how the Pet segment’s operating profit margin jumped 350 basis points last fiscal quarter (while every other segment saw their margins slip lower) and 700 basis points during the first nine months of fiscal 2020, both on a year-over-year basis.

Image Shown: General Mills’ operating profit margin is largely supported by its Pet segment, which is offsetting weakness elsewhere. Image Source: General Mills – 8-K SEC Filing covering the third quarter of fiscal 2020

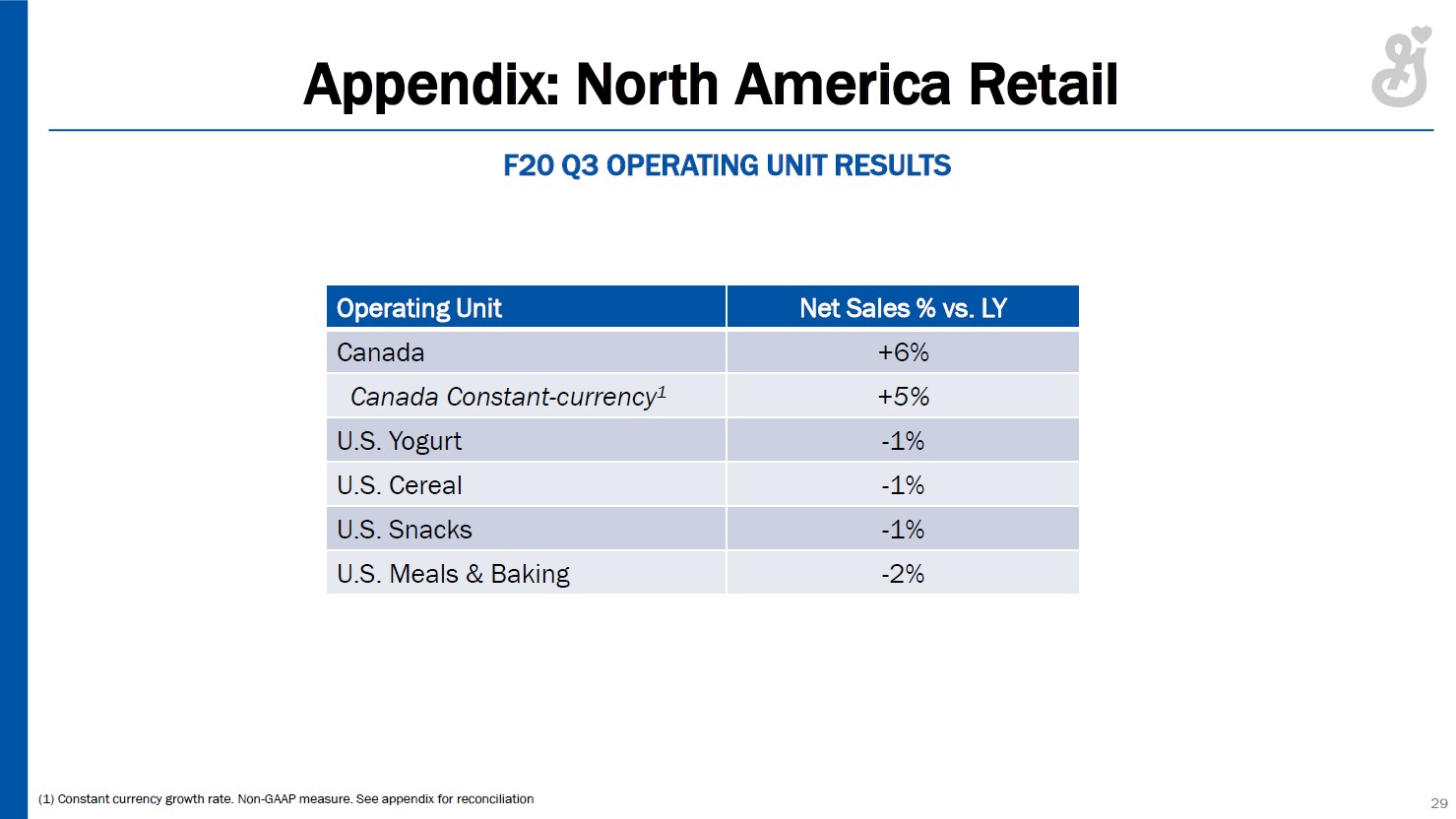

In the upcoming graphic down below, General Mills highlights some of its “sleepier” operations with an eye towards North American retail. While its Canadian segment saw its net sales grow nicely year-over-year last fiscal quarter, the company’s US business product lines saw their net sales slip lower. This is part of a longer term trend management sought to change via the acquisition of Blue Buffalo. So far, General Mills’ purchase seems to be playing out favorably, but that hasn’t been enough to juice meaningful and sustained company-wide sales growth, at least not yet.

Image Shown: General Mills’ other business product lines have seen their sales either tread water or shift lower in recent years. Image Source: General Mills – Third Quarter Fiscal 2020 Earnings IR Presentation

Concluding Thoughts

General Mills is showing signs of improvement where it’s needed, particularly as it concerns its deleveraging program and growth at its Pet segment, but more work needs to be done. We caution that General Mills’ forecasts have not factored in material disruptions in its supply chain and logistical operations, something that will need to be monitored going forward as the ongoing COVID-19 pandemic continues to shut down economic activity across the board.

—-

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Food Products (Small/Mid-Cap): CALM FLO FDP HAIN HRL JJSF LANC MKC SJM THS TSN

Food Products (Large/Mid-Cap): ADM BG CPB CAG GIS HSY K KHC MDLZ NSRGY UL UN

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.