ExxonMobil Continues to Optimize Its Asset Base

Image Source: ExxonMobil Corporation – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

According to Reuters, ExxonMobil Corporation (XOM) is in the process of divesting its Fayetteville shale play position in Arkansas, which ExxonMobil’s spokeswoman Julie King confirmed according to the news outlet. This is an upstream asset focused on the extraction of natural gas from the ground via “fracking” techniques (combing horizontal drilling and hydraulic fracturing to unlock raw energy resources from the ground).

Divestment Overview

The Fayetteville shale play was once touted as a major part of America’s way to become “energy independent” during the early days of the fracking boom. However, the play soon lost favor with energy firms large and small due to the industry being a victim of its own success, as the fracking boom led to North American natural gas prices tanking (a dynamic that began to occur roughly a decade ago). While the Fayetteville was one of the first big shale play developments in the US, cost cuts and efficiency gains were not enough to offset steep reductions in raw energy resources pricing. Please note that the play primarily produces “dry” natural gas (methane) and does not appear to have sizable amounts of liquids-rich development opportunities (meaning crude oil and/or natural gas liquids).

More prolific natural gas-weighted plays with lower production (development and operating) costs such as the Marcellus and Utica shale plays--combined with liquids-rich plays underpinned by the economics of oil and natural gas liquids sales (where natural gas was arguably an unwanted byproduct instead of a key part of the economics of those plays) such as the prolific Permian Basin and Bakken/Three-Forks plays--drove capital to flee the Fayetteville play. For reference, the Marcellus, Utica, Permian Basin, and Bakken/Three-Forks plays are all located in the US, and natural gas production from these plays directly “compete” with the Fayetteville play (as natural gas is more difficult to transport than crude oil and natural gas liquids, natural gas pricing is inherently more regional in nature).

However, domestic natural gas prices measured by the Henry Hub (UNG) benchmark have started to trend higher of late. This is largely due to a slowdown in development activity of liquids-rich upstream plays in the US in the wake of the coronavirus (‘COVID-19’) pandemic that drove crude oil prices lower last year (crude oil prices have since recovered). Additionally, the sharp recovery in US economic activity is supporting the demand outlook (excluding weather-related fluctuations) for natural gas at a time when the US is a natural gas exporting powerhouse (the ongoing though uneven economic recovery elsewhere in the world supports the outlook for US natural gas exports).

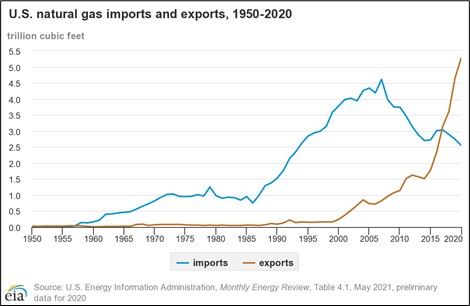

Surging liquified natural gas (‘LNG’) exports to major demand centers in Asia and Europe along with rising pipeline exports to Mexico over the past several years have provided an outlet for US natural gas production that did not exist a decade ago (in terms of total egress capacity, natural gas pipeline exports to Canada and Mexico have been around for some time). The upcoming graphic down below highlights the transformation of the US natural gas industry since 1950.

Image Shown: The US is now a major net exporter of natural gas. Image Source: US Energy Information Administration - Website

ExxonMobil is selling around 416,000 net acres in the Fayetteville shale play that house ~840 operating wells and ~4,100 non-operated wells (these are producing wells, though many are operated by third-parties). There are likely ample future development opportunities housed across this position as well. Back in 2010, ExxonMobil acquired these operations along with associated midstream assets (energy infrastructure) for about $650 million, though the trajectory of natural gas prices did not cooperate with its plans. There is not a whole lot of information on these assets in ExxonMobil’s 10-K SEC filings (even those dating back to the early 2010s decade), though these are clearly non-core assets that have likely received only a modest amount of capital in recent years.

Reportedly, privately-held Merit Energy is interested in acquiring ExxonMobil’s Fayetteville position. Merit Energy acquired BHP Group Ltd’s (BHP) position in the Fayetteville shale play back in 2018 through a deal worth roughly $0.3 billon that included 258,000 net acres and a modest amount of producing operations.

We are keeping our eye on this development and any other potential divestments ExxonMobil may pursue in the coming months now that the economic backdrop is more favorable. Reuters noted that ExxonMobil aims to sell off its Fayetteville position by the end of 2021, with bids expected by the middle of September.

Concluding Thoughts

In our view, ExxonMobil is taking advantage of the recent uptick in raw energy resources pricing to sell off non-core assets in a more favorable environment so it can trim its total debt load while pivoting towards its more lucrative opportunities. That includes its massive upstream position in the Permian Basin and off the coast of Guyana, along with its impressive downstream and petrochemical operations as well. We covered the company’s growth ambitions in our ExxonMobil’s Great Earnings Report and Promising Growth Outlook article that we encourage members to check out (link here).

We continue to like ExxonMobil as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios and appreciate management’s efforts to continuously optimize ExxonMobil’s wide-reaching asset base. The energy giant’s cash flow growth outlook is incredibly bright in the current environment. Even after the modest selloff in crude oil pricing seen over the past few weeks in the wake of the emergence of the “delta” variant of COVID-19, prices for crude oil and other raw energy resources are still up sharply year-to-date. Shares of XOM yield a nice ~6.0% as of this writing and our fair value estimate sits at $83 per share of ExxonMobil.

Downloads

ExxonMobil’s 16-page Stock Report>>

ExxonMobil’s Dividend Report >>

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: UNG, RDS.A, RDS.B, XLE, XOP, BHP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment